The failure to transform our energy system in the face of the climate crisis means the need for action becomes more urgent every day. Limiting global warming to 1.5°C means simultaneously acting on two fronts to deliver the in-depth transformation required. On the one hand, fossil fuels must be gradually and rapidly phased out – with the immediate end of their expansion [1]. On the other hand, sustainable energy sources and technologies need to be expanded massively to replace fossil fuels – while at the same time reducing the impact on the climate, ecosystems and human rights [2]. To ensure this transformation, Reclaim Finance calls on banks to seize the 6:1 ratio to allocate six dollars to sustainable power supply for each dollar allocated to fossil fuels.

To successfully transform our energy system, financial flows must drastically be modified. Investments currently oriented towards expanding fossil fuels must immediately stop and progressively be reoriented toward sustainable solutions. While this shift of the financial flows is necessary, a simple “1-for-1” substitution of fossil investments for sustainable investments is insufficient; new investments must be unlocked for the energy sector in addition to the reorientation of existing ones [3].

A massive need for financing materialized in financing ratios

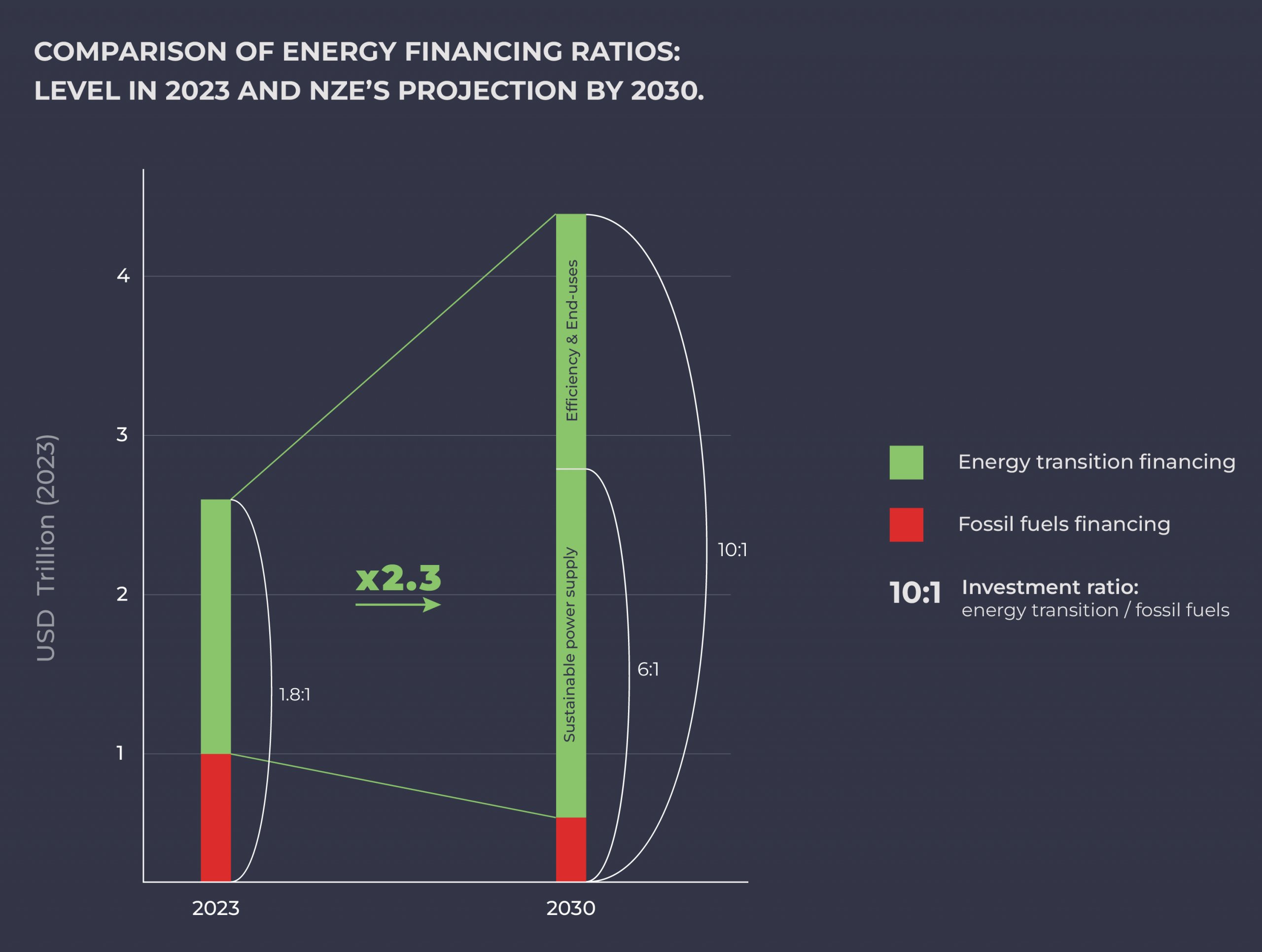

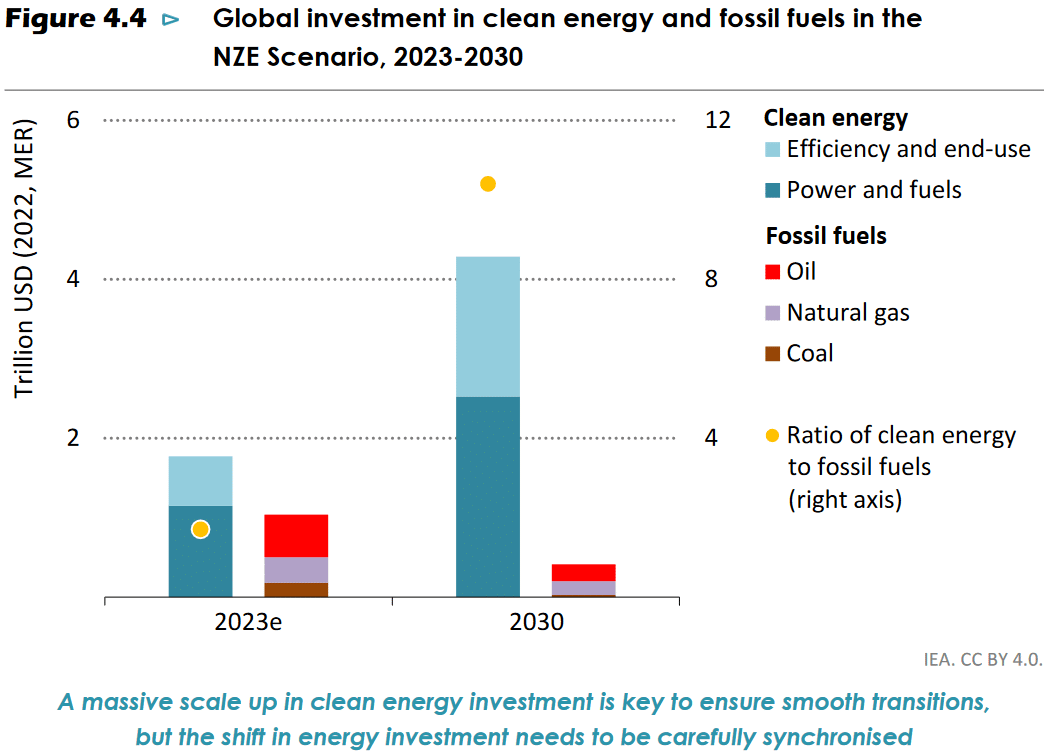

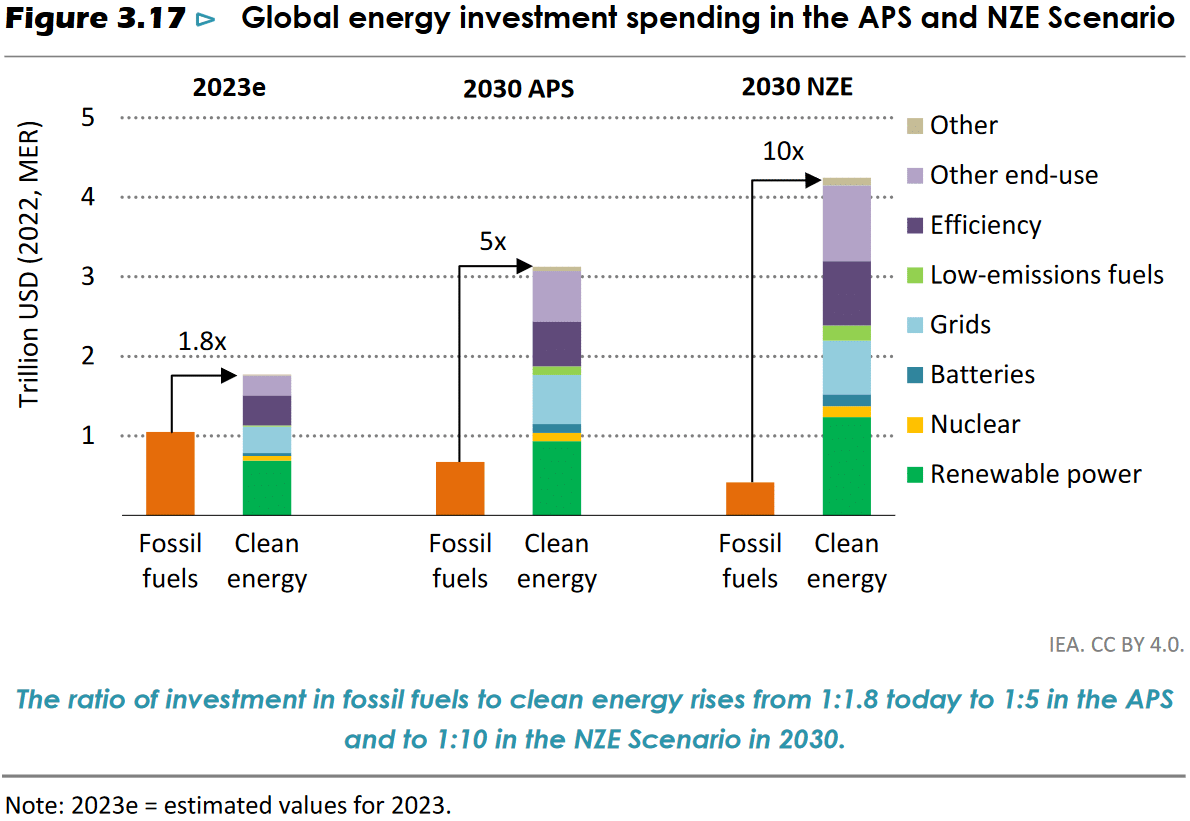

According to the International Energy Agency (IEA)’s ‘Net Zero Emissions by 2050’ (NZE) scenario, which is widely used as a route map for achieving net zero [4], total annual investments in the energy sector must rise from US$2.8 trillion in 2023 to US$4.7 trillion by 2030. Within that, annual investments in the energy transition must more than double from US$1.8 trillion 2023 to exceed US$4.2 trillion by 2030 [5]. In parallel, the IEA sees a reduction of US$0.6 trillion in fossil fuel annual investment by 2030 [6], from US$1 trillion in 2023 to US$0.4 trillion.

The IEA captures this within a financing ratio: “Global investment in clean energy is set to outstrip investment in fossil energy by a factor of 1.8 to 1 in 2023. This ratio rises to 10 to 1 in 2030 in the NZE Scenario”.

This ratio breaks down into two pillars: the “energy supply” and the “energy efficiency and end-uses”: in 2030, “around USD 2.5 trillion is invested in clean electricity and low-emissions fuels and around USD 1.8 trillion in energy efficiency and end-uses, while investment in fossil fuel supply falls to around USD 0.4 trillion” [7].

Source: IEA, Net Zero Roadmap, September 2023.

In real terms, the trajectory set by the NZE means that by 2030, for every dollar invested annually in fossil fuels, six dollars must be invested in the “clean” energy supply – mostly power supply [8] -, and four dollars must be invested in energy efficiency and end-uses [9]. This translates into an overall 10:1 ratio for the energy transition (that is energy supply, energy efficiency and end-uses transformation), including a specific 6:1 ratio for “clean” power supply . Those ratios are present in several publications of the IEA in 2023 [10].

It is important to note that financing to fossil fuels in that context should only be dedicated to maintain existing fields and reduce associated emissions, as the IEA underlined that “no new [oil and gas] fields developments are required”. [11].

“Clean power supply” covers grids, batteries, nuclear and renewable power. It represents the vast majority of investments in clean energy supply by 2030. Source: IEA, The Oil & Gas Industry in Net Zero Transitions, November 2023.

