Pre-AGM Decryption

With a planned coal phase-out in 2027 and an announced exit from gas in 2040, ENEL appears to be moving in the right direction. But the Italian utility now has to implement its transition strategy. Yet ENEL is still planning to convert some coal power plants to gas, has projects for new gas power plants, and may revive the development of its Sicilian LNG terminal. ENEL’s general meeting on May 19th is an opportunity for its climate-conscious shareholders to obtain details on the utility’s transition strategy and to challenge its contradictions.

ENEL’s coal phase-out: beware of the easy way out

The Italian utility still operates 8 coal-fired power plants. While the company has announced a coal exit date of 2027, the Italian utility must also adopt a robust strategy: ENEL has a track record of selling coal-fired plants (for instance the Reftinskaya plant in 2019) and is currently planning to convert some of its remaining coal assets to gas, which will only delay its exit from fossil fuels. Under pressure from environmental NGOs and concerned citizens, ENEL gave up last February on the conversion of 3 Italian coal-fired power plants to gas. ENEL must now commit to not converting any of its remaining coal-fired plants.

ENEL’s ambiguous strategy on gas

The conclusions of scientists regarding fossil fuels, including gas, in the power sector are clear. In its latest report (2), the Intergovernmental Panel on Climate Change (IPCC) highlighted that new fossil fuel infrastructures would lock-in carbon emissions and make it harder to limit global warming to 1.5 or 2°C, underlining that “decommissioning and reduced utilization of existing fossil fuel installations in the power sector as well as cancellation of new installations are required to align future CO2 emissions from the power sector with projections in these pathways”.

On paper, ENEL is moving away from gas: it is one of the only major European utilities to have announced a gas phase-out date. The Italian utility has made several statements in favor of disengaging from gas, criticizing its competitors’ reliance on carbon capture technology and recently blaming the dependence of EU energy policy on gas. Yet ENEL’s gas strategy remains unclear.

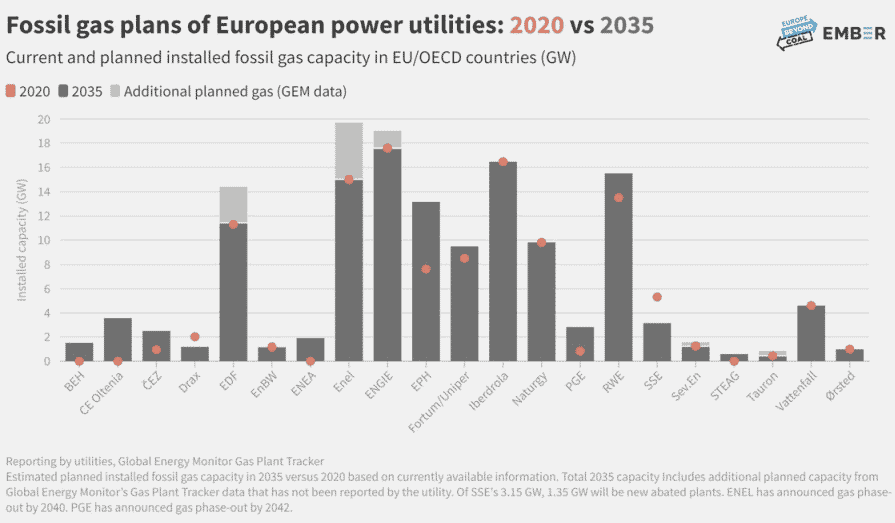

In 2021, 30% of ENEL’s capacity is derived from gas and the Italian utility is the second leading European utility in terms of gas capacity (26 GW in 2021) after ENGIE. In addition to its current capacities, ENEL is contradicting its own statements by planning new gas projects in Italy. In 2021, a joint EMBER and Europe Beyond Coal analysis found that ENEL was among the top utilities developing new gas capacity in EU/OECD:

Recently, in the context of Europe’s disengagement from Russian gas, ENEL announced it could revive its Porto Empedocle LNG terminal project in Sicily, thus choosing to face the decrease of Russian gas supplies by importing one of the most polluting types of gas. ENEL’s management specified that “LNG terminals were a short-term solution — to diversifying gas sourcing in Europe and were an add-on to the limited number of existing pipelines which make gas provisioning insecure in periods of crisis” (1). Given that the lifespan of this type of infrastructure is at least 20 to 30 years, building one to meet short-term requirements seems highly disproportionate. Investing in a new LNG terminal would lock-in fossil gas reliance for several decades, thereby locking-in the associated greenhouse gas emissions.

Investors must challenge ENEL on its climate plans at its AGM

Despite taking ambitious pledges compared to its European competitors, ENEL must scale up its commitments and exit gas in 2035 in EU/OECD in order to have a truly robust transition plan. Most importantly, the Italian utility must complete its coal phase out without selling or converting any coal assets, give up on its new gas projects and set in motion its gas exit strategy.

ENEL’s AGM provides investors with an important window of opportunity to challenge the utility on its energy transition plans and climate ambitions. Climate-conscious shareholders should ask questions to address the shortcomings of ENEL’s gas strategy, as the utility has yet to announce a precise gas exit timeline that matches its current expansion plans.

Investors who are serious about their climate commitments should take advantage of ENEL’s AGM to challenge the utility’s contradictions regarding gas and obtain more details on its transition strategy.