Bank of America (BofA), the second largest bank in the United States, published in February 2021 its updated Environmental and Social Risk Policy Framework, which completes the 2019 version. Bank of America sets “a goal to achieve net zero emissions from its operations, supply chain and financing activities before 2050”, in alignment with the Paris Climate Agreement. However, the current policy, which includes some wording on oil sands but no exclusions at all, remains highly incomplete in regard to the coal sector. New coal mines or plants are immediately excluded, but this policy ignores all companies involved in thermal coal.

1. What’s new

While its former framework, published in 2019, only excluded new coal plants in developed countries, Bank of America now makes a commitment not to engage in the following types of activities:

- Direct financing of new thermal coal mines or the expansion of existing mines;

- Direct financing of the construction or expansion of new coal plants, including refinancing of recently constructed plants, unless those facilities employ carbon capture technology.

Moreover, BofA will, by 2025, phase out all financing of companies deriving at least 25% of their revenue from thermal coal mining, unless the company has a public commitment to align its business with the goals of the Paris Climate Agreement and the transaction would facilitate the diversification of the company’s business away from thermal coal.

2. Our analysis: not even the bare minimum

Bank of America’s progress on coal exclusions is minimal, but an end to direct financing of new thermal coal mines and new coal plants is welcome. This was not too difficult for the US bank since, according to the international database IJGlobal, Bank of America has not provided any primary financing of this kind in the past decade. Nevertheless, the bank does not mention any prohibition relating to coal infrastructure, or to the retrofitting of existing coal plants, thereby extending their lifetime.

Regarding the financing of coal companies, the content of Bank of America’s Framework remains highly insufficient for several reasons:

- BofA does not exclude any coal developers, i.e. companies still planning to expand the coal industry despite the global consensus that coal should now be on its way out. Such an exclusion is the logical first step to make and the litmus test to assess the credibility of any climate commitment. The US bank will continue to be able to finance companies such as the Adani group, and its infamous Carmichael coal mine project in Australia, for which it helped to raise more than $550m of bonds on the market between October 2018 and October 2020.

- The coal phase-out announced only covers part of the coal mining sector. Coal power companies, which represent a huge part of the coal sector, remain untouched by this new coal policy. On the mining side, some big diversified mining conglomerates such as Glencore are not covered by the policy, despite figuring among the biggest coal producers worldwide. BofA even added a potential loophole for companies “with a public commitment to align their business with the goals of the Paris Climate Agreement”, which is yet to be defined precisely.

- Without further restrictions, Bank of America will therefore be able to continue to support many significant coal producers, coal utilities and coal developers. Between October 2018 and October 2020, the bank’s support for the coal sector has reached $51bn according to the latest data available. Bank of America financed Duke Energy (USA), RWE (Gemany) and Marubeni (Japan) respectively to the tune of $4,310m, $1,150m and $495m during the same time period.

Bank of America lags far behind some of its global peers such as Crédit Agricole or BNP Paribas, which adopted some immediate exclusions at the corporate level, starting with all coal developers. They have also committed to exit the coal sector by 2030 in Europe/OECD and by 2040 worldwide and requested that the companies they finance adopt coal phase-out plans aligned with these deadlines.

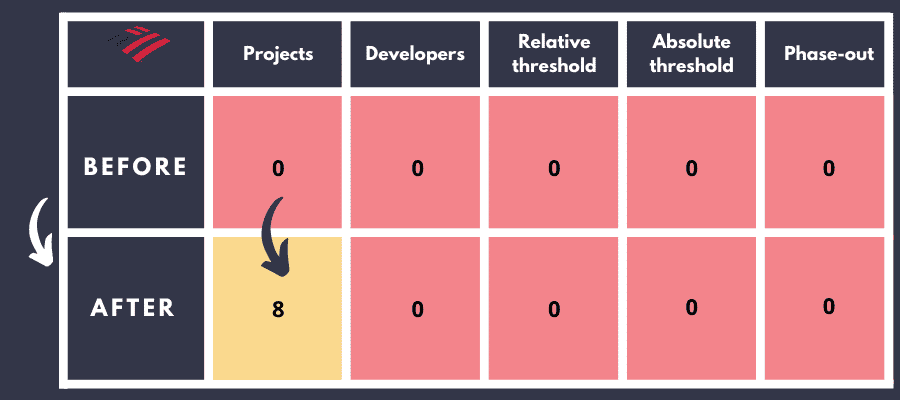

Bank of America’s scores in the Coal Policy Tool

This table presents the coal scores of Bank of America based on 5 criteria of the Coal Policy Tool

3. Our conclusion

Bank of America does not even meet the minimum standards required with this updated coal policy, which remains largely insufficient to meet the climate objectives set by the Paris Agreement. The US bank will continue to finance companies in the coal sector without any limitations for several years to come. Bank of America should immediately exclude all coal developers, adopt stringent and immediate exclusion thresholds and detail an overall strategy to fully exit coal at the latest by 2030 in Europe and OECD countries, and 2040 worldwide. It should also urgently update its policy regarding oil and gas.