END THE LNG DEVASTATING BOOM

Financial institutions must stop fueling LNG expansion

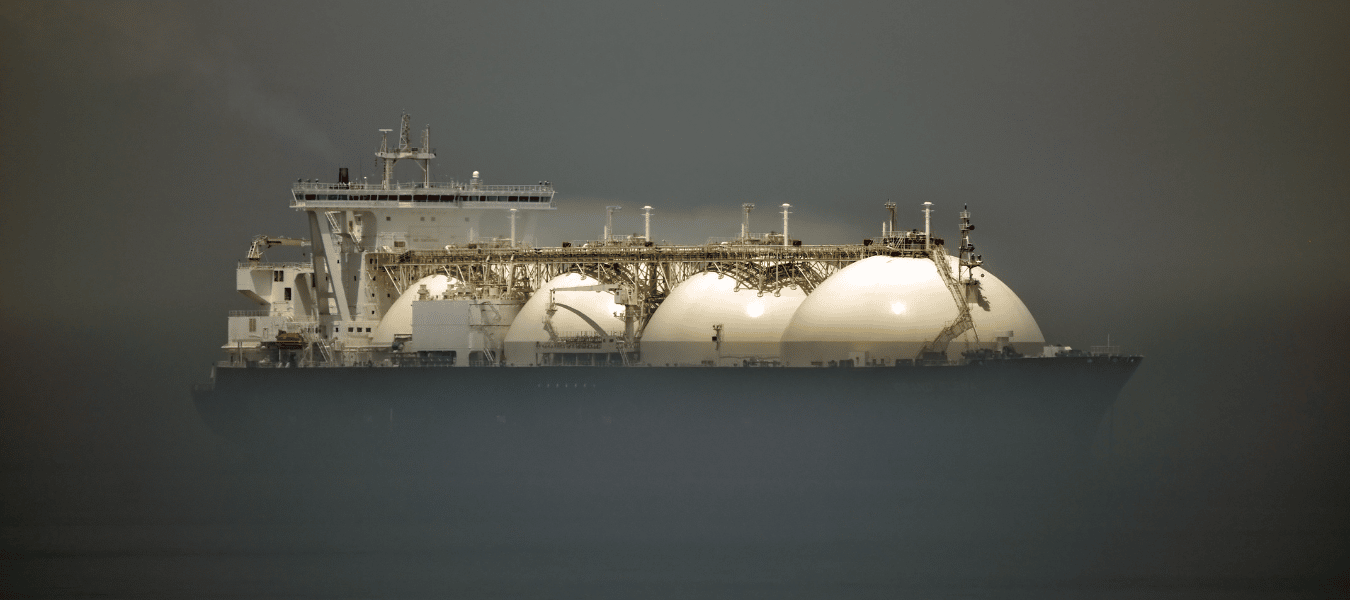

Liquefied natural gas (LNG) has come center stage over the last years. Following the Russian invasion of Ukraine in February 2022 and the subsequent spike in gas prices, this fossil fuel has been presented by the oil and gas industry as the key solution to maintain gas supply while fulfilling the imperative of energy security. Markets have thus been flooded globally over the past few years by a growing amount of LNG, driven by exports from the US, Australia, and Qatar. LNG export and import terminals have multiplied and LNG developers are planning to build many new facilities.

If these terminals are built, they will destroy any hope of limiting global temperature rise to 1.5°C. Indeed, considering that the lifespan of LNG terminals extends for several decades, they will take the greenhouse gas emissions trajectory far beyond what is possible according to any 1.5°C-aligned scenario. The Net Zero Emissions by 2050 (NZE) scenario from the International Energy Agency (IEA) has highlighted since 2022 that new LNG export infrastructure is not necessary under a 1.5°C climate scenario and that operational LNG export capacities are sufficient to meet current and future demand. What’s more, LNG terminal projects have devastating consequences for nearby communities and ecosystems.

A significant number of planned LNG terminals could not spring up without the support provided by financial institutions. Banks and investors must immediately adopt robust exclusion policies to put an end to their financial support to LNG developers and new LNG projects.

LNG, a false solution with dire consequences

of carbon dioxide equivalent (CO2e) could be released by 2030 if the 63 planned export terminals are built.

By 2030, LNG developers are planning 156 new LNG terminal projects (93 import terminal projects and 63 export terminals projects) that threaten to lock the world into a fossil fuel future. If built, the 63 planned export terminal projects could contribute to the release of over 10 gigatonnes (Gt) of carbon dioxide equivalent (CO2e) by 2030, according to our analysis. This includes more than 150 million tonnes (Mt) of methane leaks by 2030, and represents more than two years of US energy sector emissions. These climate impacts are slightly lower than those of all the coal plants in operation worldwide, which emit 12 Gt of CO2e annually.

This alarming figure is linked to the fact that LNG is fossil gas that has been cooled to about -162°C, condensing it into a liquid form. Fossil gas is extracted from gas fields, carried to export terminals where it is liquefied and loaded onto LNG carriers for transportation by sea to import terminals where it is regasified for consumption. The liquefaction process is highly energy intensive, consuming approximately 10% of the fossil gas that is processed. Other stages of the process also add to the LNG carbon footprint, with greenhouse gas emissions occurring during transportation, storage and regasification, and during end-use.

