New data from the 2025 edition of the Banking on Climate Chaos report (1) reveals that 54 of the 65 largest global banks have supported metallurgical coal (met coal) developers between 2021 and 2024, with European banks among the most significant contributors. While some European banks are globally stepping back from coal, others – including for instance BNP Paribas and Standard Chartered – remain deeply entangled in met coal expansion, undermining global climate objectives and exposing a massive loophole in their coal policies. Whether it is burned in a power plant or in a blast furnace, coal must be phased out. The first step for banks is clear: they must immediately end support for companies pursuing any new coal mining project.

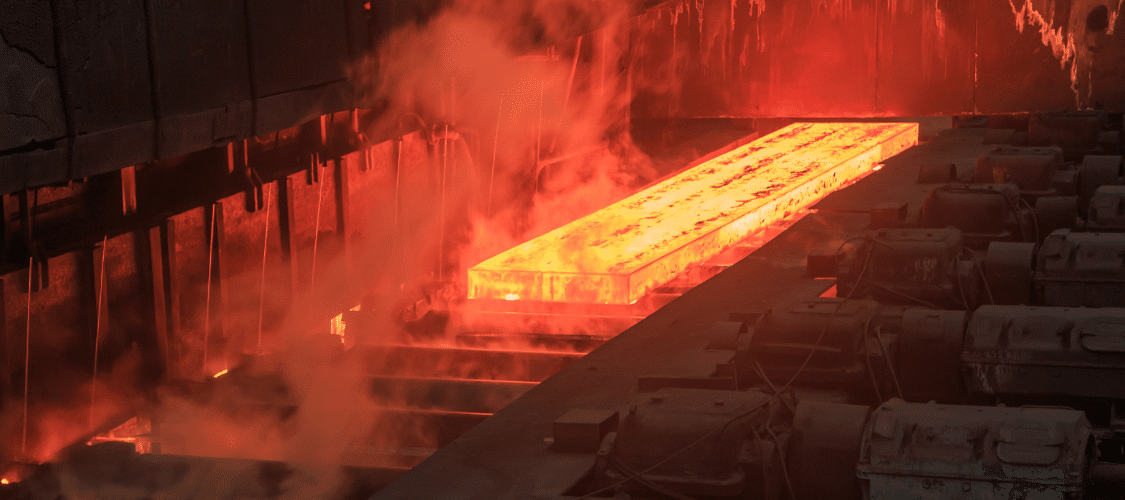

The International Energy Agency states that achieving net zero emissions by 2050 requires no new coal mines or extensions, including met coal (2) – which encompasses different types of coal used for steelmaking. (3) Yet, despite climate goals and the steel sector’s ongoing transition, (4) European banks still finance companies planning new met coal mine expansions worldwide.

European banks: met coal expansion champions

Out of the world’s 65 biggest banks, 54 have financed met coal developers since 2021, with European banks being among the most numerous. Indeed, this includes 20 European banks, 19 Asian banks, 11 North American banks, and 4 Australian banks.

In total these 20 European banks have provided US$8.9 billion to met coal developers between 2021 and 2024, being second only to Asian banks. Among these 20 European banks, six are even among the top 20 global financiers of met coal developers: Deutsche Bank, UBS, Crédit Agricole, Commerzbank, Barclays, and Standard Chartered. All other banks in the top 20 are from China, Japan, the US, and Singapore.

