THE ARCTIC IS A CLIMATE BOMB

READY TO GO OFF

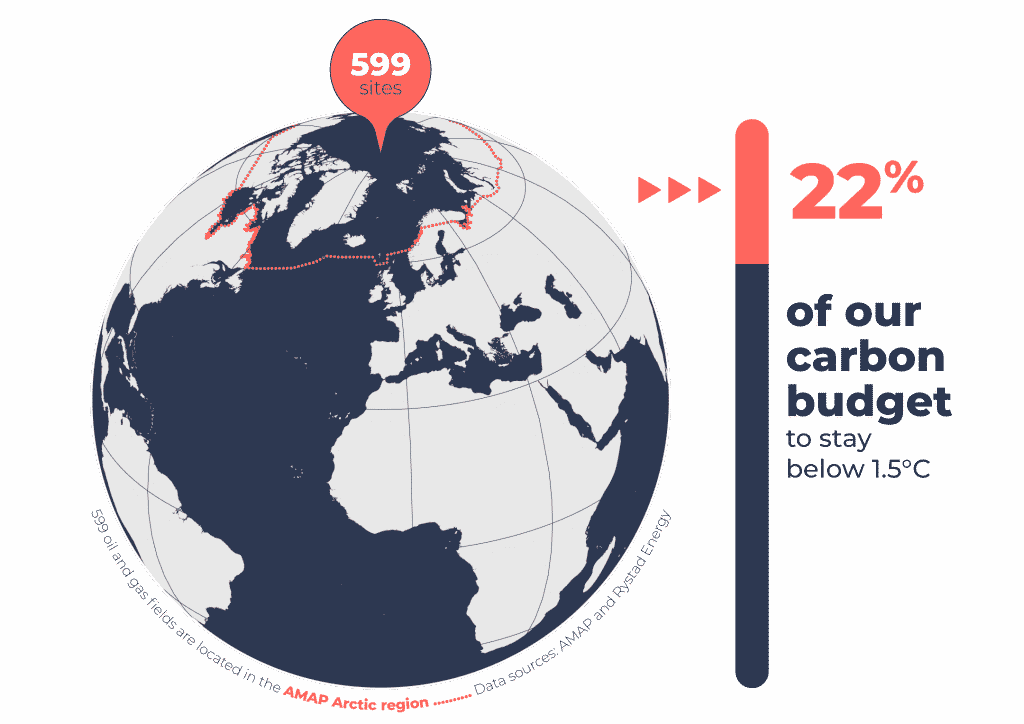

The Arctic holds enough discovered oil and gas reserves to burn 22% of our remaining carbon budget by 2050, if we are to achieve the universally-agreed goal of keeping global warming below 1.5°C. Ironically, as the Arctic melts faster and faster, its fossil fuels reserves are becoming more accessible. And the more oil and gas industry projects in the Arctic, the greater the pollution of the white ice sheets, undermining the vital role they play in cooling down the planet.

In turn, that means accelerating global warming in the Arctic, thawing permafrost and releasing methane, a gas 84 times more powerful than C02 in the short term. It’s a vicious climate circle.

