AXA Investment Management (AXA IM), the asset manager of AXA Group with €850 billion of assets under management, recently updated its coal exclusion policy. With it, AXA IM has finally made it into the small club of 21 financial institutions worldwide that have a robust and ambitious coal policy. However, it has missed the opportunity to align with the best-in-class practices of its holding company AXA (insurance) by not requiring transition plans from its customers companies embedded in the coal value chain.

1. What’s new

With the update of its policy, AXA IM has changed its exclusion criteria in the following aspects:

- Setting of clear dates for a final coal phase-out for its whole portfolio – 2030 in the OCDE, 2040 in the rest of the world;

- End of financial support for and investment into significant coal plant developers (300MW as maximum threshold for new power plant against 3000MW previously) and suppliers;

- Strengthening of exclusion criteria for companies involve in coal power generation (maximum 10 GW of production);

- Extended exclusion perimeter with scope extended towards third-party mandates and dedicated funds, as well as towards joint ventures covered from 50% stakes onwards. This shall cover Kyobo Axa Investment Management, a sizeable South Korean coal developer (€3.23 millions invested by AXA IM). Certain assets are still not covered by the policy (funds of funds, index funds, funds of hedge funds).

2. Our analysis

With AXA IM’s exclusion criteria for coal power producers going down from 3 GW to 300 MW, AXA IM is finally excluding all coal developers (mines, power plants & infrastructures). AXA IM can, however, still improve its policies by including in its exclusion list companies that buy coal mines and coal plants without plans to close them down.

Regarding the exclusion of the most coal-dependant companies, AXA IM has kept unchanged its previous exclusion criteria (maximum of 30% revenues linked to coal). By copying the Crédit Mutuel AM, it could improve by bringing down this threshold to a stricter limit (20% of revenues).

The creation of an exclusion threshold for coal power producers (maximum 10GW of coal power production) – in addition to the existing one for mining companies (maximum 20 Mt) – is positive. It allows AXA IM to strengthen its coal policy. However, even if it comes close to best market practices on this aspect, there is still scope for progress for AXA IM following CNP Assurance’s prior use of stricter thresholds (5GW and 10Mt).

When it comes to transition scenarios, adding clear coal phase-out dates allows AXA IM to send a strong signal to the market and to coal-involved companies since these dates are aligned on science (2030 for the OCDE, 2040 for the rest of the world). We do, however, regret AXA IM does not systematically require dated and realistic coal phase-out plans from its customers, as its holding company AXA Assurances did.

Lastly, we also condemn the absence of any progress on oil and gas. If there is indeed a policy regarding tar sand oil for companies involved in its trading or its extraction (maximum 20% of revenues), AXA IM did not consider it worthwhile to extend such a policy. At a minimum, it could have expanded its policy to all unconventional oil & gas projects and companies as a first intermediary step towards designing a full net zero plan for decarbonisation by 2050.

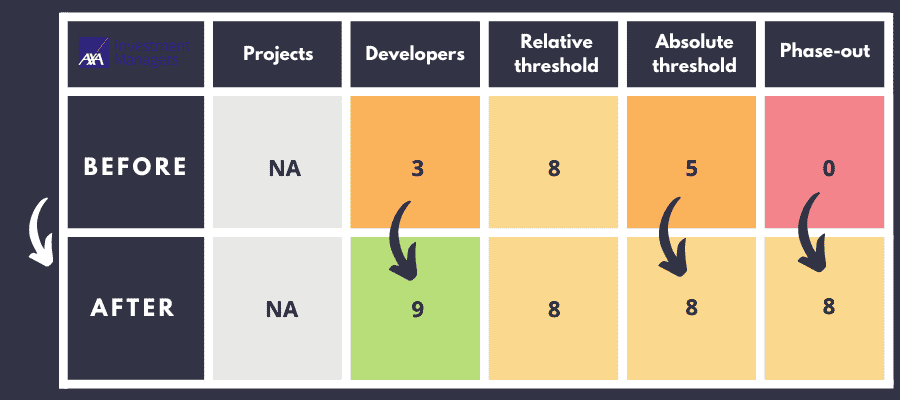

AXA IM’s Scores in the Coal Policy Tool

This table presents the coal scores of AXA IM based on four criteria of the Coal Policy Tool

3. Our conclusion

AXA IM has made substantial progress with its new coal phase-out strategy and its stricter exclusion threshold for coal-linked companies. The asset manager has finally entered the small club of financial actors with a robust coal exclusion policy. However, and this is the main drawback, we regret that an institution of this size still refuses to engage in a more systematic transition strategy, in contrast to its more ambitious holding company (AXA Assurance), especially when it comes to requiring coal phase-out plans from its customers.

Moreover, nothing new has been added regarding oil and gas, even though, five years after the signature of the Paris agreement, and following AXA IM’s membership in the Net Zero Asset Manager Initiative, pressure is mounting on financial actors to implement 1.5°C-aligned climate policies. This necessarily implies the end of all financial support to fossil fuel developers.