In July 2025, the European Central Bank announced that it will introduce climate considerations into its system of guarantees, known as the collateral framework (1). This will be achieved by adding a ‘climate factor’ based on climate-related data about each asset, the company issuing them and the sector they belong to. This change is an important step in pricing climate risks within the collateral framework and could have a significant impact on fossil fuel assets and companies.

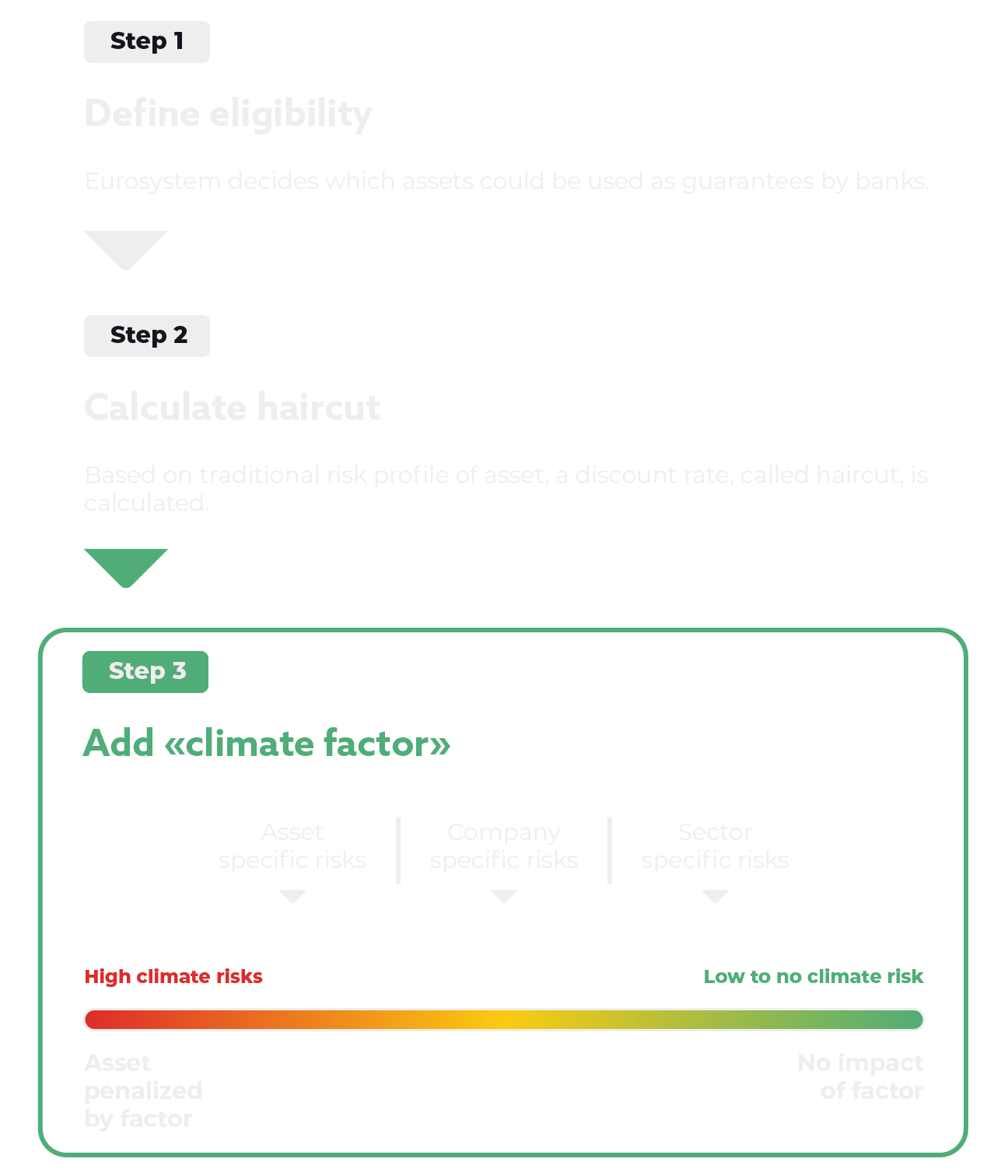

Banks that borrow money from the European Central Bank (ECB) must pledge assets as guarantees, or collateral. There are strict rules over which assets can be pledged (eligibility criteria), and which discount will be applied to their market value based on how risky they are perceived (a high discount rate, or haircut, will be applied to riskier assets).

Historically, climate considerations were not factored into this process. Many fossil fuel assets would pass the eligibility test and would even be given a relatively low haircut (2). This situation benefited fossil fuel companies and could contribute to easier financing conditions for them.

