26 March 2024 – Despite the crucial need to decarbonize the steel sector, which is one of the biggest sources of industrial emissions, the world’s major banks continue to support the largest and most polluting steel producers. They provided US$429 billion to the 100 biggest producers between 2016 and June 2023, according to a new Reclaim Finance report, which highlights the key role that banks can play in decarbonizing the sector (1). Yet many of the biggest steel producers plan to continue using fossil fuels for steel production, even though the International Energy Agency’s projections for limiting global warming to 1.5°C say new steelmaking processes are critical. Reclaim Finance is calling on the banks to urgently adopt policies to restrict their support for steel production from metallurgical coal and to finance the production of fossil-free steel.

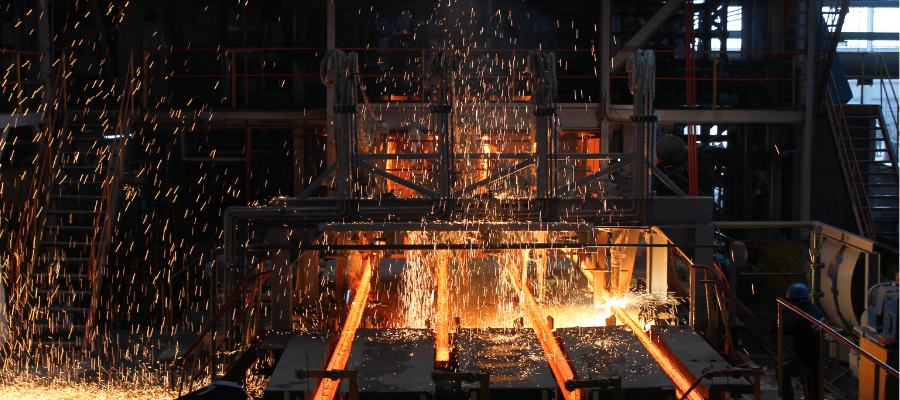

Steel is an essential material in industrial production and everyday life, but it is also the biggest industrial source of CO2, due to the use of metallurgical coal in the blast furnaces where it is produced (2). Given that demand for steel will continue to grow (3), it is crucial that this sector is decarbonized to limit global warming to 1.5°C, and it is also possible given that new technologies, notably based on green hydrogen, exist. According to studies, the steel sector could be almost entirely coal-free by the early 2040s (4).

Continuing to finance the production of steel from coal is both a climatic and a financial risk. Demand for carbon-free steel is growing and technologies are becoming increasingly competitive. Supporting the production of carbon-free steel, particularly from green hydrogen, is therefore a real opportunity for banks. They must join the transition and adopt robust policies to support the shift towards a low-carbon steel sector.

Cynthia Rocamora, industry campaigner at Reclaim Finance

Currently, just one bank globally – the Dutch bank ING – has made a commitment for the steel sector, and this is only at project level (6). Reclaim Finance says that the adoption of policies is even more urgent given that more than half of the projects planned worldwide by steel-producing companies, such as ArcelorMittal and the Korean company POSCO, will use metallurgical coal (7).

We cannot address climate change without eliminating coal from steel production. Most banks globally already recognise that coal has no future in energy, they need to wake up to the reality that it has no future in steel either, and stop wasting money on it. Investments made this decade will determine whether companies keep burning metallurgical coal in their blast furnaces for decades to come, completely derailing climate action, or if they prudently transform to green technologies.

Caroline Ashley, director at SteelWatch

ArcelorMittal, which in early 2024 announced investments to decarbonize its Dunkirk site with the help of the French government (8), still produces 70% of its steel from blast furnaces using coal. The company, which is one of the steel producers receiving the most financial support from BNP Paribas, Crédit Agricole, Société Générale and HSBC (9), still plans to continue developing blast furnaces and to extend the life of existing furnaces. This runs counter to the projections of the International Energy Agency, which states in its Net Zero Emissions scenario that to achieve net zero, emissions from the steel sector must be reduced by 90% by 2050, meaning there is an urgent need to produce steel without fossil fuels.

Reclaim Finance calls on the banks to adopt strong commitments to restrict their financing to steel produced using metallurgical coal, and to not finance new blast furnaces or extend the life of existing blast furnaces or to support the companies developing them. Reclaim Finance is also calling on the banks to commit to increasing their support for low-carbon technologies, such as green hydrogen.