Despite climate science having made clear years ago the need to swiftly halt coal production, half the global coal industry is still on course for expansion (1) and coal is still the largest source of power generation globally. If new coal mines, plants or infrastructure are still being developed, it is because it is still possible for the companies behind them to access unrestricted financing. Bonds are a critical source of funding for the companies that are seeking to expand their coal activities: nearly all coal developers in the Global Coal Exit List (GCEL) (2) have issued bonds to finance and develop their operations – these are toxic bonds.

The recent data released by Urgewald, Reclaim Finance, 350.org Japan and 25 other partners (3) gives extensive details of who is financing the 1,032 companies on the Global Coal Exit List. The List covers companies across the whole coal industry, with activities ranging from coal mining, trading and transport, to the operation of coal-fired power stations and the manufacturing of equipment for new coal plants. While identifying institutional investments of over US$ 1.2 trillion in the coal industry as of December 2021, this research also tells us more about bond financing.

A bond is basically a debt instrument where an investor loans money to a borrower – here a coal company. Bonds are crucial financial instruments to look at in terms of climate impact. On the one hand, they are a major source of financing for fossil fuel companies (4) and on the other, bond issues represent a critical moment for investors that are willing to engage companies on climate grounds because it gives them power (5). The analysis below provides insights on which investors are holding the most toxic bonds linked to coal expansion.

Key figures: the investors behind coal bonds

Financial research on the coal sector shows that a total of $228 billion is being invested, as of December 2021, in the coal industry via bonds. While climate science is calling for an annual decrease of global coal production and a swift exit of the sector (6), over a quarter of this amount – $60 billion – is being invested in companies that are developing and expanding their coal operations (7).

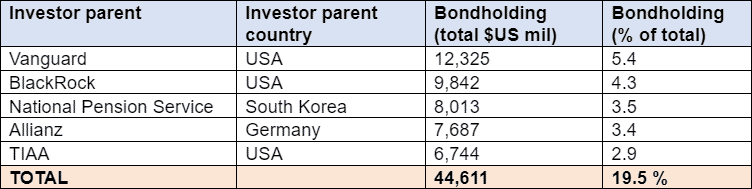

Who are the top coal bond holders? In line with the wider analysis, a small number of financial institutions play an outsized role when it comes to investing in coal bonds. The top five investors in coal bonds account for 20% of all coal bond holdings.

The most toxic bonds: bonds linked to coal expansion

Along with the last IEA net zero scenario conclusions, climate science has made clear for a while that there can be no more investments in new coal plants, mines or infrastructure. Investors should be denying debt to companies involved in such projects and should use their bond power to engage meaningfully with the rest of the coal sector.

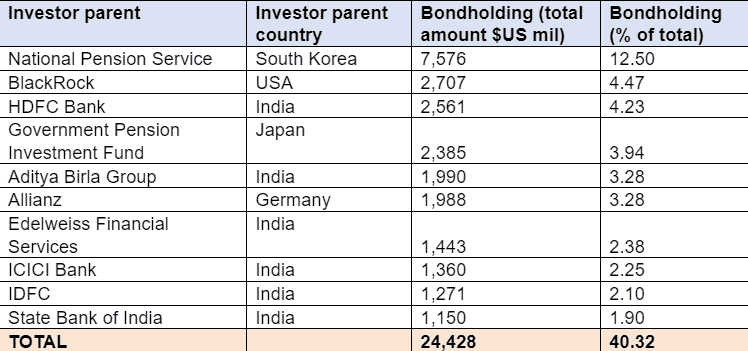

The financial research on coal shows that a handful of investors are behind the dirtiest bets on the coal industry. Ten institutions have $24 billion in bond holdings linked to coal expansion, which accounts for over 40% of the total $60 billion being invested in such companies.

Which investors are the most hypocritical?

While being among the biggest bondholders of coal companies is a problem in itself, the financial research also reveals glaring contradictions between the amounts being invested in coal bonds and the net-zero commitments made by the same institutions.

Allianz

Allianz is one of the biggest insurers worldwide and is a member of the Net Zero Insurers Alliance, Net Zero Asset Owners Alliance and the Climate Action 100+. It has recently updated its coal policy and, while it aims for a coal phase-out worldwide by 2040, the criteria are still loopholed, including on bonds (8). More importantly, Allianz does not apply its divestment policies to the more than $1 trillion in third party assets which it manages (via its branches Allianz GI and PIMCO). This results in the institution being right at the top of the tables as the fourth largest holder of coal bonds ($7.6 billion) and one of the largest investors in coal development via the most toxic bonds (i.e. linked to coal expansion), in complete contradiction with its commitments.

HSBC

HSBC is a member of the Net Zero Banking Alliance and, under pressure from shareholders, made a commitment to a total phase-out from the coal sector by 2040 worldwide (9). Yet HSBC is still supporting the expansion of the industry – including via investment of nearly $650 billion in the most toxic bonds, meaning the bonds linked to coal expansion.

BlackRock

BlackRock adopted in 2019 a very weak coal policy (10). Because of its many loopholes, BlackRock still has over $9.8 billion in coal bonds, $ 2.7 billion of which is invested in the most toxic bonds, meaning the bonds linked to coal expansion. BlackRock is also one of the biggest buyers of new fossil fuel bonds worldwide (11) and has not committed to stop buying future debt issued by coal developers. Despite these appalling figures, BlackRock is still a member of the Net Zero Asset Manager Initiative.

Bonds are a critical source of funding for the coal industry and might make their holders the last resort for companies looking to expand their coal operations. Financial institutions must deny any future debt to these companies and divest from their existing coal bond holdings. Beyond the obvious dramatic indirect climate impacts of such investments, investors will also risk losing money if they don’t rapidly move away from fossil fuels (12).