The Net-Zero Banking Alliance (NZBA) has released a revised version of its guidelines for setting climate targets (1). In addition to the targets on “financed emissions” from lending required by the original guidelines, the new ones require NZBA signatory banks to set 1.5°C aligned targets for the “facilitated emissions” from their underwriting and other capital markets activities. Unfortunately this is the only significant advance in the new version. The NZBA has missed an opportunity to correct the lack of clear requirements for target design in its previous guidelines, despite recognizing the problems caused by this lack of clarity in terms of many members setting non-transparent, non-comparable, and ineffective targets.

Closing a large loophole

The NZBA guidelines are significant as they provide the only broadly accepted industry standard for how banks should align their activities with 1.5°C, and because most of the world’s major banks outside China have signed up to the alliance (2). The NZBA is the only net-zero alliance to require its members to set sectoral targets, as opposed to broad portfolio-wide targets which obscure ambition and progress on key high-emitting sectors.

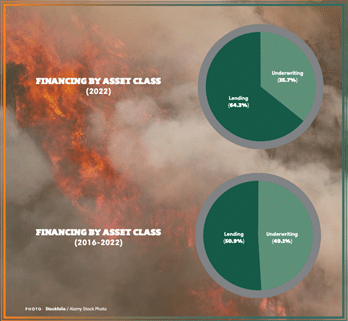

In its original guidelines released in 2021 NZBA originally required its members to only set targets for the financed emissions from their loans. The new guidelines add a long-awaited requirement to also set targets (for 2030 or sooner) for the “facilitated emissions” from their capital markets arranging and underwriting activities. As the NZBA points out, for some banks facilitated emissions can be higher than financed emissions. Roughly half of bank finance to the fossil fuel sector in recent years has come from capital markets activities (See Figure 1).

Figure 1. Percentages of finance from 60 major global banks to the fossil fuel sector attributed to loans and capital market activities (in 2022 and over 2016-2022 period). Source: RAN et al., Banking on Climate Chaos: Fossil Fuel Finance Report 2023, p.21

The facilitated emission targets shall cover “the actions of bookrunners in the issuance of new debt and equity instruments for both public and private companies and syndicated loans.” Banks must include capital markets in existing targets by 1 November 2025, and in any new targets set after that date.

Blending apples with oranges

While the NZBA has taken two steps forward by requiring facilitated emissions targets, it has taken a step back by allowing these targets to be blended into financed emissions targets. Banks are also allowed to report both types of emissions as a single number. This is an attempt to blend apples and oranges. As banks have long maintained, these are different types of finance; and the emissions are calculated using different methodologies.

The most problematic element here is that the standard methodology for measuring and reported facilitated emissions controversially allows banks to use a 33% weighting for facilitated emissions, while 100% of financed emissions must be counted (3). Combined target setting and reporting will make it impossible to assess what progress banks might be making in each of these areas, and to assess what the full (non-weighted) facilitated emissions of a bank might be.

A missed opportunity

In its 2022 progress report, the NZBA noted that for reasons including “the variety of carbon accounting methodologies” used by its members, “it is currently not possible to make a judgement on the quality of targets, to calculate the anticipated impact of the targets on global emissions, nor is it reasonable to speculate on the likelihood of an individual member’s meeting their intermediate targets (4).”

These new guidelines were an obvious opportunity to address this problem by including through mandating the use of absolute emission metrics, and setting clear requirements as to which parts of their clients’ value chains should be included for which sectors. This opportunity has been missed, and the result will likely be that NZBA members will continue to use widely divergent target designs, with widely different levels of ambition, comprehensiveness and transparency.

Transition plan vagueness

There is little else new of substance in the revised guidelines. New expanded language on bank transition plans reflects the increased attention currently given to transition plans in regulations and standards, but the only requirement is for banks to publish a “high-level transition plan” which “may be a part of existing disclosures.” This is so vague as to be of little use in committing banks to any meaningful actions.

The NZBA also continues to fail to emphasize that emission reduction targets alone are insufficient to pressure high emitters to change their practices. Emission reduction targets must be supplemented in transition plans with other types of targets including for increased finance for sustainable energy, as well as for engagement and decarbonization strategies. These strategies must include policies that end support for new fossil fuel projects and help to phaseout existing high-emission infrastructure.

Reclaim Finance agrees with the three NZBA members who issued a statement on the guidelines urging “banks both inside and outside the alliance to go raise the bar in developing policies and disclosures for the highest emitting sectors” (5). Banks must also develop 1.5°C transition plans containing a range of transparent and comprehensive absolute emissions and financial targets, as well as strong policies on fossil fuels and the financing of sustainable energy.