Swiss Re is the first reinsurer worldwide with $42 billion premiums written annually and a total portfolio of $110 billion assets under management. In March 2021, it announced new climate commitments regarding its insurance and investment activities. It becomes the first reinsurer to cover all its reinsurance treaties with coal exclusions and a phase-out strategy, which is a sizable advance. This is setting a great example for other reinsurance companies worldwide to follow. Swiss Re now has to exclude all coal developers to join the small group of 20 financial institutions worldwide with a robust coal policy.

1. What’s new

In its press release, Swiss Re commits to improve its coal policy in the following fields:

- Commitment to the long-term objective to exit coal-based assets for its investment portfolio by 2030;

- Commitment to a full group-wide phase-out of thermal coal by 2030 (OECD) and 2040 (rest of the world) for its reinsurance business.

As part of this announcement, Swiss Re also mentions that it will implement from 2023 onwards some exclusion thresholds when providing (re)insurance services to coal-linked operations and companies, which will be lowered over time. These thresholds are not yet public .

2. Our analysis: a big step forward but developers still missing

The main improvement in the policy comes from the new coal phase-out strategy. By choosing 2030 as coal end-date globally for its investments, and 2030 for the OECD and European countries and 2040 for the rest of the world for its reinsurance business, Swiss Re aligns it business strategy with climate science.

As such, this is not groundbreaking since many financial institutions have already committed to such deadlines. However, Swiss Re is the first one to apply such a commitment to the entirety of its activities, including its reinsurance treaty packages, usually left out by other reinsurers.

It is nevertheless important to stress that several gaps need to be filled to make such a coal policy a robust one. The main issue lies in the fact that Swiss Re has not committed to stop providing (re)insurance coverage to coal developers, those companies still planning new coal mines, coal plants and coal infrastructure projects. On the investment side, it only exclude strictly investments going towards coal plant developers which is insufficient too since all these actors undertake activities clearly incompatible with the Paris Agreement. This casts a major shadow over the seriousness of its coal phase-out commitments.

Another problem is the inconsistency of Swiss Re group regarding the exclusion of major coal companies: it has decided to stop investing in mining companies extracting over 20 Mt of coal annually or power producers having more than 10 GW of coal power capacity, but it has no problem (re)insuring such companies.

Another inconsistency is also problematic. Swiss Re has not applied its past commitment fully. Out of the $93 million still invested in coal companies according to the latest data available as of last December, $23 million were invested in companies that should be excluded from its portfolio already: Duke Energy ($21m – 16.9 GW of power capacity), Glencore ($1m – 123Mt extracted yearly), Anglo American ($1m – 37.8 Mt), Eskom ($1m – 82% of revenues). Answering Reclaim Finance’s question on this, Swiss Re answered that bonds are not sold and are in runoff but there may also be other explanations.

Finally, regarding the engagement process announced, it is good to see that it will apply systematically to all coal-linked companies. However, we believe Swiss Re must define precisely what it expects as a minimum from the so-called “climate strategies” It expects companies to adopt through this engagement process. Such a strategy must set the 2030/2040 coal exit deadlines mentioned above, and it must include an asset by asset detailed closure plan. Then, if such plan is not adopted or unsatisfactory, it should stop supporting these companies.

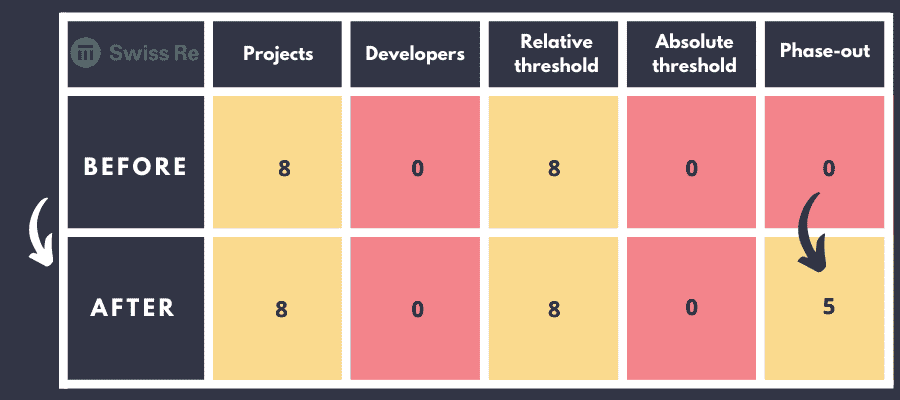

Swiss Re’s (Insurance) Scores in the Coal Policy Tool

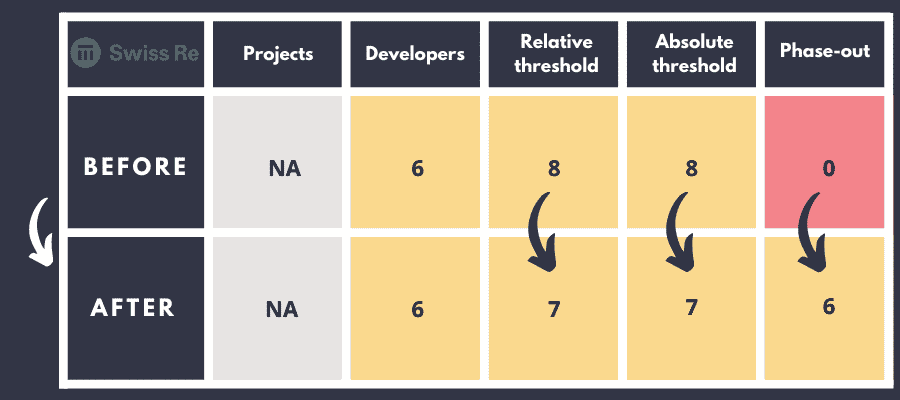

Swiss Re’s (Asset Owner) Scores in the Coal Policy Tool

These tables present the coal scores of Swiss Re based on five criteria of the Coal Policy Tool

3. Our conclusion

By coming up with a coal phase-out strategy, Swiss Re clearly establishes itself as a leading financial player amongst reinsurers and sets an example for others to follow.

However, only half of the job is done, and Swiss Re must quickly bridge the gaps between its updated policy and what constitutes a robust coal phase-out policy. This means urgently excluding all coal developers and strengthening its exclusion criteria for major coal companies.