OIL AND GAS COMPANIES

ARE LOOKING TO EXPAND

INTO THE ARCTIC

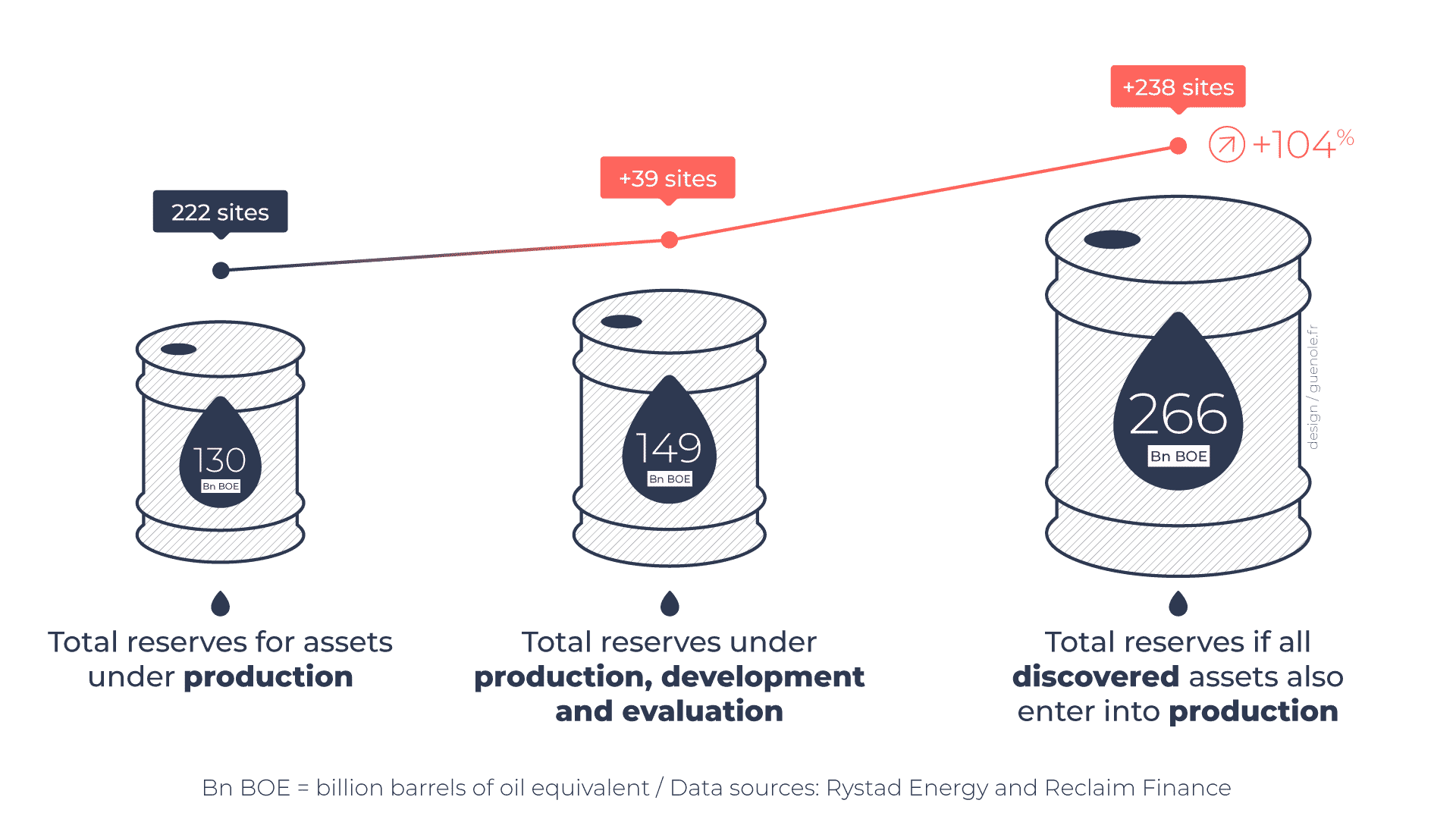

Despite the importance of the Arctic regions for climate stability, ecosystems and communities, there are 599 oil and gas fields listed in the Arctic region as defined by the Arctic Monitoring and Assessment Programme (AMAP). More than 220 of these sites are already in production. Despite heightened costs and extreme conditions, the Arctic frenzy could intensify: There are currently 39 oil and gas fields planned for production and 338 other discovered sites could also start developing. If all these future sites found the financial support they require, total reserves under production could double and burn up to 22% of our remaining 1.5°C carbon budget.

