Banking on business as usual

The energy finance imbalance

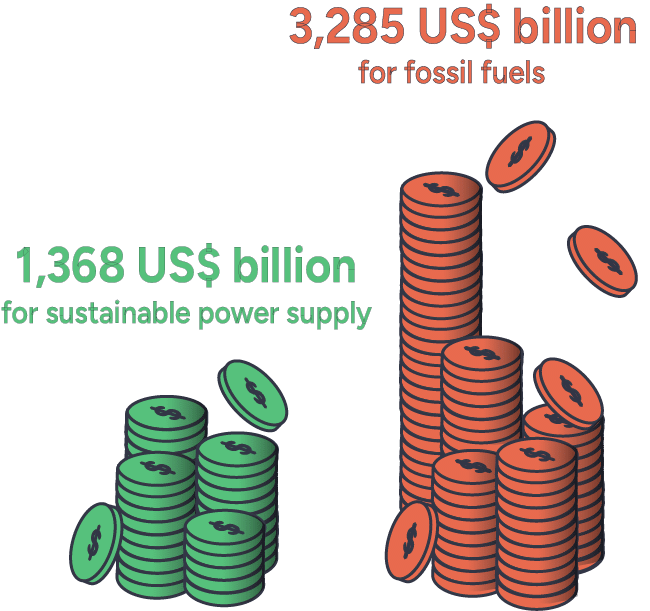

1 More than twice as much money for fossil fuels as for sustainable alternatives

Between 2021 and 2024, the 65 biggest banks globally allocated to fossil fuels more than twice the amount of money allocated to sustainable power supply. Only 1,368 billion dollars financed sustainable power supply while 3,285 billion dollars financed fossil fuels, i.e. a ratio of 0.42:1. This means, only 42 cents went to sustainable power supply for each dollar they allocated to fossil fuels. This is nowhere near the 6:1 ratio by 2030 – indicated by the International Energy Agency (IEA) in its Net Zero Emissions (NZE) scenario – or even the more conservative 4:1 ratio articulated by Bloomberg New Energy Finance (BNEF), to which banks have become increasingly attentive and receptive, especially in North America. This raises serious doubts about the ability of banks to align their activity with a decarbonization trajectory, and to reach net zero by 2050.

3 All banks are late

Yet, in a race where all banks are behind schedule, there are significant disparities. European banks stand out, even though they are still nowhere near doing what is needed. Almost all are in the top half of the ranking, with a regional ratio of 0.70:1 over the period. At the bottom of the ranking, Japanese banks (0.35), US banks (0.25), and Canadian banks (0.22) are still actively delaying the energy transition.

4 Sustainable power financed in too few countries

Financing for sustainable power supply is heavily concentrated in a few countries. 93% of financing allocated to sustainable power supply is tapped by companies and projects based in OECD countries and China. This illustrates a problem raised also by the IEA: “emerging markets and developing economies (EMDE) represent one third of global GDP, two third of global population, but only 18% of clean energy investments”. This is a problem as the transition must be global and EMDEs have even greater need for financing.

of financing is concentrated to

OECD countries & China

5 Targets without a plan

Banks recognize the importance of transforming the power sector but do not demonstrate how they intend to align their financing activities with a net-zero trajectory. So far, many banks have set intensity targets for the power sector but very few demonstrate how this will influence the way they finance the sector. They need to do this by setting a financing target based on a scope centred on sustainable solutions, and linked to an Energy Supply Financing Ratio (ESFR). Only eight banks set a financing target dedicated to the power sector and only four banks are publishing their ESFR.

6 Recommendations

Banks should urgently align their support to the energy system with the needs of a net-zero trajectory. Consequently, they should adopt climate strategies that address the transformation of the power supply sector. This requires in priority:

8 Explore the sustainable power policy tracker

banking on business as usual

The energy finance imbalance

Sept 23, 2025

The report measures the financing allocated by the 65 biggest global banks for both fossil fuels and sustainable power supply. It uses that data to calculate the energy supply financing ratio (ESFR), a critical metric to assess their contribution to the energy transition. Additionally, the report also reviews the few existing ESFR and their methodologies, and analyzes the banks’ policies and commitments toward supporting the energy transition.

A website by

In partnership with