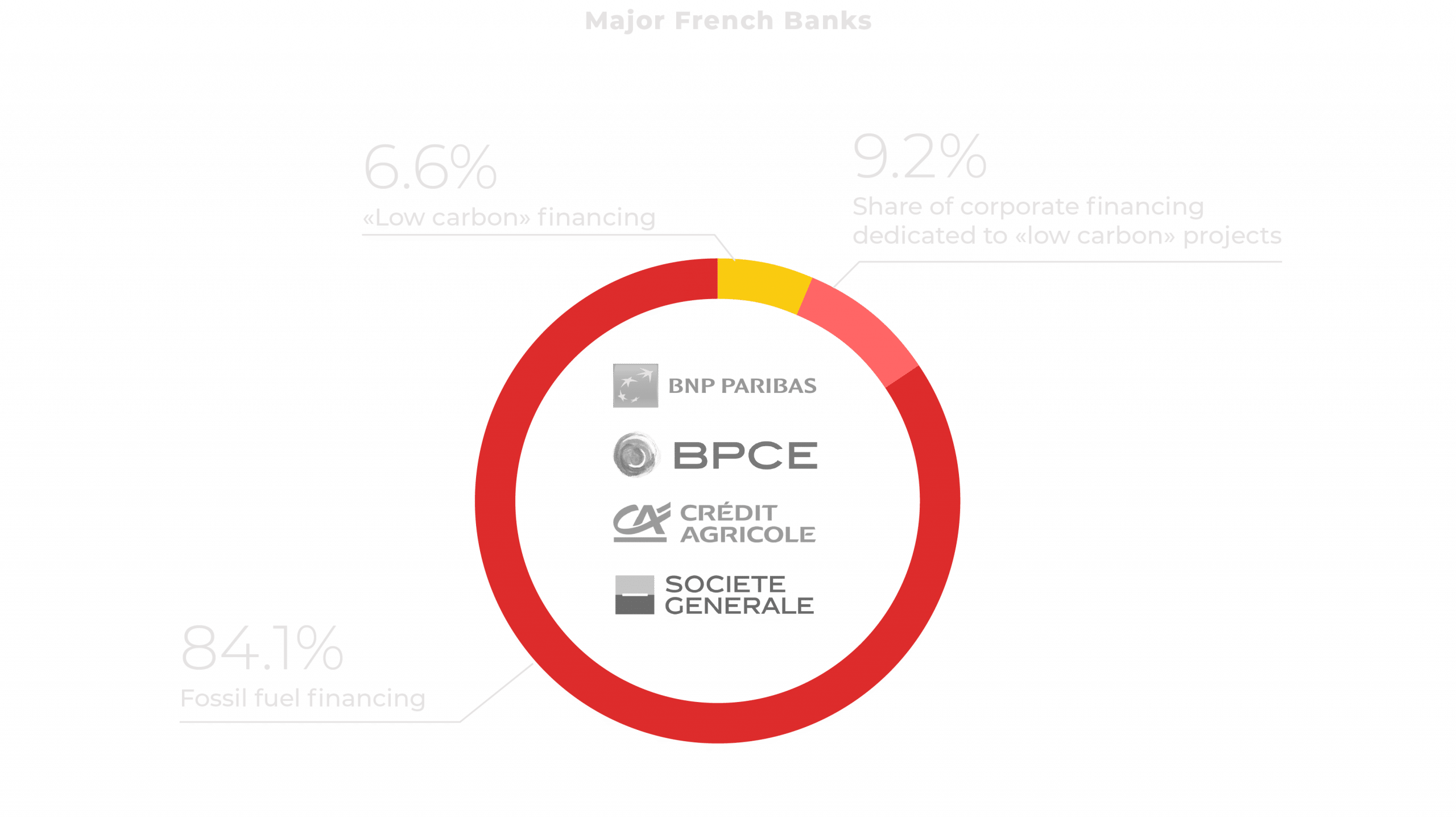

Only 17.3% of the financing provided by French banks to the 5 largest European oil and gas companies (1) went to their “low carbon” activities (US$7.1 billion) between 2020 and 2023, rather than their fossil fuel activities (US$34.2 billion). Financing dedicated to “low carbon” projects or subsidiaries accounted for just 7.5% of the overall financing. Using new figures, Reclaim Finance reveals that French banks’ new financial support to these companies is not being used to finance the transition, despite their claims. While analysis of the climate strategies of these companies shows that they intend to mainly invest in oil and gas, there is only one solution to ensure banks align their practices with their rhetoric: stop financing these companies until they stop developing new fossil fuel projects.

French banks are among the largest financiers of the biggest oil and gas developers. They provided over US$67.5 billion in financing between 2020 and 2023 to 12 of the world’s largest integrated oil and gas companies (2), despite being aware of their massive fossil fuel development plans.

After contesting the first Net Zero for 2050 scenario by the International Energy Agency (IEA) published in May 2021, which projected an end to new oil and gas fields after January 1, 2022, with LNG included in the 2022 and 2023 versions, French banks finally acknowledged, albeit sometimes timidly, the incompatibility of these new projects with the goal of limiting warming to 1.5°C and with their own climate commitments.

However, they continue to largely defend their support for the largest, and especially the European, oil and gas companies, in the name of diversification and their ability to finance the transition.