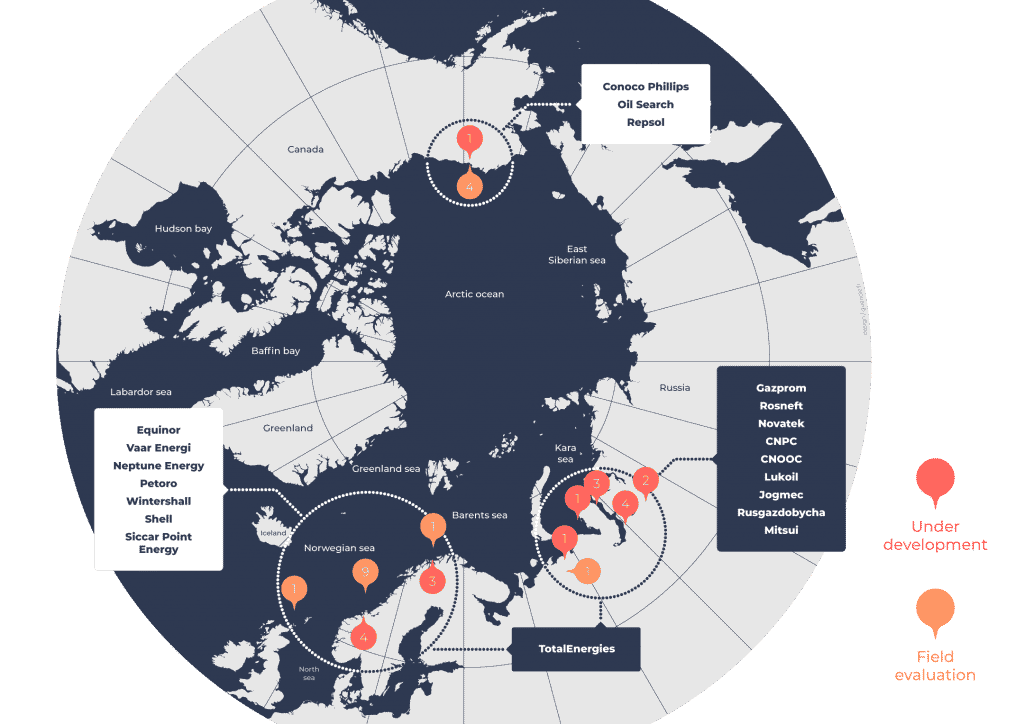

Shockingly, Arctic oil and gas production is already ramping up: in the next five years, Arctic oil & gas production is set to increase by 20%. There are more than 20 companies developing new oil and gas projects in the Arctic region. We call them the “Arctic expansionists”. The number 1 long and short-term expansionist in the Arctic is Gazprom, the biggest Russian energy company and second largest oil and gas producer in the world in 2020. Gazprom has big plans for the Arctic as 74% of its oil and gas reserves are based there. Russian companies may be leading the oil and gas frenzy in the Arctic but American ConocoPhillips is listed as the 3rd biggest expansionist with production levels due to increase by 36% by 2030. Nearly half of the companies are European, with French outfit TotalEnergies leading the way: by 2030, TotalEnergies’s oil and gas production in the Arctic is set to increase by 28%.

BIG MONEY IS FUELLING

THE ARCTIC CRISIS

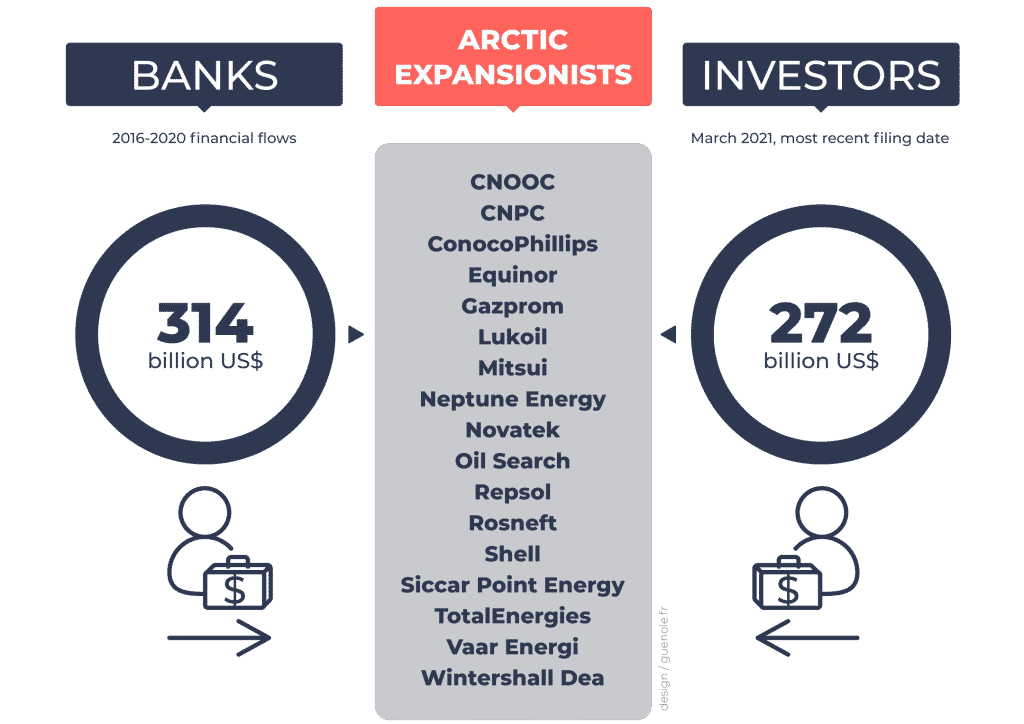

None of this fossil fuel bonanza could take place without backing from private finance. Bankers, investors and insurers have been directly or indirectly fuelling oil and gas expansion in the Arctic.

