Three years after its last update, Deutsche Bank has announced the main points of its updated coal policy. While there has been some progress, the German bank still fails the litmus test of climate credibility as it will not immediately blacklist companies that still plan to expand their activities in the coal industry, despite the climate crisis we face and the fact that these plans are totally incompatible with a 1.5°C trajectory. Deutsche Bank must correct this giant loophole in its policy and follow many of its peers by making the end of coal expansion an immediate and mandatory requirement for its existing clients.

The main points of the policy

Deutsche Bank published the following main elements of its updated policy in a media release on March 2nd, 2023:

- A requirement that coal companies deriving more than 50% of their revenues from thermal coal adopt a ‘credible transition plan’ with the expectation that they reduce this dependency to below 50% of their revenues from thermal coal by 2025 in OECD countries or to below 30% by 2030 in non-OECD countries;

- A requirement that coal companies deriving more than 30% of their revenues from coal or exceeding new absolute thresholds of 10 Mt of annual coal production for mining companies and 10 GW of coal capacity for power generators, adopt a ‘credible transition plan’ by 2025, with the expectation to include coal exit dates of 2030 in the OECD and 2040 worldwide, with some exceptions.

Deutsche Bank is expected to publish the full updated coal policy in the coming weeks.

Our analysis

THE POSITIVES

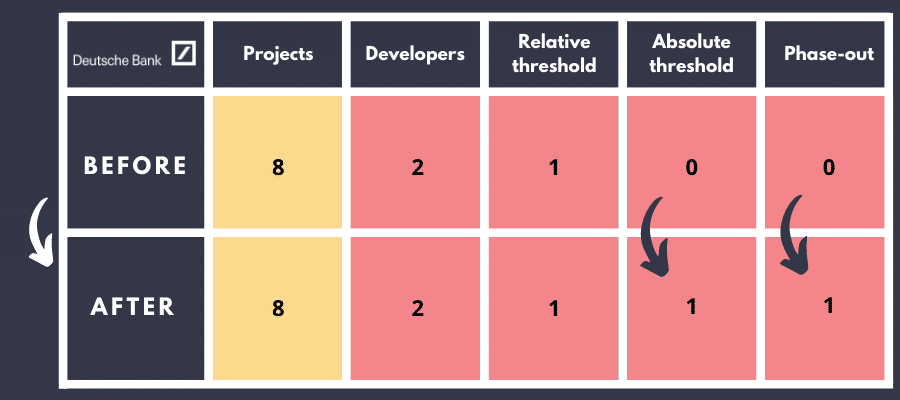

- Deutsche Bank extended the scope of companies covered in its approach with the lowering of its relative threshold and the adoption of absolute thresholds for both coal mining and coal power companies. The latter is particularly important because it is the only way to be able to cover large conglomerates which are very diversified and thus below the 50% or 30% relative thresholds. But even if these thresholds are exceeded, they do not trigger an automatic exclusion;

- The German banking giant has, for the first time, provided some details of its definition of a “credible transition plan”, setting an expectation of interim targets for some companies, and the adoption of coal phase-out deadlines for all companies in scope.

POINTS FOR IMPROVEMENT

- Deutsche Bank has failed to immediately exclude companies that are planning and developing new coal projects. The concept of expansion is not even explicitly addressed by the bank. According to the Global Coal Exit List (GCEL), there are 371 coal developers,which are below the 50% threshold that triggers the expectation to reduce the share of coal in their activities over time. Collectively, they are still planning195 GW of new coal power capacity, almost the equivalent of the current US coal fleet, and they represent 75% of the 490 coal developers listed in the GCEL. Among the companies not covered are some coal developers that have previously been supported by Deutsche Bank, including those in the table below.

- The relative and absolute thresholds do cover a significant number of companies listed in the GCEL, but the absolute threshold for coal power remains too high to cover some important coal power producers such as Berkshire Hathaway Energy and Vedanta Resources, which given their size should be covered. Above all, these thresholds are not exclusion thresholds, they only define the scope of companies for which Deutsche Bank ‘requires’ a ‘credible transition plan’ with specific ‘expectations’. The bank will only proceed with exclusions after a period of engagement, which could last until 2025 or even after, and only as a ‘last resort’;

- The exceptions to the coal phase-out deadlines expected in a “credible transition plan” are also significant as they cover important state-owned companies in countries that have adopted a Just Energy Transition Partnership: Indonesia, Vietnam and South Africa. As part of these partnerships, some measures will be put in place to accelerate the coal phase-out in these countries. Yet, none of their main coal operators, i.e. PLN in Indonesia, EVN in Vietnam or Eskom in South Africa have guaranteed that they will phase-out their operating coal assets by the deadline, despite their net zero commitments. In fact, they still plan additional coal power capacity with more than 6 GW, 5 GW and 1 GW respectively, according to the GCEL.

Coal developers supported by Deutsche Bank (1)

| Coal developer | Total financing (lending and underwriting, US$ million) from 2019 to November 2021 | Company that is still involved in… |

|---|---|---|

| Adani | 400.09 | 8 new coal mining projects in Australia (including the Carmichael project) and India, as well as over 12 GW of additional coal power capacity in 6 different projects throughout India |

| Glencore | 1,217.16 | 9 new coal mines/expansion of existing mines in Australia and South Africa |

| SDIC | 76.32 | Almost 7 GW of new coal capacity in 5 projects in China |

This table shows Deutsche Bank scores based on the 5 criteria of the Coal Policy Tool

Deutsche Bank missed the opportunity to follow many European large banks such as the French banks Credit Agricole, BNP Paribas and Societe Generale, or the UK banks, HSBC, Barclays and Standard Chartered, to explicitly and immediately exclude many coal developers. This should be the first and immediate red line that must be required by Deutsche Bank for any transition plan developed by existing clients to be credible. The German bank needs to correct this and start tackling the oil & gas sector in its next policy update. Deutsche Bank could also start excluding direct financing for new oil & gas fields and related midstream infrastructure which are incompatible with a 1.5°C scenario, as recently adopted by HSBC. It will have to also tackle corporate services to expansionists to show credibility. Since it joined the Net Zero Banking Alliance in April 2021, Deutsche Bank has channeled almost US$9 billion to the main oil and gas developers.