Another significant aspect of LNG processing is the high level of associated methane (CH4) emissions. LNG is composed of methane, a greenhouse gas over 80 times more powerful than CO2 over 20 years. Methane leaks can occur throughout the LNG value chain. Although LNG is often presented as an alternative to coal, these leaks negate the “climate benefits” of fossil gas and may even worsen the situation.

Even though the IEA’s NZE 2024 World Energy Outlook reiterated that no new gas fields should enter production, the development of LNG facilities is currently intensifying upstream fossil gas expansion by connecting fossil gas fields to distant markets and creating gas dependency in new countries. Once a terminal is constructed, new fossil gas fields could enter into production to maintain its utilization rate, despite the need to halt upstream gas expansion. With long term gas infrastructure connected to fossil gas fields on the export side, and growing distribution networks on the import side, LNG facilities are leading the energy sector to fossil fuel lock-in.

However, the projected peak in gas demand by 2030 alongside renewable energy growth and electrification could render new oil and gas investments stranded assets in the near future. In Europe, three-quarters of Europe’s LNG import capacity could be unused by 2030.

of Europe’s LNG import capacity could be unused by 2030.

Financial institutions risk climate and communities through LNG expansion

In addition, the development of LNG facilities often leads to violations of rights, such as forced displacements and the loss of livelihoods. LNG export also terminals pose risks to the health of communities, such as high levels of air pollution through fine particulate matter (PM2.5) and ozone (O3), a pollutant damaging for human health, ecosystems and crops. LNG processing and storage facilities are associated with water contamination and the risk of explosion, while LNG pipelines can be responsible for dangerous gas leaks. LNG expansion also dramatically affects ecosystems and biodiversity.

Banks and investors pour billions into LNG expansion

billion granted to LNG expansion by 400 banks worldwide between 2021 and 2023.

billion in exposure to the largest LNG developers for their LNG expansion by the 400 most exposed investors in May 2024.

According to Reclaim Finance analysis, the 400 biggest banks supporting LNG expansion provided US$213 billion to LNG developers and their new projects from 2021 to 2023. The 400 investors we assessed – by continuing to support LNG companies without requiring the end of fossil fuel expansion – hold accountability in the LNG boom through their US$252 billion in exposure to LNG expansion as of May 2024.

US banks are at the forefront, with responsibility for 24% of overall financing of LNG development (JP Morgan, Bank of America, and Citi appear in the top 10 banks). Japanese banks follow, contributing 14% of the total amount, with Mitsubishi UFJ Financial Group claiming the top spot, and Mizuho, and SMBC ranking among the top five global banks providing financing to LNG expansion between 2021 and 2023, followed by Chinese and Canadian banks.

Banks from France, Spain, the UK, Germany, Italy, the Netherlands and Switzerland collectively contributed 27% of overall financing to the recent LNG boom. Several European banks such as Santander, ING, Crédit Agricole, Deutsche Bank, HSBC, Intesa Sanpaolo, and BPCE are among the top 30 global banks which supported the most LNG expansion between 2021 and 2023.

In May 2024, US investors accounted for 71% of the total investment in LNG expansion, with BlackRock, Vanguard, and State Street leading the way. Canadian investors follow, but at a considerable distance, holding 6% of the total investor exposure.

The support of banks to LNG expansion is intensifying with an overall 25% increase of financing between 2021 and 2023. No less than 1,453 transactions were made between banks and LNG developers to support LNG expansion in 2023 alone, directly contradicting the NZE scenario and its clear, lasting statement that no new LNG export facilities are necessary.

And there is no sign that the support of banks and investors for the sector is going to dry up in the near future. In fact, although 26 out of the top 30 banks and 14 out of the 30 biggest investors behind LNG expansion have pledged to achieve carbon neutrality by 2050, none that are highly exposed to LNG have committed to end all financial services. Only seven players out of the top 30 banks and top 30 investors tackle LNG through their sector policies, and none of them is doing so effectively. The seven banks with some LNG restrictions are all European: ING, Barclays, BNP Paribas, BPCE, Crédit Agricole, HSBC, and Société Générale. Not one of these policies addresses corporate financing, instead they only cover LNG export terminal project financing, and they do so insufficiently to curb the banks’ support for LNG expansion.

Financial institutions must stop supporting LNG developers’ expansion plans

A significant number of planned LNG terminals could not happen without the support provided by financial institutions. Banks and investors must immediately adopt robust exclusion policies to put an end to their financial support to LNG developers’ expansion plans and new LNG projects.

Reclaim Finance calls for banks to adopt comprehensive policies to:

- End financial services for new LNG projects, especially export terminals which contradict climate goals, and also for import terminals which hinder the development of renewable energy.

- End financial services for LNG export developers and commit to extending this exclusion to LNG import developers that fail to abandon LNG expansion plans.

Reclaim Finance calls for investors to adopt comprehensive policies that:

- Require LNG companies in their portfolios to immediately stop LNG expansion.

- Stop new investments in companies developing new LNG export terminals, and that direct the use of existing holdings to engage and vote against strategic management-proposed items (for example, the re-election of directors, remuneration, and financial statements).

Banks and investors should require LNG import terminal developers to adopt transition plans aligned with a 1.5°C pathway with no or low overshoot, that includes no new LNG import terminals, and that relies on minimal negative emissions, such as the IEA’s NZE scenario.