Recommendations

The financial sector has a major role to play in the ecological transformation of our societies. Immediate action on its part is essential to ensure that greenhouse gas emissions are halved by 2030 and to limit global warming to 1.5°C, the imperative set by the Intergovernmental Panel on Climate Change (IPCC).

Reclaim Finance has developed a set of ambitious and realistic recommendations for all financial actors – banks, insurers and investors – to help them transform their activities. These recommendations are not exhaustive and mainly address the energy sector.

The credibility of a climate policy depends on what it contains, the level of ambition it sets for itself, the effectiveness of its implementation and the methodological rigor on which it is built.

It is recommended that financial actors base their climate policy on scientific foundations and methodologies adapted to the objectives sought. Our recommendations list here the key elements to be integrated (reference scenario, databases, scope of application of the policy, engagement and voting policy, etc.).

For futher informations, you can contact us at contac@reclaimfinance.org

Asset Managers

These recommendations lay out the bedrock of a solid transition plan, focusing on key areas such as decarbonization targets, decarbonization strategy, public and private engagement strategy, reporting and governance, as well as just transition and biodiversity.

These recommendations identify key actions that enable asset managers to stop supporting coal expansion and support portfolio companies in closing their existing infrastructure.

See our Asset Manager analysis in the Coal Policy Tracker

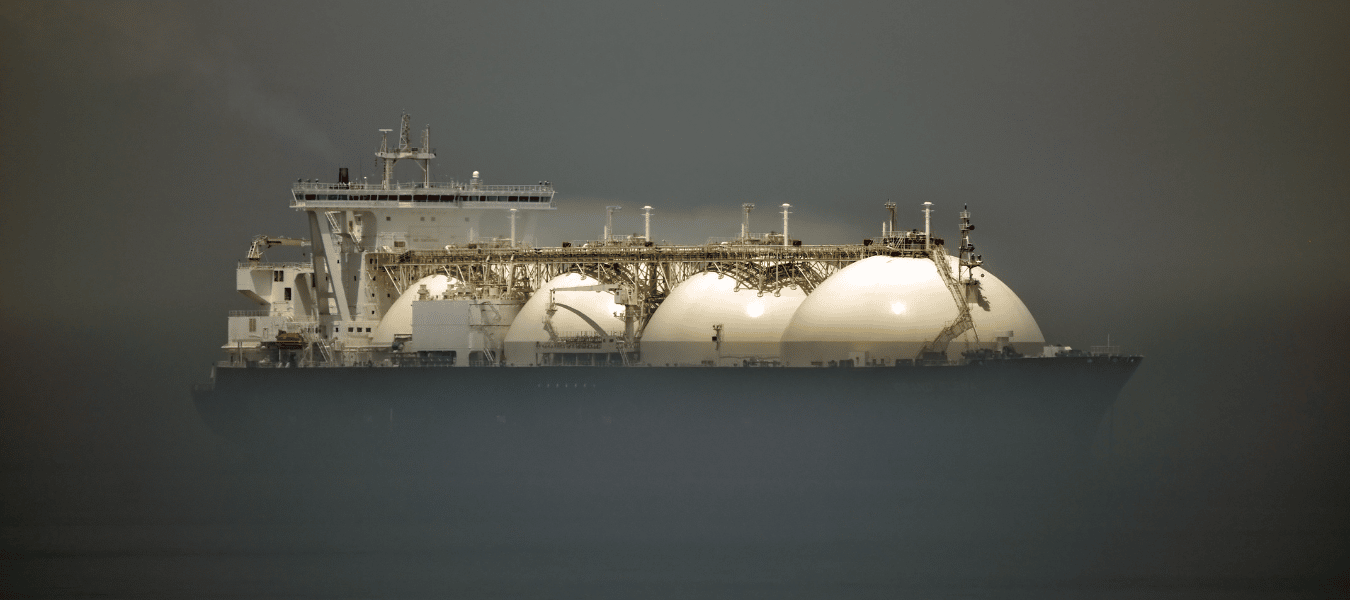

These recommendations identify key actions that enable asset managers to stop supporting oil and gas expansion, and to support portfolio companies in adopting a robust climate plan.

See our Asset Manager analysis in the Oil and Gas Policy Tracker

These recommendations identify key actions that enable asset managers to participate in the decarbonization of the power sector by accelerating the closure of fossil fuel plants, encouraging power generation companies to adopt credible transition strategies, and supporting the deployment of renewable energy.

These recommendations identify key points to enable asset managers to implement credible and effective engagement and voting policies, and then report transparently on their activities and the results achieved. The recommended voting practices are then detailed by type of vote and resolution.

Banks

These general recommendations set the framework for what a good climate policy adopted by banks should include, with methodological recommendations on many aspects of this policy (baseline scenarios, datasets, décarbonation targets, scope of the policy, definitions, etc.).

These recommendations lay out the bedrock of a solid transition plan, focusing on key areas such as decarbonization targets, decarbonization strategy, public and private engagement strategy, reporting and governance, as well as just transition and biodiversity.

These recommendations identify key actions that would allow banks to help stop the expansion of coal and support portfolio companies in closing their existing infrastructure.

See our Banks’ analysis in the Coal Policy Tracker

These recommendations identify key actions that would allow banks to contribute to halting oil and gas expansion and decreasing oil and gas production by 2030, and to support portfolio companies in adopting a robust climate plan.

See our banks’ analysis in the Oil and Gas Policy Tracker

These recommendations identify key actions that would allow banks to participate in the decarbonization of the power sector by accelerating the closure of fossil fuel plants, encouraging power generation companies to adopt credible transition strategies, and supporting the deployment of renewable energy.

These recommendations detail how banks can make their lobbying policy consistent with their climate policy. It is essential that this policy is applied both in their direct lobbying (with public agents, such as governments, legislators, regulators, administration, international organizations, etc.) and in their indirect lobbying (with scientific journalists, artists, etc.), or in their internal organization (with their employees, subsidiaries and contractors, from all business areas and all operational jurisdictions).

(Re)Insurers

These recommendations lay out the bedrock of a solid transition plan, focusing on key areas such as decarbonization targets, decarbonization strategy, public and private engagement strategy, reporting and governance, as well as just transition and biodiversity.

These recommendations identify key actions that enable (re)insurers to stop supporting coal expansion, both in their (re)insurance (underwriting) and investment activities, and support their clients and investees in closing their existing infrastructure.

See our (Re)Insurers’ analysis in the Coal Policy Tracker

These recommendations identify key actions that enable (re)insurers to stop supporting oil and gas expansion, both in their (re)insurance (underwriting) and investment activities, and support their clients and investees in adopting a robust climate plan.

See our (re)insurers’ analysis in the Oil and Gas Policy Tracker

These recommendations identify key actions that enable (re)insurers to participate in the decarbonization of the power sector, both in their (re)insurance (underwriting) and investment activities, by accelerating the closure of fossil fuel plants, encouraging power generation clients and investees to adopt credible transition strategies, and supporting the deployment of renewable energy.

These recommendations identify key points to enable (re)insurers to implement credible and effective engagement and voting policies, and then report transparently on their activities and the results achieved. The recommended voting practices are then detailed by type of vote and resolution.