From “clean” to “sustainable”, financing the new power supply system

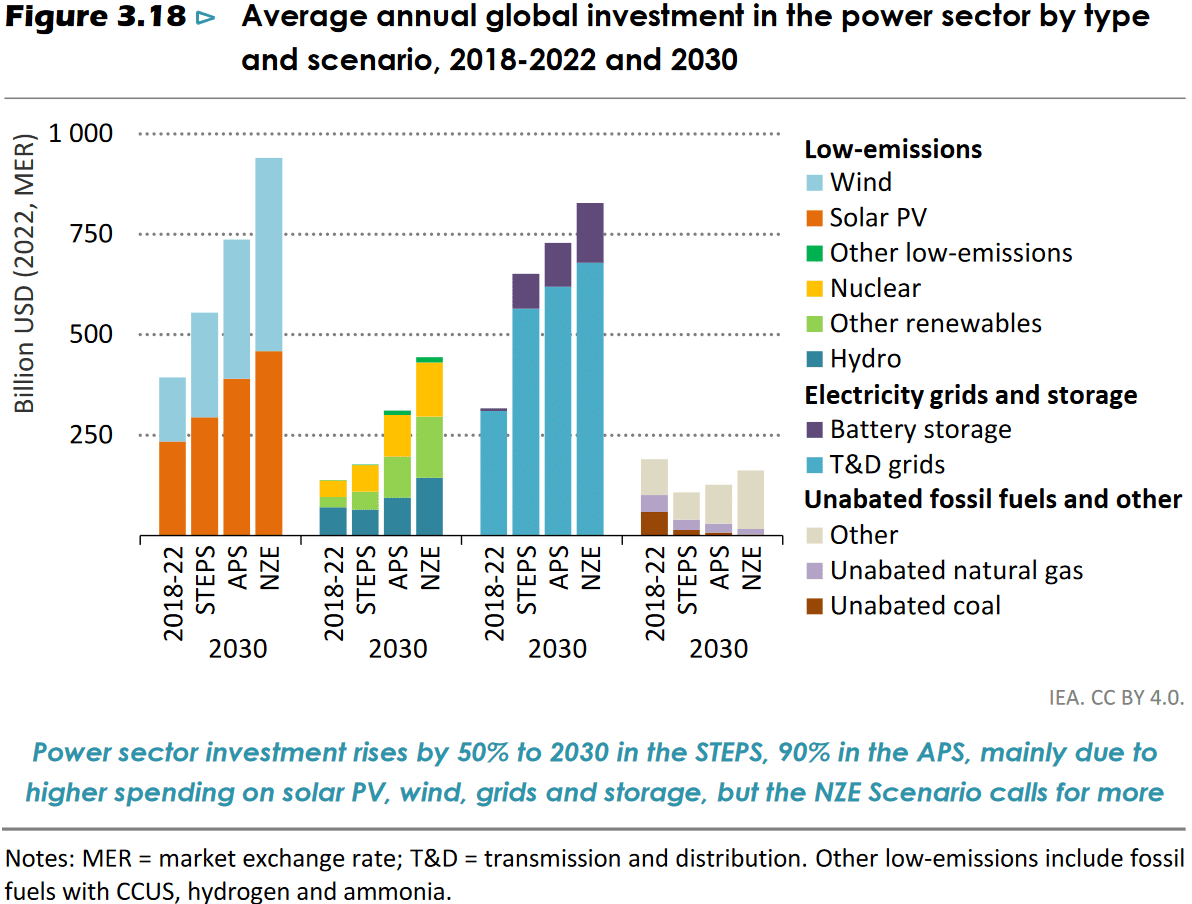

It is also crucial to well define what to finance and what to avoid to build a truly sustainable future. Despite clearly acknowledging that investments in the power sector must be mainly focused on solar PV, wind, grids and storage [12], the IEA’s projections are based on a broader “clean” perimeter.

This notion also includes technologies, such as biomass or nuclear energy, whose development is uncertain or associated with damaging social, environmental and climate impacts or risks and pose too great a risk to our ability to meet the 1.5°C objective and global biodiversity protection targets. It also bets on the use of immature or non-existent technologies at a commercial scale, such as Carbon Capture Use and Storage (CCUS) [13]. Therefore, we believe that such technologies should not be included in banks’ energy transition finance targets, which should be focused on sustainable power [14].

Energy sources and technologies that are commercially mature, rapid to deploy and with limited impacts on ecosystems and human rights are already available. Aligning with NZE’s investment projections and the 6:1 ratio while concentrating the scope of power targets on those solutions – solar PV, wind, grids and storage – remain highly relevant considering the IEA’s NZE scenario gives only a 50% chance of limiting global warming to 1.5°C.

In the NZE, sustainable power supply (wind, solar, battery storage and grids) represents the core of investments in the clean power supply by 2030. Source: IEA, World Energy Outlook, October 2023.

How financing sustainable energy translates for banks

As the IEA explicitly underlines, “these economy-wide ratios provide an important guide for financial actors looking to assess their equity and lending portfolios against net zero targets” [15]. To achieve a 6:1 ratio by 2030 for annual energy financing, banks should immediately:

- Set specific financial targets dedicated to sustainable power supply and publicly disclose the scope of energy sources and technologies covered in a specific framework. This framework must limit financing to sustainable power supply and exclude unsustainable solutions [16].

- Immediately end their support for fossil fuel expansion, at both project and corporate level [17].

Those commitments should cover all types of bank activities, including direct lending and off-balance sheet capital market activities. Besides, the 6:1 ratio is also a key financing target for banks willing to publish a credible climate transition plan [18].

Overall, a rapid and just energy transition is achievable now and requires banks to radically change their practices. They must drastically reduce their financing to fossil fuels, immediately end any support to their expansion, and massively increase financing to sustainable power supply. To do so effectively, they must align their ambitions with climate science and therefore seize the science-based 6:1 financing ratio. There is no more time to waste.