Copublished with Steelwatch

Tokyo, Japan, March 7, 2024 – Japanese banks, including Mitsubishi UFJ Financial, Mizuho Financial, SMBC Group, and Sumitomo Mitsui Trust, have provided more than USD 66 billion to the 50 biggest companies developing metallurgical coal projects for steel production outside of China.

Detailed data in Reclaiming Finance’s new report, Metallurgical Coal Financing: Time to call it off, reveal that Japan is one of the top countries globally still financing the expansion of the highly polluting sector. (1) Japanese banks make up four of the top five financiers of metallurgical coal expansion. Overall, Japanese banks provided more than 29 percent of banking support to companies developing such coal supplies excluding China between January 2016 and June 2023.

At the same time, Japanese investors, including the Government Pension Investment Fund, Mitsubishi UFJ, Nomura and Sumitomo Mitsui trust, held USD 25 billion in met coal developers as of June 2023. This means that they provided 16 percent of investments in the top 50 met coal developers.

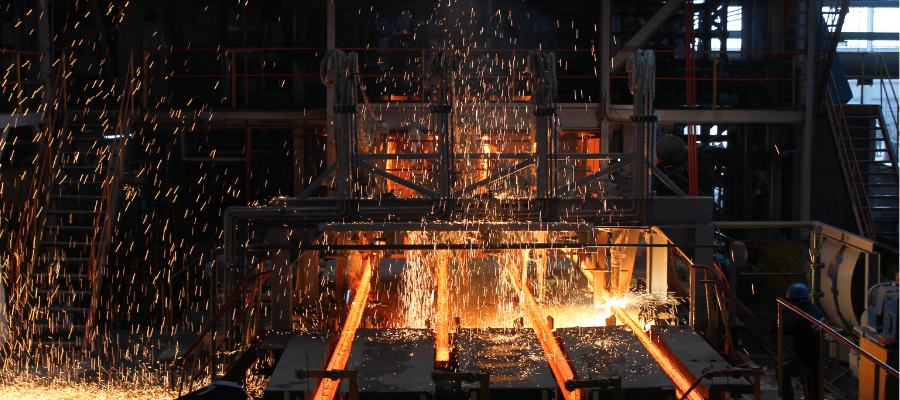

The use of metallurgical coal in steelmaking makes it the biggest industrial emitter of CO2 globally. The iron and steel industry accounts for around 7 percent of global greenhouse gas (GHG) emissions, and 11 percent of global carbon dioxide (CO2) emissions. (2) Ending metallurgical coal expansion while developing alternatives requires the active involvement of financial institutions.

The solutions to decarbonise steel exist, and the transition to new technologies is underway. Banks and investors can help drive the transition by supporting clean solutions, and shunning old coal-based processes. Financial institutions, including the Japanese banks who are currently among the biggest financiers of metallurgical coal, must urgently adopt policies to stop financing any expansion. Investments in coal-based steel are simply fuelling the climate fire. (3)

Cynthia Rocamora, Industry Campaigner with Reclaim Finance.

According to the International Energy Agency (IEA), demand for coking coal (metallurgical coal) will fall as “existing sources of production are sufficient to cover demand through to 2050”. (4) Despite this projection, banks are seemingly happy to fund unneeded new projects by 118 companies, amounting to a total planned production capacity of 406 Mtpa (million tonnes per annum) of coal.

Using metallurgical coal to manufacture steel is disastrous for the climate, emitting 2.3 tonnes of CO2 for every tonne of liquid steel. (5) It is clear that Japanese banks, investors and insurers are sadly global leaders in a dirty business – financing expansion of met coal projects. They are prolonging coal usage in the steel industry, exacerbating climate change and at the same time taking huge financial risk, as these mines will become stranded assets when the steel industry tips to clean steel. Japanese financial institutions face a choice: change course and exit met coal, or load their balance sheets and the planet with huge liabilities.

Caroline Ashley, Executive Director of SteelWatch