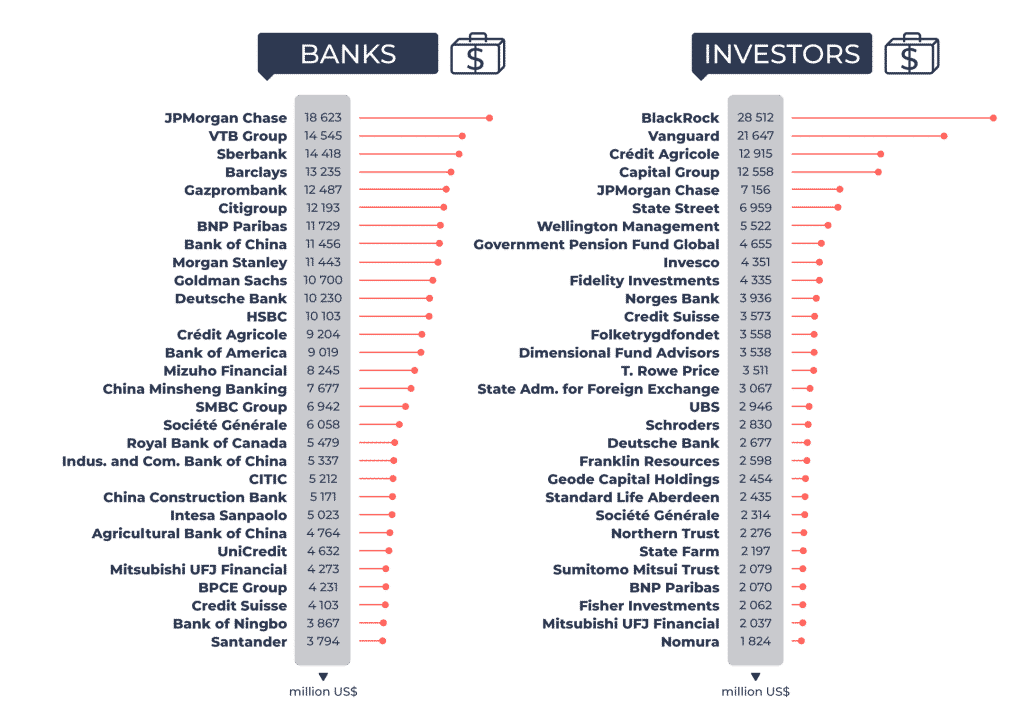

We undertook extensive research to investigate how banks and investors were supporting the Arctic expansionists. The findings: from 2016 to 2020, commercial banks channeled $314 billion to Arctic expansionists in loans and underwriting. As of March 2021, investors held roughly $272 billion in those same companies in shares and bonds.

80% of all loans and underwriting to Arctic expansionists comes from just 30 banks. The list includes banks committed to restricting oil & gas financing in the Arctic: JPMorgan Chase (top globally with $18.6bn between 2016-2020), Barclays (4th largest, $13.2bn), Citigroup (6th, $12.2bn) and BNP Paribas (7th, $11.8bn). In 2020 alone, despite adopting Arctic exclusion policies, BNP Paribas and HSBC were the top financiers of the companies developing new oil and gas in the Arctic.

There are hundreds of investors backing oil and gas companies developing new projects in the Arctic. 30 financial companies are responsible for $162.6 billion of the investments, led by BlackRock (top globally with $28.5 bn), Vanguard (2nd, $21.6 bn), and Crédit Agricole via Amundi (3rd, $12.9 bn). Only two of the top 30 investors currently have a policy restricting investments in the Arctic. Top investor, Blackrock, does not have an Arctic policy.

BANKS, INVESTORS AND INSURERS

ARE FAILING TO PROTECT THE ARCTIC

Although an increasing number of banks, investors and insurers have some sort of restriction for oil and gas operations in the Arctic, support for oil and gas development in the Arctic has continued largely unabated. Policies are failing to stop oil and gas expansion in the Arctic for three reasons.

1. Firstly, none of the policies exclude corporate support to companies developing new oil and gas projects in the Arctic.

2. Secondly, none of the policies fully cover the Arctic region: not one major financial player listed in our report has chosen to protect the most comprehensive and climate-relevant Arctic boundaries as defined by the Arctic Monitoring and Assessment Programme.

3. Thirdly, too many policies don’t rule out support for gas projects in the Arctic, despite its potent role in global warming and recents calls by the IPCC and the IEA to reduce gas production.

Click here to explore our interactive map, navigate through the different Arctic exclusion scopes, and find out whether financiers are effectively tackling oil and gas expansion in the Arctic.