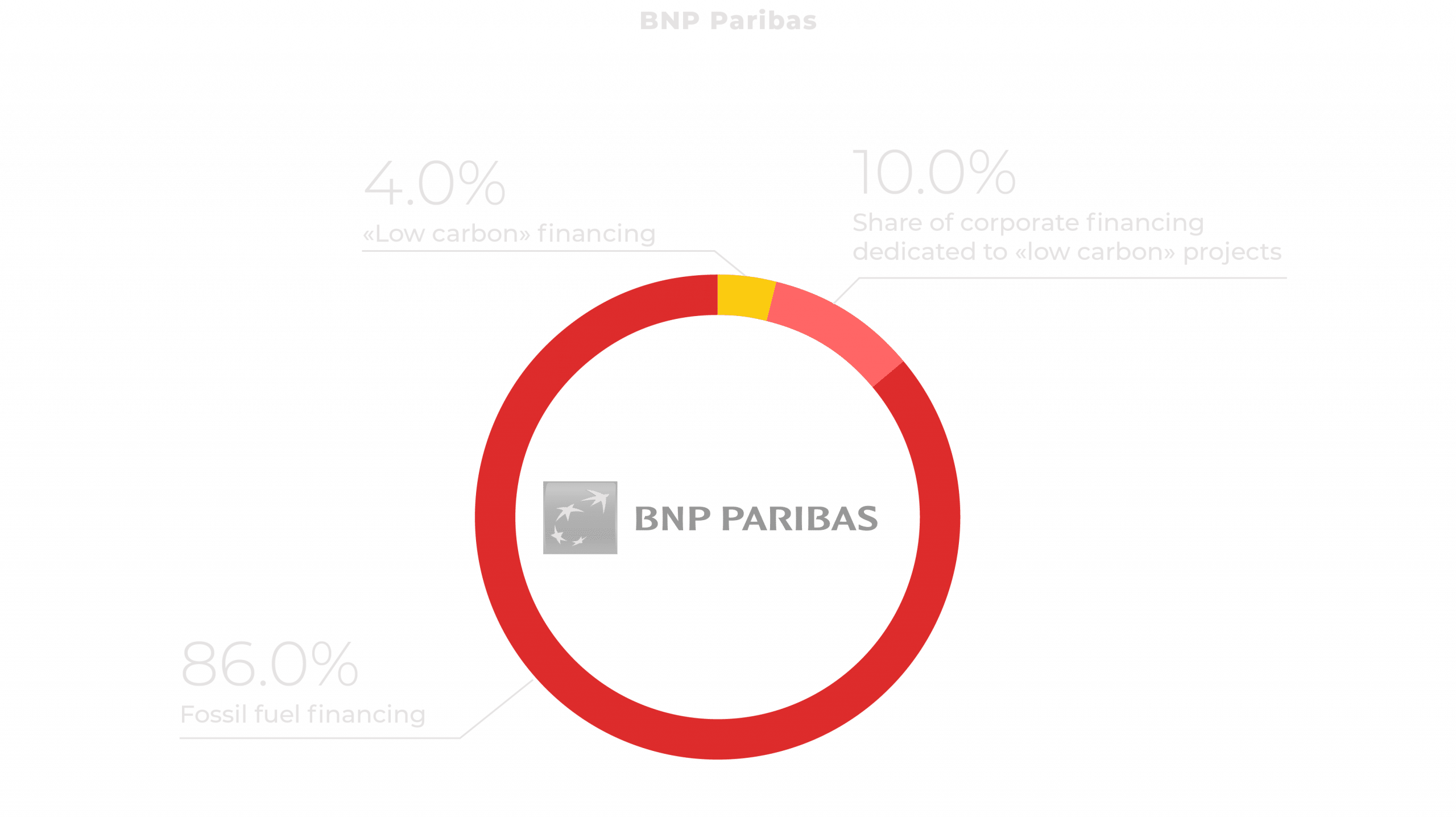

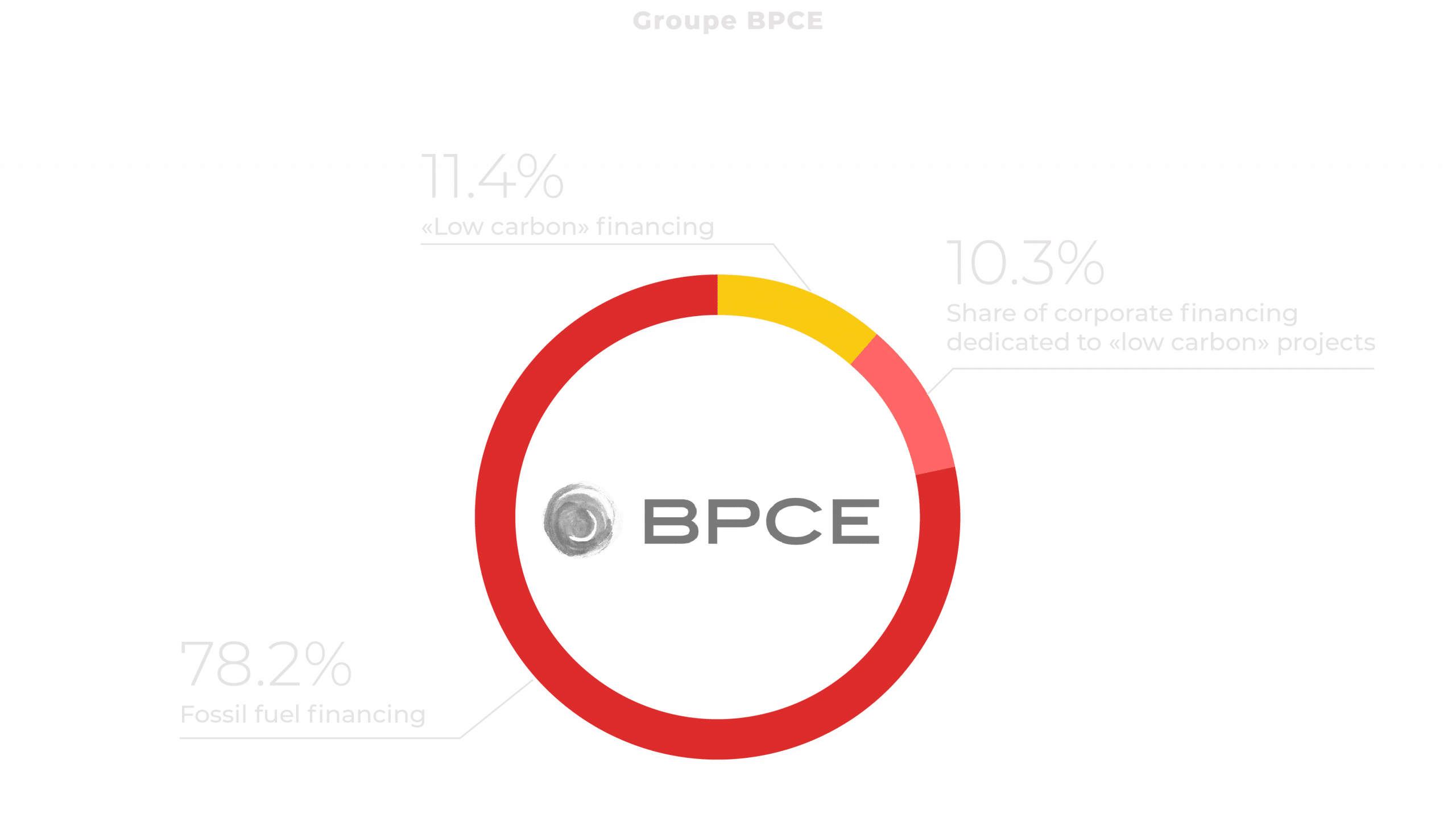

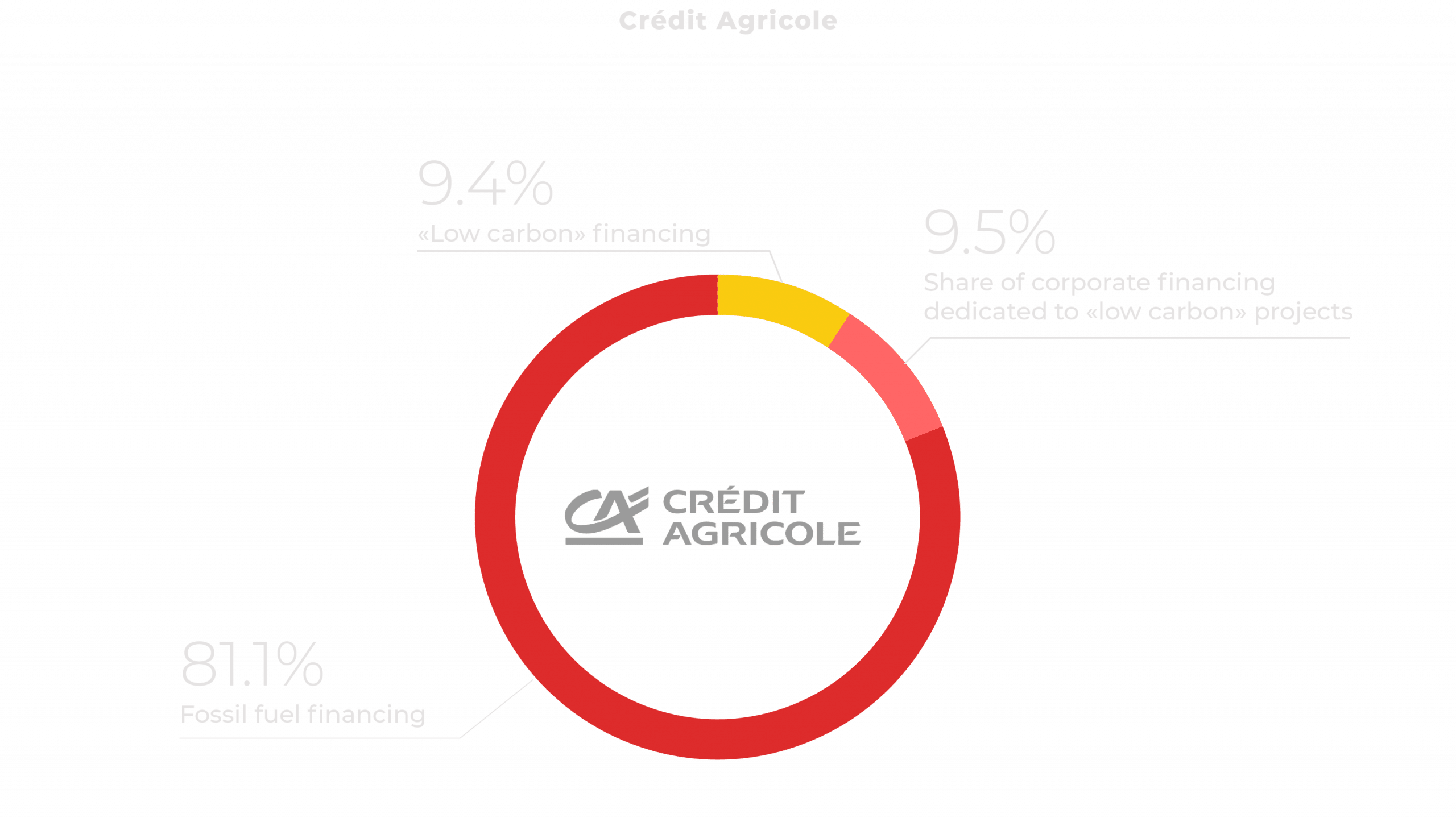

Reclaim Finance wanted to examine this claim, comparing for the first time the financing allocated by the 4 main French banks to