Fortum/Uniper is one of the main producers of electricity from fossil fuels in Europe (1), is struggling to propose a robust and credible strategy to get out of coal, and yet is included in the portfolios of many financial institutions, including BNP Paribas, Société Générale and Crédit Agricole. Between coal exit dates that are at best not aligned with scientific recommendations, at worst non-existent, and a growing recourse to gas, the company is far from being in transition.

According to the Global Coal Exit List, many banks and investors support Fortum/Uniper, including several French institutions. Fortum/Uniper is, however, a company mired in fossil fuels, with 13% of its electricity still coming from coal in 2021 and 47% from fossil gas (2).

A deceptive exit from coal …

Despite a desire to present itself as a player in the energy transition, Fortum/Uniper does not have a robust and credible coal exit strategy:

- Its exit plan is not detailed and does not follow scientists’ recommendations, with coal-fired power plants active until 2038 in the EU;

- The Berezovskaya (operated by Unipro, the russian subsidiary of Uniper) and Apatitskaya (Fortum/Gazprom joint venture) plants in Russia have no planned exit date;

- Coal-fired power plants are either sold or converted to gas, so emissions do not disappear but are simply transferred to other companies or other fossil fuels.

Moreover, the credibility of the energy company is undermined by its legal action against the Dutch government, which aims at challenging the Dutch 2030 coal phase-out date (3).

And an increasing use of gas

Fortum/Uniper plans to increase its gas-fired generation capacity by 2035, triple its LNG portfolio, and is developing two new gas-fired power plants in Germany. Yet the IEA’s conclusions to limit warming to 1.5°C are clear: all fossil fuel power plants not equipped with capture devices must be closed by 2035 for EU/OECD states.

While Russia’s war in Ukraine could have prompted Fortum/Uniper to scale back its gas development ambitions, the group is turning to diversifying supplies (4). With the increase in LNG imports and the resumption of the development of the Wilhelmshaven LNG terminal in Germany, the energy company is preparing its exit from Russian resources but is anchoring its dependence on fossil fuels.

Moreover, the energy company remains active in Russia through its 12 gas-fired and combined cycle power plants (5), with a total capacity of 15 GW of electricity (6). While Uniper’s long-term supply contracts rely heavily on Russian resources (up to 55% of the gas imported into Germany in 2021 (7)), the energy company has even increased its supplies of Russian gas since the beginning of the war.

