PrOTECT Africa from a CARBON future

Financial players must stop TotalEnergies’ expansion plans

Africa is already in the midst of a climate emergency. The continent only accounts for around 3% of global greenhouse gas emissions, yet its communities, ecosystems and economies are experiencing ever more intense heat waves, droughts, cyclones and catastrophic floods. While the Intergovernmental Panel on Climate Change (IPCC) and United Nations Environment Programme (UNEP) warn that global greenhouse gas emissions must be halved by 2030 to limit global warming to 1.5°C, the number one source of these emissions – the fossil fuel industry – continues to expand thanks to the support of financial institutions. This has to change.

This report identifies the financiers and investors behind 200 companies, which are flooding Africa with new fossil fuel projects. Far from being in transition, all of these companies are pursuing reckless fossil expansion plans that are incompatible with a 1.5°C climate path. Financial institutions must immediately cease all investments, loans and financial services to them.

Financial institutions are locking Africa into a carbon-heavy energy future

International financial institutions have sunk hundreds of billions of dollars into oil, gas and coal projects in Africa in the past three years. Between January 2019 and July 2022, 352 banks channeled over US$ 98 billion to companies developing new fossil projects in Africa and over 5,000 institutional investors held, in July 2022 shares and bonds totaling US$ 109 billion in companies developing new fossil fuel projects in Africa.

Despite having pledged to meet net zero by 2050 following a 1.5°C pathway, most banks, insurers and investors have no policy in place to stop supporting fossil fuel developers. In 48 African countries out of 55, 200 companies are preparing to add at least 15.8 billion barrels of oil equivalent to their production portfolios before 2030. The extraction and combustion of these resources would release 8 Gigatons of CO2 eq into the atmosphere – more than twice the amount the European Union emits each year. In addition, these companies also plan to double the continent’s liquefied natural gas (LNG) export capacity and to build over 20,000 km of pipelines (enough to connect the North and South Poles!)

TotalEnergies is the biggest oil and gas developper in Africa

Among companies exploring or developing new fossil reserves, building new fossil infrastructure such as pipelines or LNG terminals figures TotalEnergies, which is the biggest developer of new upstream oil and gas resources in the continent.

The French oil and gas major, already responsible for over 14% of short-term oil and gas expansion in Africa, is exploring for oil and gas in 15 African countries. In 2021, TotalEnergies’ total hydrocarbons production equaled 1 billion barrels of oil equivalent, out of which 25% came from Africa. Today, the major aims to add 2.27 billion barrels of oil equivalent to its production portfolio in the continent, which demonstrates once more the company is far from being in transition.

TotalEnergies hides its anti-climate strategy under the guise of a fake “climate” plan but remains the 7th largest oil and gas expansionist worldwide with more than 70% of its capital expenditures dedicated to fossil fuels?