the “low carbon” activities of 12 of the largest oil and gas companies globally with the financing allocated to their fossil fuel activities (upstream, midstream, downstream).

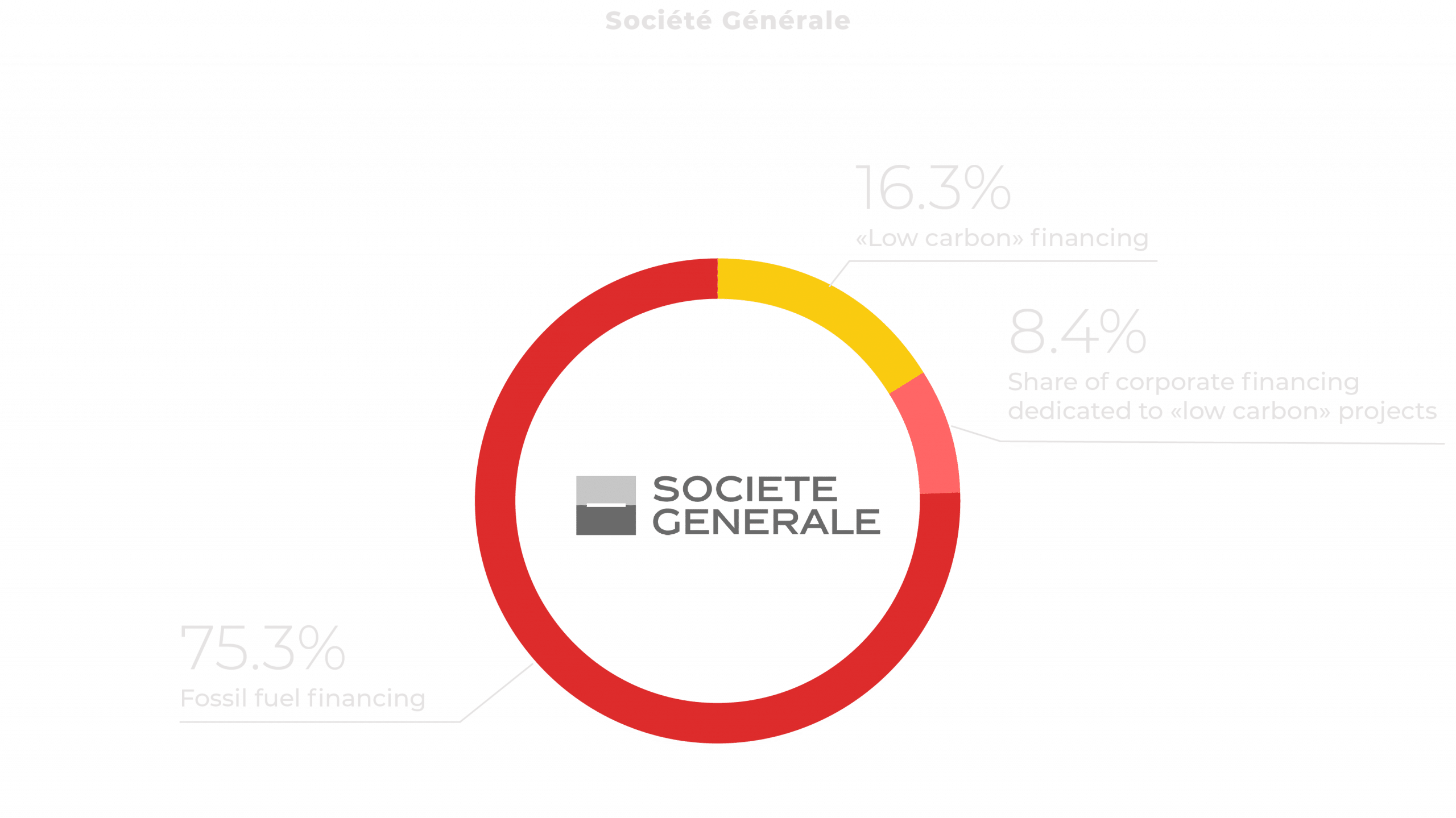

“Low carbon’s” minuscule share of financing

On average, 82.7% of the financing provided by French banks to the 5 largest European companies – BP, Eni, Equinor, Repsol, and TotalEnergies – went to fossil fuels. In the worst case, “low carbon” activities received just 11.1% of financing (BP).