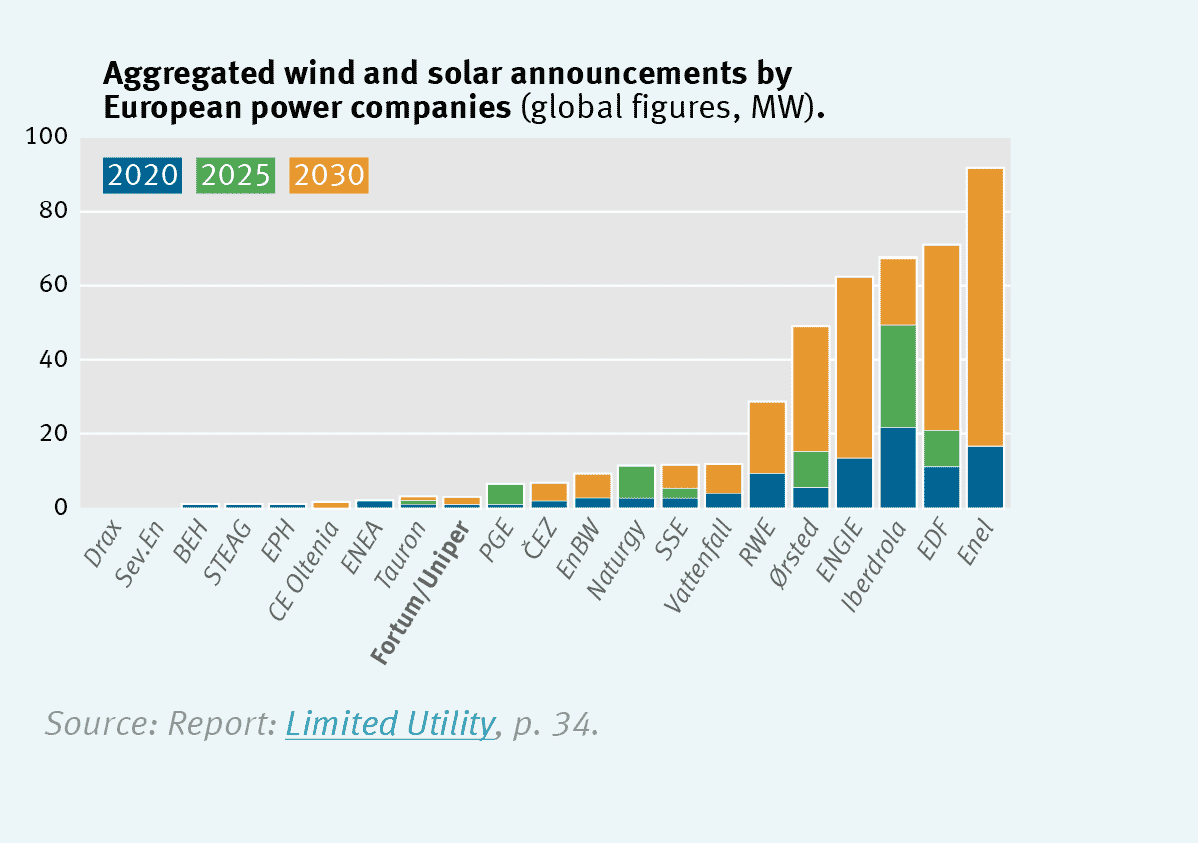

This entrenchment in gas is to the detriment of renewable energies, even though the group has considerable room for improvement: in 2021, less than 1% of its electricity production will come from solar and wind power (8). Despite announcements of wind power development … in Russia, Fortum/Uniper’s renewable energy targets remain low and are unlikely to close the gap with other European energy companies, as shown in the graph below:

Tightening the net of the financial institutions’ policies

Many financial institutions support Fortum/Uniper, even though they have adopted coal policies. Among them are several French institutions (9):

- BNP Paribas, which is its 2nd most important bank ($939.99 million in support between January 2019 and November 2021) as well as an investor ($139.84 million);

- Société Générale, both a bank ($231.24 million) and investor ($143.32 million) of the group;

- Crédit Agricole, 6th investor ($200.46 million).

Fortum/Uniper is in the portfolios of many other French institutions, including AXA and Crédit Mutuel CIC. This highlights the inadequacy of their policies and the urgent need to be more ambitious, in particular by specifying their requirements in terms of transition plans.

Until now, financial institutions have been content to exclude companies with high exposure to coal that do not have an exit plan. While many are calling for the adoption of such a plan, too few are paying attention to the overall transition strategy of companies, for example by looking at whether they are committed to closing their power plants and not converting them to gas, or whether they are integrating their exit from coal into a real transition strategy aiming at an exit from all fossil fuels, beyond coal. It is obviously essential to remember that gas, presented by many economic and financial players as a transition energy, is in reality a fossil energy, composed mostly of methane, a greenhouse gas 84 times more important than CO2 over 20 years (10). The evaluation of a transition plan based on the simple diversification of energies is therefore insufficient.

The insufficiently restrictive policies of the financial institutions allow them to support energy companies such as Fortum/Uniper, which are not only engaged in bad plans to get out of coal, but which maintain a dependence on fossil fuels. Limiting warming to 1.5°C means getting out of coal by 2030 but also closing gas-fired power plants by 2035 in the EU/OECD. Fortum/Uniper’s banks and investors must therefore urgently demand that the company adopt a real transition plan, otherwise they will fall into false solutions and miss their own climate goals.