A glimpse of TotalEnergies’ climate bombs in Africa

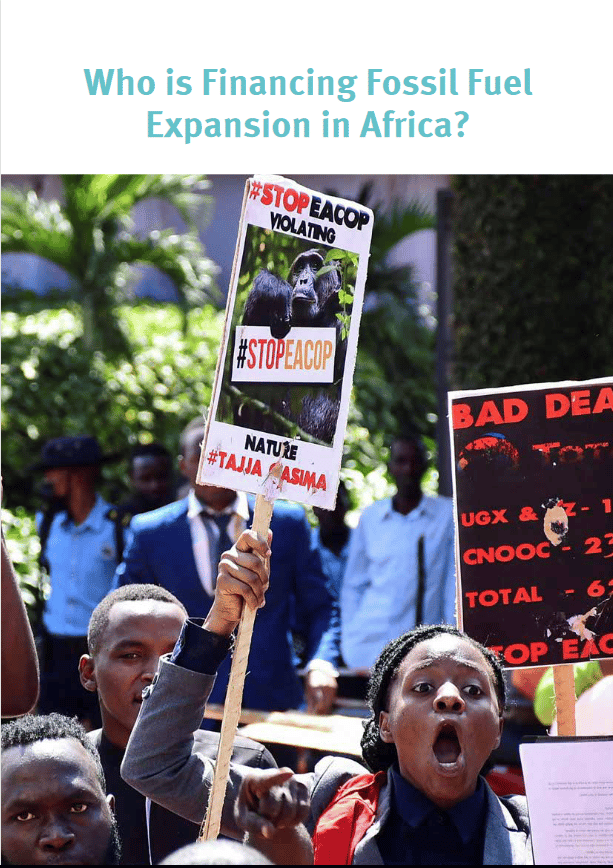

EACOP

Led by TotalEnergies (62% at stake), the East African Crude Oil Pipeline would be the longest heated pipeline in the world (1443km), crossing Uganda and Tanzania. It will go through Lake Victoria basin, on which about 40 million people in East Africa depend.

The project EACOP/Tilenga will directly affect the land of more than 100 000 people, and will emit at its pick 34 million tons of CO2 per year (6 times the CO2 emission of Uganda per year).

South Africa

In September, TotalEnergies applied for a production license to exploit two major gas fields off South Africa’s southern coast. In a rich and biodiverse area, TotalEnergies would open a dangerous precedent. Indeed, in the word of the fossil industry itself, “if Brulpadda and Luiperd are determined to be commercially viable, these discoveries could launch theSouth African oil and gas industry to the next level and attract much needed investment”.

Mozambique LNG

Financial players must stop TotalEnergies’ expansion plans

TotalEnergies’ anti-climate strategy is powered by the complicity of financial players.

Behind the company’s dreadful oil and gas expansion plans are banks, insurers and investors that keep supporting the company with loans, insurance coverage and other financial services, without even calling the French major to stop developing new fossil fuel projects.

Among them are especially the French financial institutions BNP Paribas, Crédit Agricole and its asset management subsidiary Amundi, as well as Societe Generale and BPCE group.

Top 15 investors supporting in TotalEnergies

Shares and bonds (July 2022)

| Investor Parent | Investor Parent Country | Total (US$ Mln) |

|---|---|---|

| BlackRock | United States | 4258 |

| Vanguard | United States | 1714 |

| Government Pension Fund Global | Norway | 1527 |

| Wellington Management | United States | 1107 |

| T. Rowe Price | United States | 803 |

| Crédit Agricole | France | 719 |

| Capital Group | United States | 686 |

| Deutsche Bank | Germany | 632 |

| Fidelity Investments | United States | 524 |

| Société Générale | France | 516 |

| BNP Paribas | France | 503 |

| Fisher Investments | United States | 466 |

| JPMorgan Chase | United States | 464 |

| Dimensional Fund Advisors | United States | 334 |

| Geode Capital Holdings | United States | 331 |

Top 15 banks supporting in TotalEnergies

Loans and underwriting services (Jan16-Jun22, US$ mln)

| Investor Parent | Investor Parent Country | Total (US$ Mln) |

|---|---|---|

| Barclays | United Kingdom | 1136.66 |

| Société Générale | France | 1108.19 |

| BNP Paribas | France | 1050.05 |

| JPMorgan Chase | United States | 949.20 |

| Crédit Agricole | France | 945.34 |

| SMBC Group | Japan | 756.42 |

| Royal Bank of Canada | Canada | 723.78 |

| Mizuho Financial | Japan | 684.50 |

| Deutsche Bank | Germany | 635.42 |

| Citigroup | United States | 618.82 |

| Goldman Sachs | United States | 897.57 |

| Morgan Stanley | United States | 538.16 |

| Banco Bilbao Vizcaya Argentaria (BBVA) | Spain | 475.25 |

| Santander | Spain | 434.73 |

| Groupe BPCE | France | 433.84 |

This report identifies the financiers and investors behind 200 companies, which are flooding Africa with new fossil fuel projects. Far from being in transition, all of these companies are pursuing reckless fossil expansion plans that are incompatible with a 1.5°C climate path. Financial institutions must immediately cease all investments, loans and financial services to them.