The percentage allocated to “low carbon” drops from 17.3% to 15.0% when the 2 major US companies and national oil and gas companies are included (3).

However, it is possible to allocate financing specifically to a company’s “low carbon activities by financing certain projects or acquisitions in the low carbon sector. This is largely the case for the French banks’ “low carbon” financing for Equinor, which received 95.9% of its “low carbon” financing in this way. However, due to the levels of corporate support provided, targeted support for “low carbon” activities remains proportionally less, representing 49% of the support received by Equinor from French banks between 2020 and 2023.

Breakdown of financing to

TotalEnergies, BP, Eni, Equinor and Repsol per bank

Banks absent from guaranteed fossil-free deals

TotalEnergies, along with Equinor, Repsol, Eni, and BP, is one of the few companies to have raised targeted financing for “low carbon” activities.

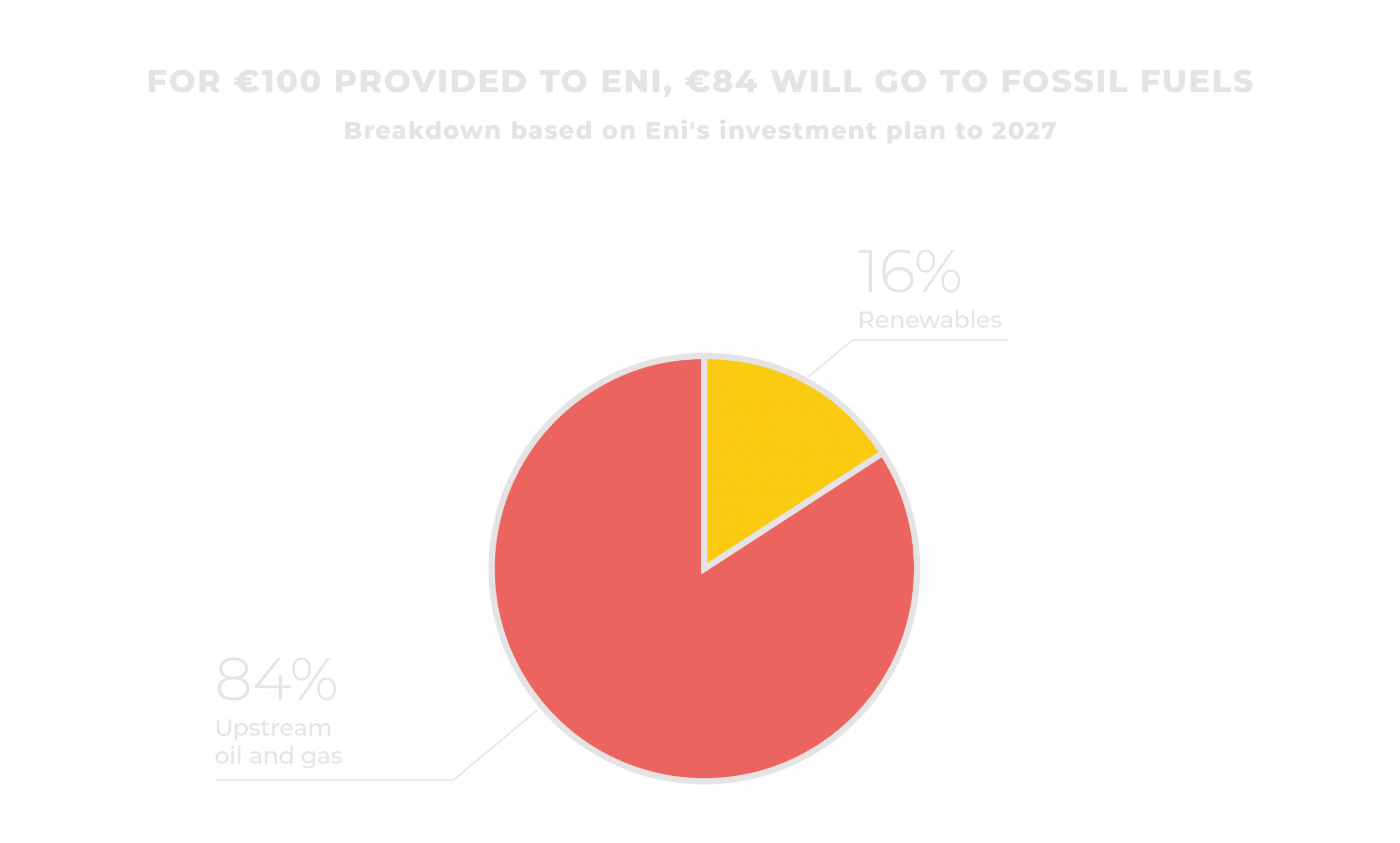

BNP Paribas was the only French bank to participate in BP’s dedicated “low carbon” financing, while Crédit Agricole was the only French bank to participate in two of Eni’s targeted “low carbon” financing requests, for a total amount of US$585.6 million raised by Eni. Eni, however, has sought targeted finance on several occasions, with 6 calls for a total of US$841.2 million between 2020 and 2023, 4 of which involved only Italian financial actors. French banks did provide significant financing for Eni, with US$9.0 billion between 2020 and 2023 for fossil fuel activities. Even BNP Paribas, who has largely stayed away from corporate financing for oil and gas developers in almost the last year, participated in a US$3 billion loan in December 2023 (4) alongside other banks including Natixis, Société Générale, and Crédit Agricole.