Factoring in climate considerations

The ECB’s announcement introduces a new layer to the evaluation process of assets used as collateral. After calculating the haircut, the ECB will add the new ‘climate factor’ impacting the value of the asset as collateral. This factor will be based on a three-tier analysis, each component designed to encompass specific dimensions of climate-related risk (3):

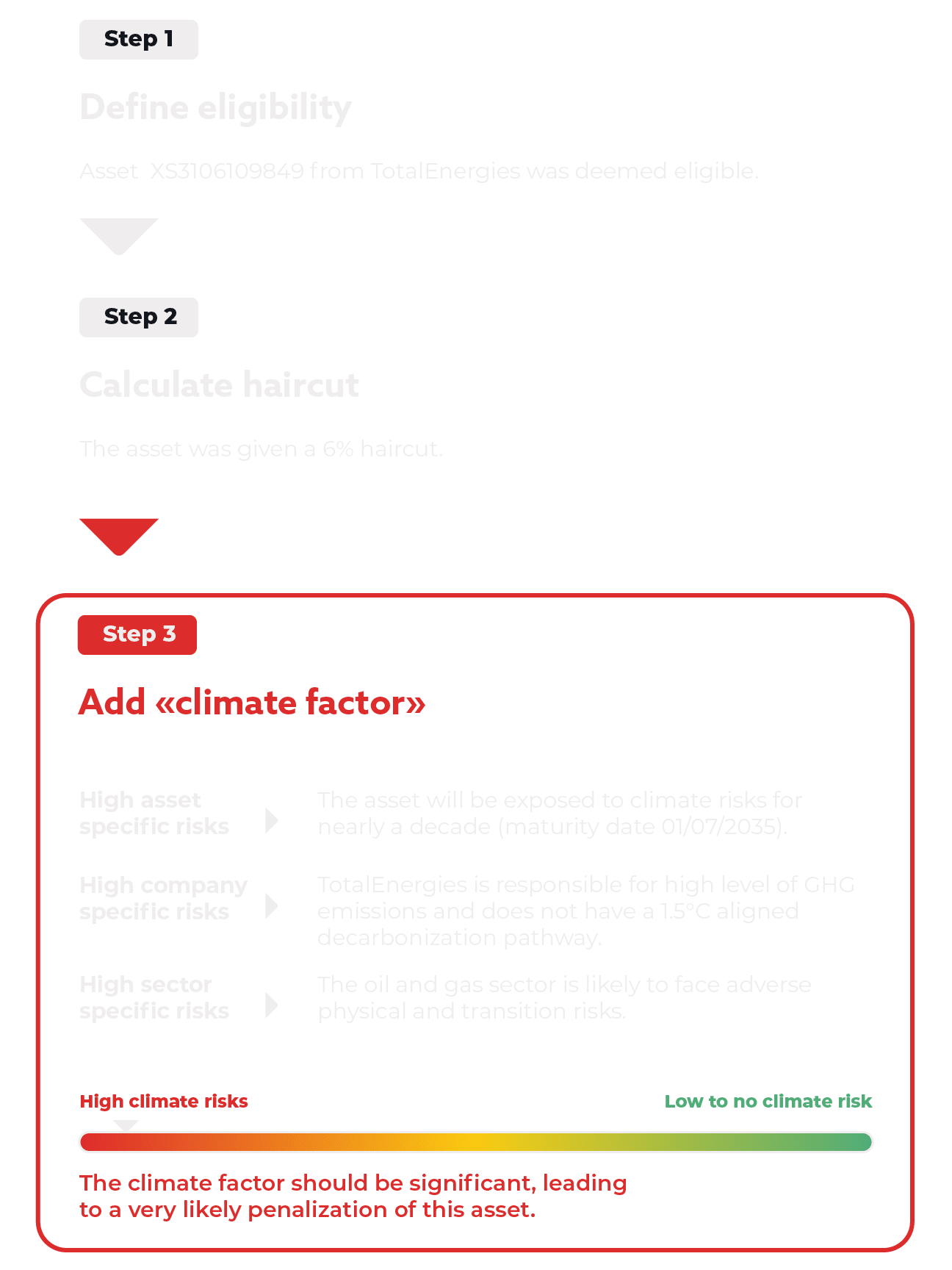

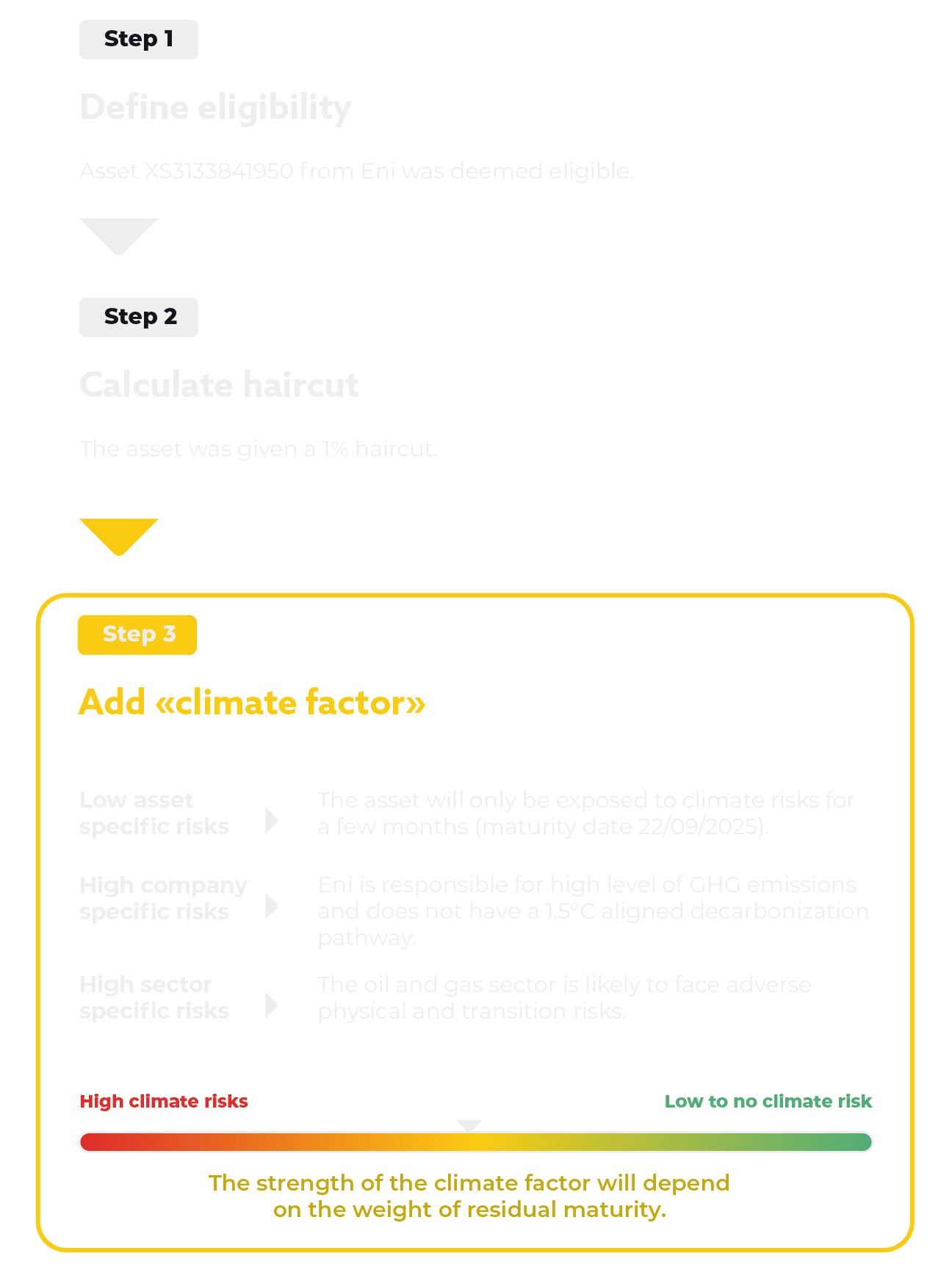

- The asset level analysis focuses on the asset’s vulnerability, or how much its price is likely to be impacted by unexpected future climate shocks. This asset-specific vulnerability will be based on residual maturity.

- The company level analysis looks at several climate metrics of the company issuing the asset to assess its exposure to transition risks. This issuer-specific exposure will be based on the methodology previously developed to favor companies with better climate performance in the ECB’s asset purchase programs (4).

- The sector level analysis considers how the sector as a whole will be affected by transition and physical climate risks. The sector-specific stressor will be based on the Eurosystem climate stress test data.

Assets facing high levels of risk in one or more of these categories will be discounted, their climate factor will decrease their value as collateral. Depending on how exactly it is calculated, the measure could have a significant impact and disincentivize banks from using long-term assets from carbon intensive companies and sectors as collateral. The following analysis provides more information on how the climate factor works and what key considerations the ECB should bear in mind when designing it.

