The London and Bermuda-based insurer announced on past February 1st 2022 that it “will not insure the construction or operation of any new thermal coal mine and/or its dedicated infrastructure.”

- This is the first step of this recently founded insurer, which has rapidly become an important player in the fossil fuels sector. It comes in reaction to an NGO campaign targeting Convex’s potential involvement in the Carmichael coal mine project in Australia.

- The new policy is clearly insufficient in the face of the urgency of the climate crisis, especially given that Convex can continue to insure coal power projects and coal companies across the board.

- The policy also has no restrictions whatsoever regarding the oil and gas sector.

- A real first step towards aligning its operations with 1.5°C would be to adopt a robust coal policy similar to that of the Bermuda-based insurer AXIS, and to end its coverage of any oil and gas expansion.

Our analysis: a baby step

THE POSITIVES

- This first measure taken by Convex on fossil fuels comes after an active campaign from NGOs including Market Forces, which targeted the company for its involvement in the infamous Carmichael coal mine project in Australia. Convex had indeed become one of the last holdouts refusing to join the more than 40 of its peers ruling out any coverage for this dodgy deal.

- Its statement indicates that the insurer will not insure Carmichael nor any other new thermal coal mine or its dedicated infrastructure. It becomes the 43rd global insurer and 108th major company to rule out support for Adani’s mine. This is an important first step since Convex entered the market recently, in 2019, against the tide of a global exodus, and quickly became a major energy sector insurer, underwriting coal, oil, and gas companies, according to the Insure Our Future campaign.

THE NEGATIVES

- The new measure is only a baby step as the exclusion of the direct insurance of new thermal coal mines is just the very first obvious and immediate step that an insurer can take, something which should already have been adopted years ago.

- Convex’ statement does not cover the direct coverage of new coal plants at the project level, nor the insurance of coal mining/power/infrastructure companies at the corporate level. There are still 655 new coal plants in the pipeline and each of them is inconsistent with the Paris Agreement climate targets. It also fails to include any restrictions regarding the oil and gas sector.

Ending the expansion of fossil fuels has become the litmus test of the credibility of fossil policies adopted by financial institutions since even the IEA recognized last year that we cannot afford to develop any new coal projects or oil and gas fields if we want to limit global warming to 1.5°C.

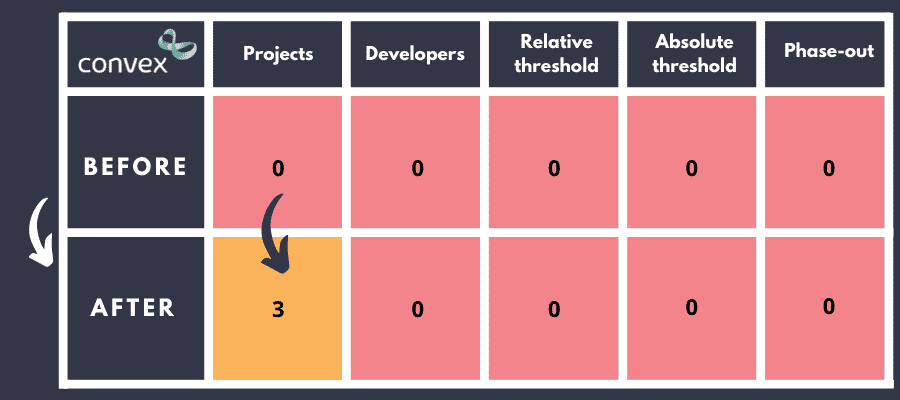

Convex scores in the Coal Policy Tool

Our conclusion

Convex must urgently follow up on this first step and align itself with best practices in the sector, such as the robust coal policy adopted by AXIS Capital, another Bermuda-based insurer. It must immediately exclude the coverage of new coal plants and of coal developers, and it must also start to tackle the oil and gas sector by also excluding oil and gas expansionists.