The majority (57%) of French banks’ “low carbon” financing for the 5 European companies was through corporate financing. The issue with this is that corporate financing for companies, whether in the form of loans or bond issuances, supports all of a company’s activities, including fossil fuels.

Some banks acknowledge that this corporate financing is problematic. Crédit Agricole CEO Philippe Brassac even admitted to the Senate that they may be criticized for their contribution to companies’ non-renewable, i.e. fossil, activities. But the banks, including Crédit Agricole, continue to justify this in the name of supporting the transition. The argument is strategic: they acknowledge the problem in order to better refute it, indicating that it is a lesser evil to accept in order to support the transition of these majors.

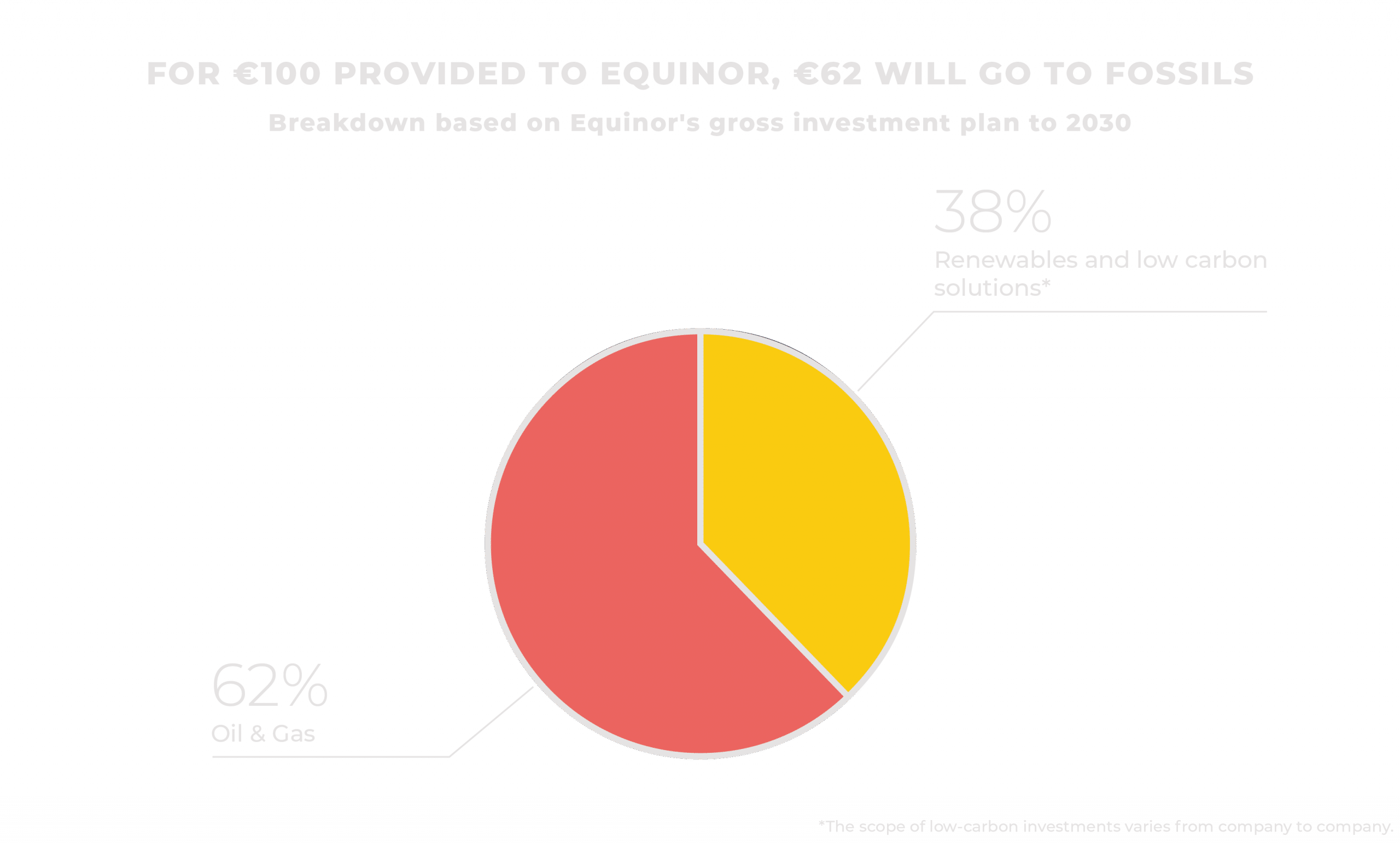

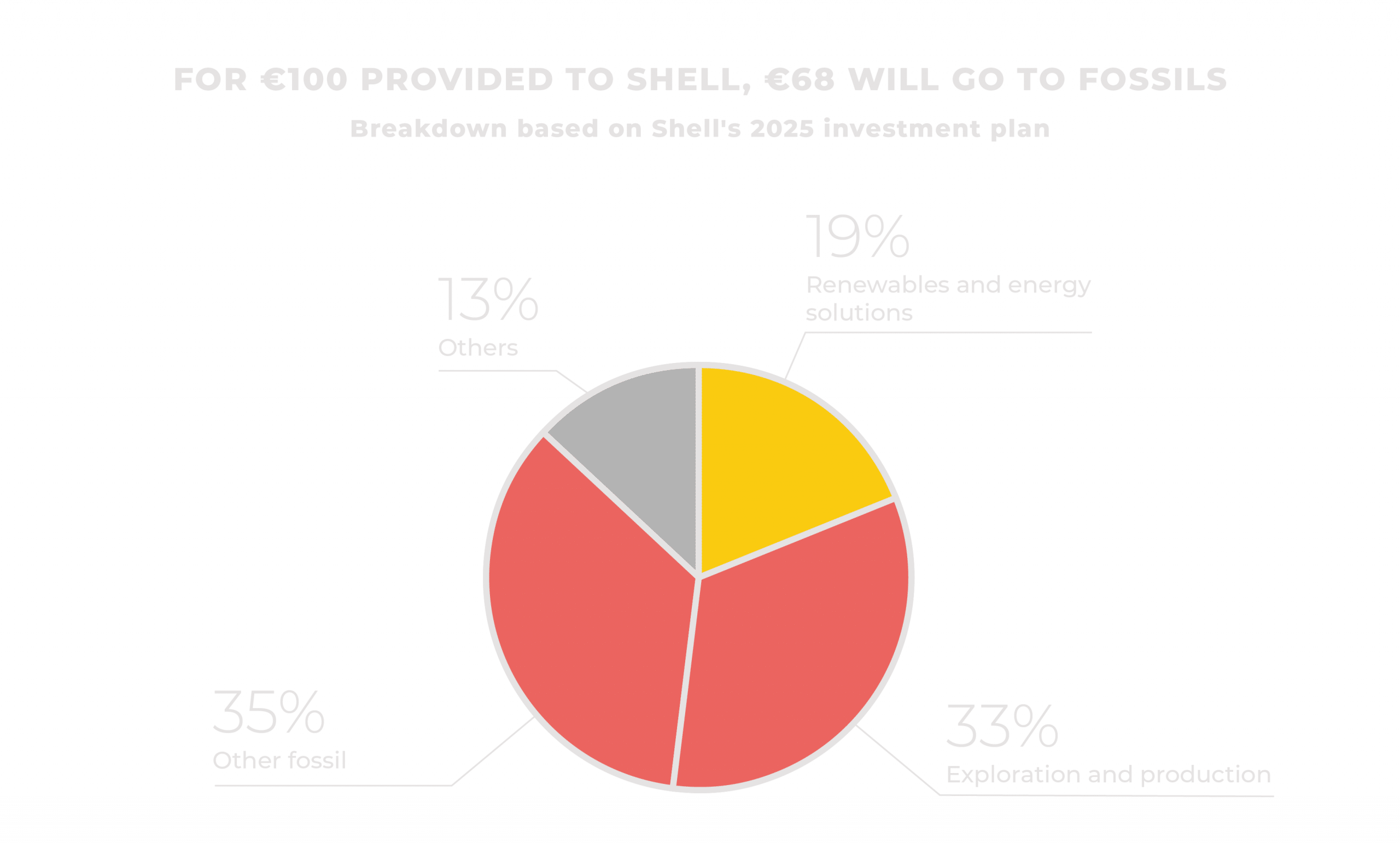

However, our analysis reveals that, apart from Equinor, no company plans to allocate more than a third of its investments to “low carbon” activities in the coming years. In other words, providing untargeted financing to these companies will serve fossil fuels more than “low carbon” activities.

