By 2035, European oil and gas majors will have consumed their remaining 1.5°C carbon budget, according to new Reclaim Finance analysis (1). Despite their climate ambitions, the “best in class” of the oil and gas industry are currently not aligned with a 1.5°C scenario and very far from transitioning away from fossil fuels. In fact, all of them are currently developing new oil and gas projects. Financial institutions should not be fooled by the climate label on a business -as-usual strategy: there is no such thing as “best in class” if it falls short of what climate science requires. Banks, insurers and investors must think twice before granting them new financial services.

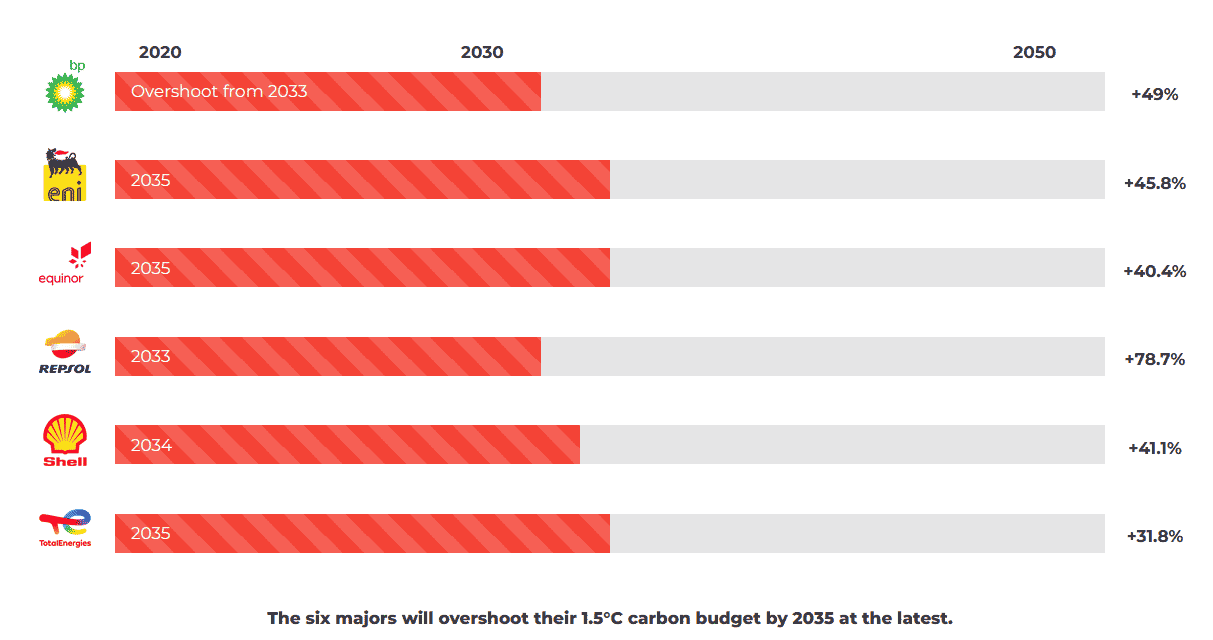

The six European majors will overshoot their carbon budget by 2035

Based on company targets and data, Reclaim Finance calculates that by 2050, TotalEnergies, Shell, BP, Eni, Equinor and Repsol will each have released 32% to 79% more GHG emissions than they are allowed in a 1.5°C scenario (2). This analysis shows that their claims of carbon neutrality and net zero cannot be taken at face value by their shareholders, as long as their business strategies include new fossil fuel exploration and production plans. Since their short to medium term strategy remains fossil-fuel based and lead to a rapid buildup of greenhouse gasses in the atmosphere, all six majors will start overshooting their carbon budget by 2035 at the latest.

Plans to develop new oil and gas fields

The pathway matters much more than the final destination. The recent pledges to achieve net zero by 2050 (3) will not be enough to avoid a massive carbon budget overshoot unless the six majors make drastic changes to their short term strategy. Currently, all six majors are planning to develop new oil and gas fields, despite the IEA’s net zero scenario (4) clearly demonstrating there is no room for oil and gas expansion in a 1.5°C world. TotalEnergies, Shell et BP rank among the top 10 expansionists globally according to the Global Oil and Gas Exit List (5).

Currently, nothing signals a u-turn in their oil and gas strategy. Despite claims and targets to increase their renewable energy capacity, the numbers tell another story: 60 to 90% of their near term investments are still allocated to fossil fuels. Consequently, in 2030, renewables will account for less than ¼ of their energy mix. TotalEnergies’ projections reveal a massive 42.4% increase in oil and gas production by 2030 compared with 2016 levels, overshadowing efforts to increase renewable energy production (less than 15% of the energy mix by 2030) (6).

Exiting Russia: a turning point for oil and gas production?

In response to Putin’s war in Ukraine, several major oil and gas companies have announced that they will be pulling out of their operations in Russia, including BP, ExxonMobil, Shell, Equinor and Eni (7). These announcements could change the structure of the oil and gas market. BP was particularly exposed through its 19.75% stake in Rosneft (8), which accounted for a third of its oil and gas production in 2021. BP is at a turning point: the major can either switch its Russian assets to other oil and gas assets or finally get on track to achieve its target to reduce oil and gas production by 40% in 2030 compared with 2019 levels (9). Following the sale of its Russian assets, Shell’s production is expected to decrease by 5.6% over the short-term instead of plateauing. (10)

TotalEnergies, also very exposed to Russian oil and gas which represent 17% of its world production (11), has announced that it will no longer contribute capital to new projects in Russia but refuses to withdraw from the 4 projects in operation and in development (12). The French group also refuses to sell its 19.4% stake in Novatek, the second largest natural gas producer in Russia. TotalEnergies and Novatek notably have shares in the Arctic LNG 2 (13) liquefied natural gas expansion project. While many financial players are taking action against Russian companies, more than 75 NGOs are also calling on them to no longer grant new financial services to TotalEnergies as long as it has not withdrawn from Russia (14).

Fossil fuels are the source of many imbalances, generating conflicts and wars and causing climate chaos. The climate strategies of the largest European oil and gas companies remain very far from being aligned with a +1.5°C scenario. If the European majors continue to make the situation worse by continuing to invest massively in fossil fuels, they will exceed their carbon budget much sooner and by much more. A large number of financial institutions, banks, insurers and investors have recently made climate commitments or joined net zero alliances. They cannot continue to ignore the impact of oil and gas expansion and turn a blind eye to the oil and gas plans of the majors: they are simply not compatible with their climate commitments.