Money is the oxygen flowing through the fossil fuel system. Yet it’s now known that limiting global warming to 1.5°C requires global banks to stop bankrolling the fossil fuel industry, starting with the dirtiest of them, coal. Yet, despite its updated coal policy, Standard Chartered ranks first among UK bankers of coal plant developers due to its significant business activities in Asia. As Standard Chartered’s AGM opens tomorrow, it seems like a good time to take a closer look at where the bank stands on coal financing.

Standard Chartered: n°1 UK bank for coal plant developers

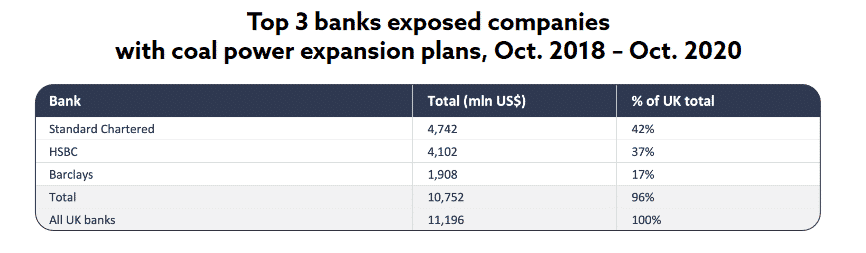

According to a new report by Reclaim Finance and Urgewald, Standard Chartered channeled more than $10 billion to companies in the Global Coal Exit List between October 2018 and October 2020, with almost half of this amount ($4.7 billion) going to coal plant developers. This makes it the UK bank with the highest financing of/for companies that are betting most heavily against the success of the Paris Agreement, such as Power Finance Corp (PFC) in India ($1.5 billion financing in the same period), PLN in Indonesia ($969 million) or POSCO in South Korea ($524 million). With $283 million in underwriting services, Standard Chartered is also the third biggest financier of Adani in india, the company behind the highly controversial Carmichael coal mine in Australia. In Asia, the last resort for the expansion of the coal industry, companies building new coal plants in the region can rely on Standard Chartered’s continuous financial support. Standard Chartered has been the leading bank behind the companies driving the expansion of India’s and the Philippines’ coal pipelines (until the moratorium).

A coal policy that still makes (a lot of) room for new coal

All new coal plants under construction today take us further away from achieving the Paris climate goals. It is critical to cease support for coal plant developers and abide by the No New Coal principle. Since 2018, Standard Chartered has been working to reduce its coal financing but to no avail: the policy currently excludes mining and power companies with 100% of their EBITDA from thermal coal from 2021 onwards. The policy plans to lower this threshold to 80%s in 2024, 60% by 2025, 40% by 2027 and 5% by 2030. However, this policy remains too weak to effectively cease support to new coal plant developments. The thresholds will stay high for too long: according to Urgewald’s research, this means that in 3 years from now the bank would only have to drop 2 coal companies. The 40% threshold that will have a visible impact on the bank’s portfolio cannot be postponed to 2027: that is way too late to address the climate emergency we are facing now.

Also, the EBITDA is not an adequate metric to define the relative size of a company’s coal-related operations: some coal plant developers have a low or even 0% coal share of revenue. For example, Standard Chartered has lent 1.5 billion US$ to PFC, an Indian company which derives low to no earnings from coal operations, but is paving the way for new coal plants in India by lending money to coal developing companies. Four new coal power plants with a total capacity of 9.6 GW began construction in India in 2019, and all have received funding from PFC. In theory, Standard Chartered could still finance these kinds of companies well after 2030.

The bank needs more immediate exclusion thresholds at the corporate level and must exclude all coal developers if it wants its coal phase-out strategy to be credible.

The pressure is mounting on Standard Chartered to review its policy. Market Forces threatened to file a resolution at the bank’s 2022 AGM because of its hypocrisy over climate change. Today, Standard Chartered has just been targeted by a hoax claiming that the bank would stop financing coal plant developers by 2021 and other fossil fuel developers by 2023. If Standard Chartered turned the hoax into policy, it would help kick coal out of the global system.