Among top companies (5) financed by these banks include:

- BHP and Mitsubishi, which together as part of the BHP Mitsubishi Alliance are planning the Saraji East, Caval Ridge Horse Pit Extension and Peak Downs Continuation Project in Australia. The latter could continue operating until 2116. (6) BHP’s attempt to make its financiers believe that met coal is needed to decarbonise the steel sector (7) seem to be working, as BHP and Mitsubishi continue to receive support from banks like BNP Paribas – whose coal appetite for both thermal and metallurgical coal is still going strong – Santander, Barclays, Deutsche Bank, Crédit Agricole, and UBS. (8)

- Anglo American, which has expansion plans in Australia and Canada – the Moranbah South, Theodore, Belcourt Saxon projects – of over 30Mt. It just about to reopen the Grosvenor mine in Moranbah (9) after a methane explosion a year ago, which shed light on the methane burden of coal mines (10) and left workers severely injured and traumatised. (11) Yet, Anglo American continues to receive support from Barclays, Crédit Agricole, Santander, Standard Chartered, BNP Paribas, HSBC, BBVA, Unicredit, and Commerzbank.

- Glencore, the world’s second biggest coal miner, which has plans to expand 17 coal mines (both thermal and metallurgical), including massive met coal projects like the Hunter Valley Operation Continuation Project in Australia and the Fording River Extension Project in Canada. The 2024 acquisition of the Elk Valley Resources (EVR) met coal mines brought a fivefold increase in Glencore’s met coal reserves, in addition to plans to expand coal production by almost 30%, with multiple operations projected to continue beyond 2050. (12) Despite all this, major European banks like Deutsche Bank, Commerzbank, ING, Santander, BBVA, UBS, Standard Chartered, HSBC and Barclays, have continued financing Glencore since 2024

Although met coal expansion financing has slightly declined since 2021 (US$4.2 bn), European banks increased support in 2024 (US$1.7 bn) versus 2023 (US$0.7 bn). Without robust policies, financing remains wide open, and the slowdown is still far from enough to curb sector growth — a critical step to meet climate goals.

Time to bridge the met coal gap

European banks were early adopters of coal restrictions and generally have stronger standards, but must close remaining gaps to end all coal financing. Many have thermal coal policies yet still fund developers through loopholes, while continuing to support met coal developers. Only a few banks — such as ING, HSBC, and BNP Paribas — have met coal exclusions, and only at the project level, which fails to stop financing companies driving met coal expansion.

“Metallurgical coal” encompasses different types of coal used in steelmaking. (13) Bloomberg has revealed that some mining companies had sold metallurgical coal to coal power companies, thus rendering financial institutions’ distinction between thermal and met coal obsolete. (14) This confirms that financial institutions seeking to have a robust coal policy can no longer afford to leave met coal out of the equation.

Despite some commitments on met coal and steel decarbonization, Standard Chartered – one of the few signatories of the Sustainable Steel Principles (15) – BNP Paribas – one of the few banks with a met coal policy – are still entrenched in the financing of met coal developers. German banks Deutsche Bank and Commerzbank also continue to finance met coal developers. After a drop from 2021 levels, their funding rose again in 2024, supporting clients like Anglo American, Glencore, and JSW Steel — the latter building two new met coal mines and a captive power plant in India (16) despite local opposition. (17)

Other banks are following a more encouraging path, with a steady decrease in their financing since 2021. Most of them only have one remaining met coal developer in their clients in 2024. This includes UBS (Glencore), Crédit Agricole (Mitsui & Co), and HSBC (JSW Steel).

Encouragingly, BBVA, Société Générale, ING, and BPCE have not financed met coal developers since 2023. Société Générale and ING, early movers with project-level restrictions, must now extend these to the corporate level, while BPCE — the only major French bank without met coal restrictions — should adopt corporate-level restrictions directly.

European banks must close policy loopholes and ban financing for all coal developers. BBVA, Société Générale, ING, and BPCE must formalise a commitment to not finance any more met coal developer as they have not done so since 2023. Banks with only one met coal developer in portfolio – UBS, Crédit Agricole, Commerzbank and HSBC – must commit to stop financing these companies if their met coal expansion plans persist. Laggards like Standard Chartered and BNP Paribas, which increased funding in 2024, must adopt strong policies over empty promises. All banks should use the Global Coal Exit List and Metallurgical Coal Exit List (18) to fully exclude coal financing.