The UK banking group Lloyds published on February 24th, 2022, its new sector policies covering the coal and oil & gas sectors. Not only the bank finally goes beyond project level exclusion, but it adopts what is now the most stringent coal policy from the UK. As Standard Chartered or NatWest, Lloyds commits to exit fully from the coal power sector by 2030, earlier than HSBC’s deadline in 2040. Lloyds is also exiting the coal mining sector at a much earlier date than its peers, with an almost immediate phase-out from the sector. Not only Lloyd’s exclude all coal mine/plant developers but it also becomes the UK bank with the most stringent immediate exclusion threshold without exceptions, 5% from revenues for coal mining and 25% for coal power. Unfortunately, Lloyds doesn’t show the same level of ambition on oil and gas where most of the new measures only cover some unconventional projects, while most of the financing goes through corporate finance. It becomes though the first UK bank to exclude the direct financing of the development of new oil fields, but remains far from blacklisting all oil & gas developers.

The policy

On coal

• Exclusion of direct financing to new and expanded thermal coal mines or coal plants, including retrofits expanding the life of the plant;

• Exclusion of corporate financing to coal mine/plant developers;

• Exclusion of mining companies deriving more than 5% of their revenues from thermal coal by the end of 2022, and companies deriving more than 25% of their revenues from coal power by the end of 2022, 20% by the end of 2023;

• Full phase-out from thermal coal mining and coal power by 2030.

On oil & gas

• Exclusion of direct financing for the development of new oil fields;

• Exclusion of direct financing to upstream, midstream and downstream projects in the Arctic (defined by the International Hydrographic Organization (IHO)) and Antarctic, as well as reserve based lending secured by Arctic or Antarctic asset;

• Exclusion of direct financing to upstream, midstream and downstream tar sands projects, as well as “companies involved in the exploration or development of oil sands, outside of fields already approved for development as of 2021”;

• Exclusion of direct financing to onshore oil & gas shale fracking projects;

• Exclusion of new clients in the oil and gas sector unless it is for renewables and transition technologies and clients have credible transition plans.

Our analysis: significant progress on coal, not on oil & gas

THE POSITIVES

• Lloyds joins the growing number of banks excluding coal mine/plant developers, the first immediate step to do in terms of corporate level exclusions

• The updated coal policy will have a concrete impact on Lloyds coal portfolio, excluding companies such as RWE or PPL, which Lloyds financed in 2021 and 2020

• Lloyds expands its oil & gas exclusions at the project level, now covering midstream and downstream Arctic/Antarctic and tar sands projects

• Lloyds becomes the first major UK bank to exclude projects dedicated to the development of new oil fields, no matter if they are conventional or non-conventional oil fields

• Following the latest NatWest policy, LBG becomes the second major UK bank to adopt an exclusion criteria at the corporate level, and the first one to exclude some oil and gas developers (even if only for tar sands)

THE NEGATIVES

• Lloyds still has to exclude any financing to coal infrastructure projects and companies planning new coal infrastructure

• The UK bank does not use the right metric for its exclusion of coal power companies, relying on the share of revenues while a more relevant metric is the share of power generation, which is closer to the real impact of coal power companies on the climate

• Lloyds still has a lot of progress to make on oil & gas, starting by expanding the exclusion of any direct financing to any new gas projects, as well as the exclusion of upstream and midstream oil & gas developers, not only tar sands developers

• Lloyds should also update its definition of the Arctic, and adopt the AMAP one instead of the IHO one, the AMAP one being more comprehensive and relevant

Ending the expansion of fossil fuels has become the litmus test of the credibility of fossil policies adopted by financial institutions since even the IEA recognized last year that we cannot afford to develop any new coal projects or oil and gas fields if we want to limit global warming to 1.5°C.

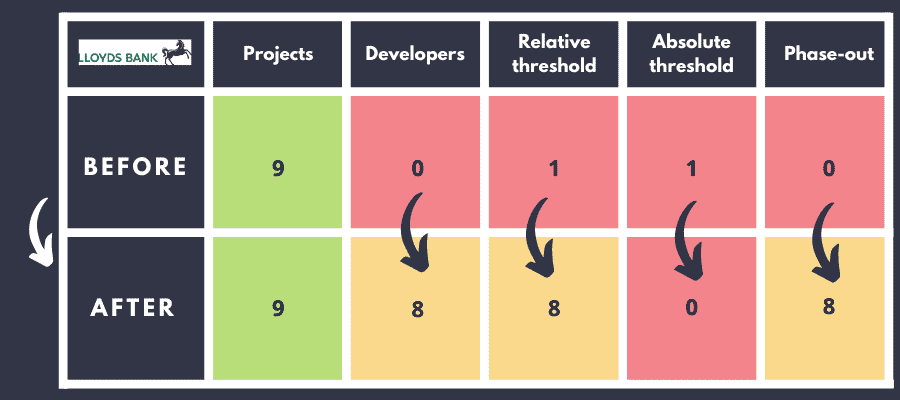

Lloyds scores in the Coal Policy Tool

This table presents the coal scores of Lloyds based on five criteria of the Coal Policy Tool.

Our conclusion

The adoption of these updated sector policies represents a giant leap forward regarding the coal sector, with most of the elements of a robust policy now in place, starting with the exclusion of coal mine/plant developers. Lloyds must now do the same on the oil & gas sector and strengthen its policy with a zero tolerance to any oil & gas expansion to contribute to solve the urgent climate crisis we face.