This year’s G7 Summit is taking place from 13 to 15 June in Italy, amidst ongoing extreme global weather events and the world’s 12th hottest month on record. The G7 have committed to phase out their use of coal power but failed to address how their private financial sector continues to support coal’s expansion globally. G7 governments must take concrete policy and regulatory actions to redirect the billions that still support coal towards sustainable energy investments.

Over the last three years,

flowed from commercial banks to the coal industry.

In April 2024, the G7 Climate and Energy Ministerial meeting committed to “calling on” private finance to stop funding coal and made a commitment to exit coal power by the “first half of the 2030s” (1). However, simply “calling on” private finance to stop funding coal will not be an effective solution without being accompanied by effective regulatory measures.

G7 commercial banks pouring fuel on the coal fire

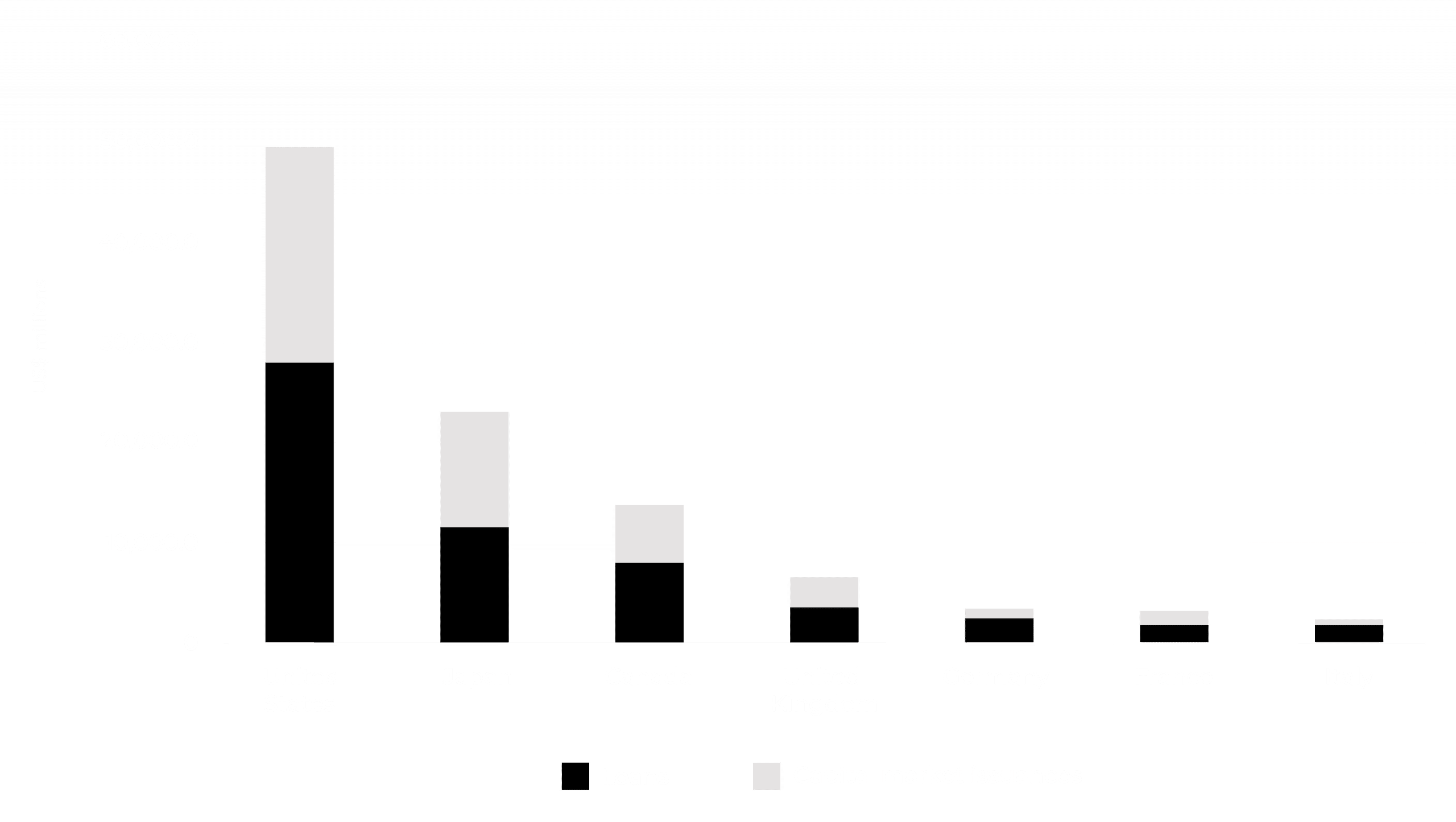

Over the last three years, an astounding US$470 billion flowed from commercial banks to the coal industry through loans and capital market issuances (2). G7 banks are leading the pack – six out of the seven members rank among the top 10 countries globally when it comes to having commercial banks that finance coal. Between 2021 and 2023, the G7’s commercial banks provided a staggering US$101 billion for the coal industry.

Financing by bank in G7 countries for coal

The largest offenders are American and Japanese banks, who collectively directed more than US$73 billion to the coal industry. This is capital that could have been otherwise redirected towards sustainable energy investments, grid modernization projects, and energy efficiency initiatives – crucial elements in a successful energy transition.

American banks are the largest coal lenders in the world. Together, they provided US$49 billion worth of loans and capital market issuances for the coal industry in the last three years. The Bank of America actually increased its financing of coal since the Paris agreement. Between 2016 and 2023, the bank increased its coal financing by 30%. Worse still, the bank recently weakened its restrictions on financing coal (3).

Japanese megabank Mizuho is the world’s top coal lender. It provided US$500 million more in loans than Bank of America (in second place) over the past three years. The other Japanese megabanks, MUFG and SMBC, ranked third and fourth in terms of their coal lending over this period, together providing more than US$6 billion in loans to the coal sector.

G7 failing its own phaseout

The irony is that the total amount of funding for coal in the last three years by commercial banks in G7 countries is more than twice the amount pledged by the G7-led International Partners Group to support the Just Energy Transition Partnerships (JETPs). The JETPs are intended to provide technical assistance and resources in support of developing countries’ energy transitions.

While finance from the G7 is hindering much more than helping coal phaseouts at the global level, G7 members are also lagging on their own domestic phaseouts. The US still has over 200 GW coal capacity left in operation, and while it has been falling rapidly, there are signs that this decline could be stalling (4). This 200 GW is more than the combined coal capacity of South Africa, Indonesia and Vietnam, the three main coal-dependent recipients of JETP funding.

The G7’s current pledge to exit coal by the “first half of the 2030s,” falls short of the timeline scientists say is necessary to limit global warming to 1.5°C (5). While the rest of the G7 governments have set targets to phase out their domestic coal fleets, Japan has yet to do so.

The G7’s approach of simply “calling on” private finance to abandon coal is too weak given the urgency of the climate crisis and the billions that G7 financial institutions are providing to the coal industry. Instead, the G7 and other advanced economies must use policy and regulatory tools, such as stricter capital requirements, and outright prohibitions for coal developers, to stop coal expansion and redirect funds to sustainable energy investments. Initiatives like the Coal Transition Accelerator must live up to its expectations to create replicable international standards in the private financial sector to phase out coal globally (6).