Company level analysis: beware of methodological flaws

As per the methodology developed for the ECB’s asset purchase programs, the company level analysis of the climate factor will rely on a) backward-looking climate metrics (i.e. carbon intensity and rate of decarbonization) to account for past greenhouse gas emissions (GHG); b) forward-looking climate metrics (i.e. decarbonization target) to assess their commitment to transitioning, and c) the quality of climate disclosures. This analysis is therefore expected to penalize assets issued by companies responsible for high levels of GHG, with little to no intention to reduce these emissions and/or lacking transparency.

However, the methodology also contains several flaws which made it possible for the ECB to continue to buy assets from highly polluting companies, including fossil fuel corporations (5) (6). Several methodological choices contributed to painting an incomplete picture of companies’ climate impact:

- Relying on carbon intensity (carbon emission over revenue): Keeping absolute emissions constant whilst diversifying a company’s activities or increasing its revenues would decrease carbon intensity. Absolute emissions should therefore be considered alongside carbon intensity.

- Using a ‘best-in-class’ approach: Favoring companies with lower scopes 1 and 2 emissions compared to their sectoral peers in highly carbon intensive sectors is problematic. It allowed companies with a poor environmental record, but not as poor as their peers, to be rewarded.

- Overlooking key forward-looking metrics: Whether the company has plans to expand fossil fuel activities, and other equally damaging activities such as deforestation, should be part of the forward-looking metrics used.

Sector and asset analyses: enter new parameters

The sectoral component of the climate factor will be the same for all assets within a specific sector. For each sector, it aims at accounting for both the physical risks from climate change and the transition risks from moving towards a carbon-neutral economy. It is expected to penalize assets linked to carbon intensive sectors which typically face high transition risks – since the increase of carbon prices is seen as a key driver of these risks (7). Similarly, sectors vulnerable to the risks of sea level rise, heatwaves, storms or other physical hazards will be penalized by the factor (8). The fossil fuel sector has been identified as particularly at risk in climate stress tests, notably due to the inevitable transition away from fossil fuels and to the exposure of much fossil fuel infrastructures to climate disasters and disruptions.

The climate factor’s asset-specific component will penalize assets with longer maturity which are considered more exposed to climate-related risks by default. This favors “short-term” assets or assets approaching their maturity date, regardless of the climate impact of their issuer and their sectoral exposure to climate-related risks. Although differentiating between assets with long and short residual maturity makes sense from a risk perspective, this criteria should not be given disproportionate weight in the total factor. Otherwise, it could end up overpowering the other two components and giving a free pass to carbon intensive assets with little residual maturity. In particular fossil fuel assets with low residual maturity should still be strongly penalized, even if it is slightly less than long term ones (9).

Scoping out the impact

The climate factor will be applied to a subset of the collateral pool: marketable assets issued by non-financial corporations and their ‘affiliated entities’. The inclusion of ‘affiliated entities’ in the scope implies that financial corporations which only exist to support fossil fuel companies should also be covered (10).

However, marketable assets issued by non-financial corporations and their affiliated entities represent less than 5% of collateral pledged by banks (11). In contrast, bank loans represent more than 30% of collateral used and covered bank bonds around 28%. Adapting and extending the climate factor to other asset classes should therefore be a priority for the ECB.

Despite its limited scope, the climate factor could have a significant impact on how banks treat carbon intensive assets, and by extension, companies. Indeed, studies suggest that carbon intensive assets on average have lower haircuts than other similar assets (12). If the climate factor rectifies this situation, carbon intensive assets would lose some of their value as collateral and banks might prefer to use other assets as collateral. By making these assets less appealing for banks, the climate factor could negatively impact carbon intensive companies’ access to financing (13).

Furthermore, the ECB’s decision to penalize carbon intensive assets sends the clear message that climate risks are not priced in properly by traditional risk analyses. This in itself could have far-reaching indirect consequences, notably as the ECB is expecting European banks to increasingly consider climate-related risk after several years of engagement (14).

The introduction of a climate factor in the ECB’s collateral framework marks a significant turn in the assessment of assets used as collateral by banks. The climate factor is expected to penalize assets from carbon intensive companies, especially fossil fuel assets. As the ECB finalizes the details of the factor for an implementation mid-2026, it needs to ensure the final design adequately considers climate impact and is significant enough to disincentivize the use of carbon intensive assets as collateral. Going forward, the ECB also needs to explore ways to extend the climate factor to other asset classes in the collateral framework.