TotalEnergies is no exception

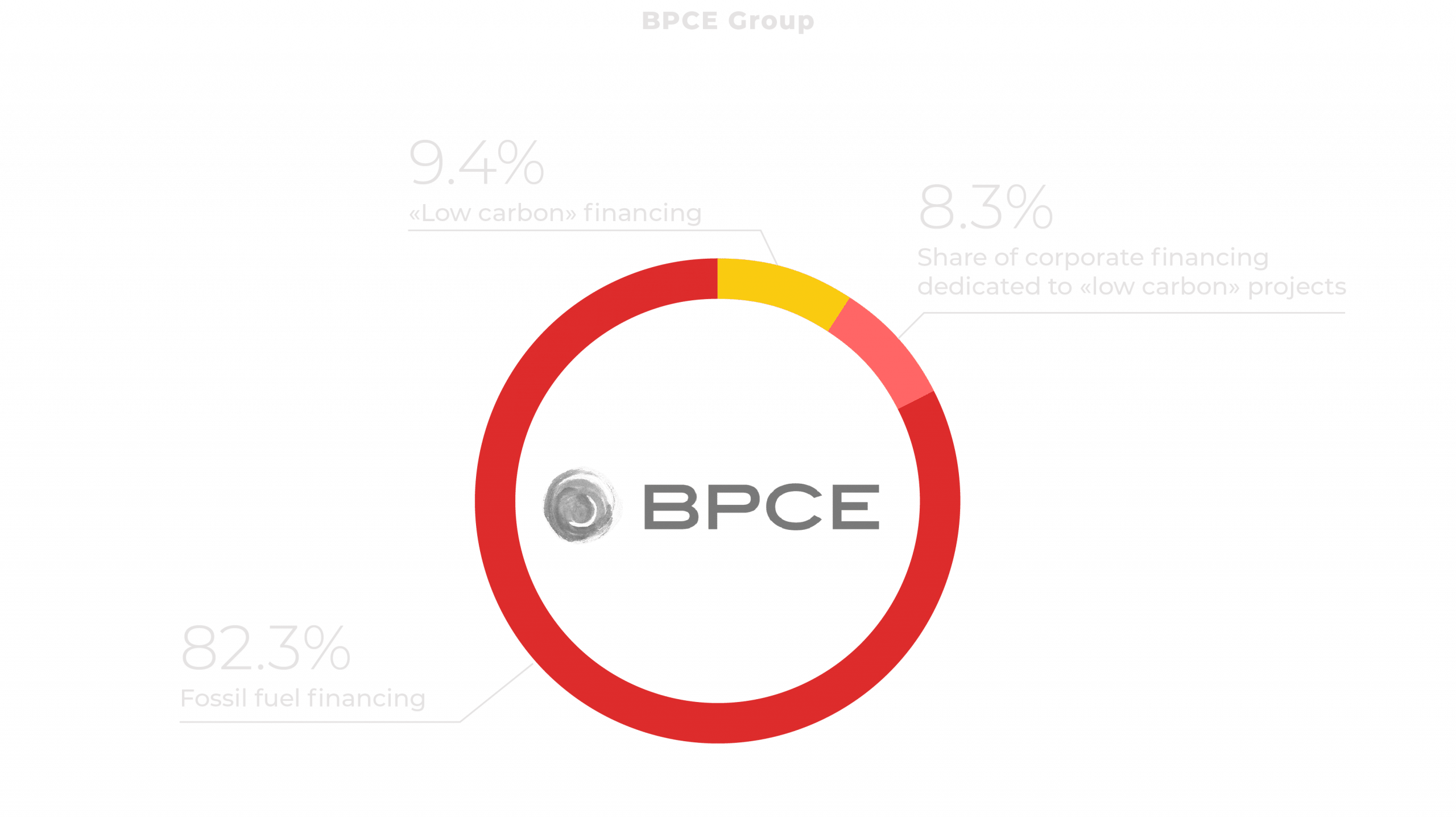

Of the US$14.8 billion that the 4 main French banks provided to TotalEnergies between 2020 and 2023, over 84.1% went to its fossil fuel activities. BNP Paribas allocated 12.7% of their total financing to TotalEnergies to “low carbon” activities, Crédit Agricole 14.9%, while BPCE allocated 17.7% and Société Générale nearly 24.7%.

Most of this US$14.8 billion took the form of corporate financing. The 4 French banks’ dedicated financing for “low carbon” activities amounted to just US$980.7 million between 2019 and 2023.

Crédit Agricole provided US$288.7 million for “low carbon” activities, 16 times less than what it provided for TotalEnergies’ fossil fuel activities during the same period. However, when questioned about its financing for TotalEnergies at the Crédit Agricole annual general meeting in May 2023, Philippe Brassac recognized that oil and gas expansion was incompatible with the goal of limiting warming to 1.5°C, but claimed that the bank’s financing for TotalEnergies supported the group’s renewable activities. The figures demonstrate otherwise. When added to the portion of corporate financing attributable to TotalEnergies’ “low carbon” activities, the amounts provided by Crédit Agricole still only represent 14.9% of the total financing provided to the French major between 2020 and 2023. Despite their strong commercial relationships with TotalEnergies, French banks did not participate in all of the company’s targeted financing calls for “low carbon” projects. They did not participate for example in the US$1.8 billion received by Seagreen Wind Energy, a subsidiary of TotalEnergies, in 2020.

At the end of 2023, and with the conclusions of COP28, we made even more radical decisions, namely to concentrate our project financing solely on renewable energy or “low carbon” projects given the likely importance of the volumes needed in the coming years. And I emphasize because it’s somewhat controversial, I emphasize that we do not exclude any renewable energy project, including those of energy companies. We face the criticism that if you finance energy companies’ renewable energy projects, you allow them in a way to develop the rest., It’s probably true but in any case, our policy, transparently, is not to reject any renewable energy financing project. And as for corporate financing for energy companies, because here too, we face another criticism that must be answered, you talk about projects but in the end, what are your criteria for non-dedicated corporate financing? Well forour corporate financing for energy companies, we decide based on their transition plan and the credibility of their transition plan.

Philippe Brassac, CEO of Crédit Agricole, during the hearing at the Senate on the resources mobilized and that can be mobilized by the State to ensure TotalEnergies respects France’s climate objectives. (5)

It is worth noting that TotalEnergies is the world’s leading listed company in terms of planning the most new oil and gas fields, ahead of BP, ExxonMobil, Shell. TotalEnergies plans to allocate 66% of its net investments to fossil fuels by 2028, with 30% of its net investments dedicated to oil and gas expansion (including new oil and gas fields and new LNG terminals).

Breakdown of TotalEnergies financing per bank

Financing a major oil and gas company is financing oil and gas. This truth needs to be reiterated, and it has been demonstrated through Reclaim Finance’s new research. Contrary to their claims, the four largest French banks continue to fuel our dependence on fossil fuels and oil and gas expansion when they finance TotalEnergies and its peers. Only financing specifically directed to “low carbon” projects can guarantee the absence of support for fossil fuel expansion. As for corporate financing, which represents the lion’s share of financing to these companies, it must immediately cease and be formally excluded through public commitments from French banks.