Nedbank is the fourth largest bank in South Africa with a fifth of market share and $84 billion in assets. It has just announced in April 2021 at its AGM a new energy policy, in which it improves its past fossil fuel exclusion commitments.

By setting 2045 as an end date to stop almost all fossil fuel financing, it sets a positive precedent not only in South Africa but globally. However, the updated policy lacks intermediate exclusion steps and does not end support to fossil fuel expansion in general, and coal in particular. Consequently, this announcement remains, overall, insufficient.

1. What’s new

Regarding coal project financing, Nedbank had already committed to stop financing all new coal power plants and coal mines outside South Africa. It has now committed to stop such project financing in South Africa by 2025.

On oil and gas, Nedbank has announced the following measures:

- The immediate end of project financing for new oil and gas exploration worldwide;

- The immediate end of project financing for “new utility-scale or embedded oil-fired power” units, unless it is part of a backup supply to renewable generation projects;

- From 2035 onwards, the end of “any new financing for oil production, regardless of jurisdiction”.

Nedbank finally announced it will reach “zero fossil fuel exposure” by 2045, with an exception: it will continue up to 2050 to finance “natural gas production where it will play an essential role in facilitating the transition”.

2. Our analysis: a great end-goal but no steps in between

The most impressive step forward is the announcement of a total phase-out by 2045 of all fossil fuels. This is a first worldwide and must be commended as such as it is setting an ambitious precedent to follow for other financial institutions in the North and the Global South. Such commitment seems to encompass both project and general corporate financing for all coal mining, oil & gas exploration & production, and all power generation from fossil fuels.

On coal:

Overall, and beyond this 2045 commitment, we can hardly praise Nedbank’s updated coal policy.

The only new commitment regarding project financing is to stop the financing of new coal mines in South Africa by 2025. However coal infrastructure projects are still not covered.

The main gap in the policy is the lack of any immediate exclusion at the corporate level, for the general financing of coal companies, which is problematic since Nedbank is no small player in the coal mining sector with $400 million exposure (ZAR5.7 bn). Instead of committing to a maximum 1% exposure to coal, whereas it was already at 0.7% in 2019, Nedbank should start by immediately excluding all coal developers and by setting maximum coal exposition thresholds for companies (absolute and relative), and lower these thresholds over time.

On oil & gas:

The promise to reach zero exposure on all fossil fuels by 2045 (minus some exception on gas), is unprecedented in South Africa and globally for a commercial bank. It sets the right ambition for other banks to follow.

However, once again, the intermediate steps remain insufficient, delayed or simply missing, and its exposure to the sector is high: $1.1 billion in the oil sector, $320 million in gas and $810 million in fossil-based power production (respectively ZAR15.9 bn, ZAR4.6 bn and ZAR11.5 bn).

If we can praise the end of oil & gas exploration direct financing, this does not mean that Nedbank will stop general corporate financing for oil & gas developers planning such exploration drills. Neither does it covers the production, midstream and downstream sector for the oil & gas sector. In fact the only existing exclusion criteria on this side will apply very late. In this regard, waiting until 2035 to stop financing new oil production projects and setting no date for such commitment on gas remains insufficient considering the lifespan of such projects.

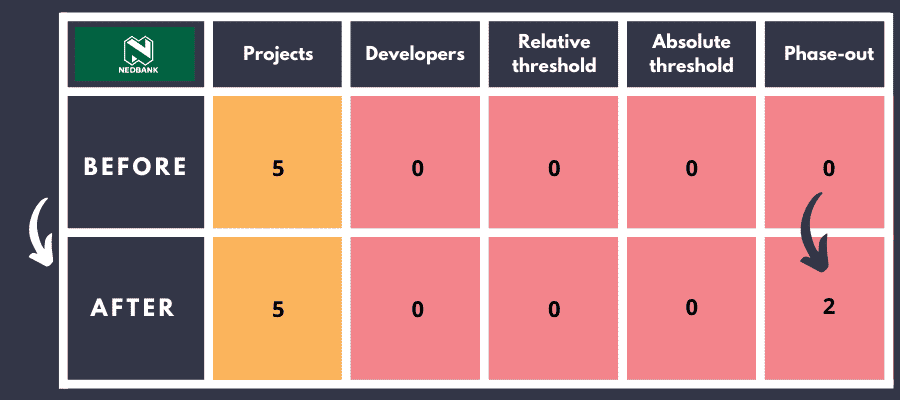

Nedbank’s Scores in the Coal Policy Tool

This table presents the coal scores of Nedbank based on five criteria of the Coal Policy Tool

3. Our conclusion

By setting an ambitious 2045 fossil fuel phase-out commitment, Nedbank can be seen as a great exception among its South African peers and appears to be a leading financial institution worldwide. We hope this example will rapidly spread. However, by not setting ambitious intermediary steps to reach such goal, Nedbank is clearly lagging behind international best practices. Long-term commitments must come alongside clear short-term exclusion criteria on coal and are highly needed.

It is highly regrettable that Nedbank. In a South African context: adopting an ambitious strategy for a progressive fossil fuel phase out would have sent a strong message to Eskom, the South African energy giant, that the market now awaits an orderly and ambitious coal phase-out strategy.