Copublished with Transport & Environnement

A new investigation by Reclaim Finance and Transport & Environment (T&E) reveals that Europe’s leasing giants have made little to no meaningful climate commitments, despite their growing influence and key role in decarbonizing the automotive sector. As the EU Fleets Regulation is expected before the end of 2025, the NGOs urge the European Commission to take action by imposing binding obligations on leasing companies to accelerate their green transition.

Across Europe, leasing has become the main way of accessing new cars. The sector already accounts for over 50% of new registrations, a figure expected to rise to 70% by 2030.

This shift gives leasing companies—subsidiaries of carmakers (e.g. Mobilize for Renault) or banking groups (e.g. Ayvens for Société Générale, Arval for BNP Paribas)—significant power in shaping the EV transition. These companies are key intermediaries between car makers and clients. They set listed monthly prices for new models, which influence how attractive electric vehicles appear. They also guide customers through the transition —or fail to do so. And they manage the resale of vehicles at the end of the lease period, shaping the second-hand market, where 8 out of 10 Europeans buy their cars.

Unlike carmakers, leasing companies are not subject to any specific climate regulations. There is currently no requirement for emissions transparency, no binding targets, and no phase-out timeline for internal combustion engine (ICE) vehicles. It’s hardly surprising, then, that the warning lights are flashing red when it comes to decarbonization – and that no leasing company has committed to moving away from fossil fuels.

Lucie Pinson, Executive Director at Reclaim Finance

Worrying lack of transparency, weak and inconsistent climate targets

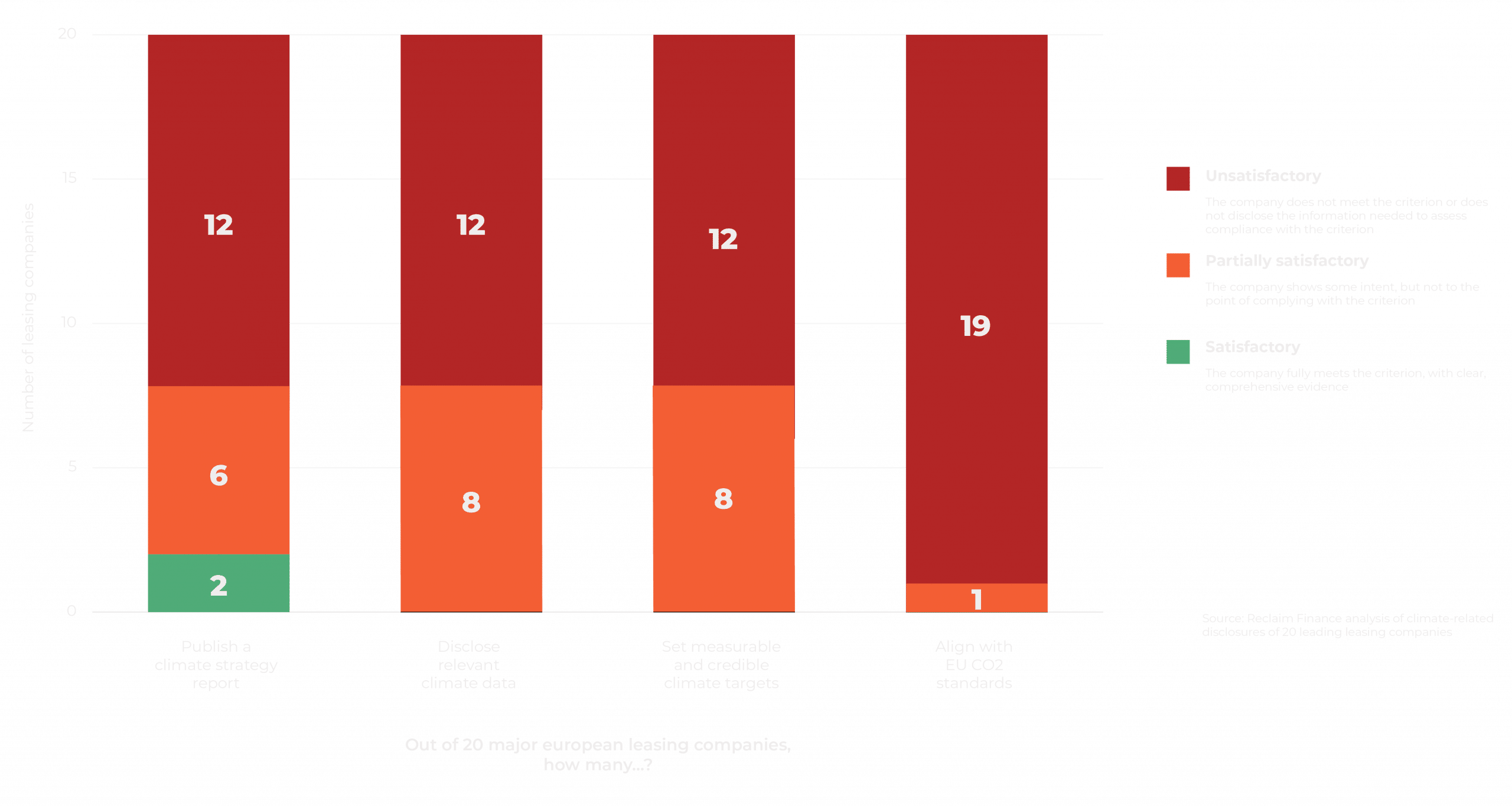

In response to this regulatory gap, Reclaim Finance and T&E analyzed the climate disclosures [1] of twenty major leasing companies [2]. The findings are concerning:

- 12 out of 20 leasing companies publish no public information specifically about their leasing activities. Among them are major players like Stellantis Financial Services, Mercedes-Benz Financial Services, and Toyota Financial Services.

- Even in the case of the 8 companies that disclose information, none provide a transparent detailed breakdown of their fleets by vehicle type, country, or year, making it impossible to evaluate their decarbonization progress.

- Only 9 companies have climate targets, but these are fragmented, short-term, poorly detailed. Some have recently been weakened or suspended, as seen with Arval (BNP Paribas), Ayvens (Société Générale), and Mobilize (Renault).

- No leasing company has committed to stop financing new ICE vehicles in Europe, even after 2035, when the EU plans to ban their sale.

The leasing sector is largely unaccountable on climate

Regulation is urgently needed

The conclusion is clear: policymakers need to introduce policies to reverse this trend and ensure that leasing companies play their role and become real green leaders.

Reclaim Finance and T&E call on the European Commission, Members of the European Parliament and Member States to include binding measures in the upcoming EU Fleets Regulation, expected by the end of 2025:

- Mandate transparency on leasing fleet data: vehicle types, emissions, and fleet composition—broken down by country and year;

- Set regulatory targets for the electrification of leasing fleets, including a phase-out of new ICE vehicle financing.

This report is a wake-up call for policymakers. Without regulation, leasing companies will continue to dodge their responsibilities in the climate transition—even though they hold many of the levers

Stef Cornelis, Fleets and Freight Director at T&E