MS&AD is the top insurer in Japan with US$30.4 billion (JPY3400 bn) net premium written and total assets of USD 212.8 bn. On June 25th, it announced a new coal exclusion policy, finally deciding to completely stop the underwriting of new coal power plants, without exception.

A baby-step such as this is welcome but clearly insufficient. The path ahead remains long: the underwriting of coal mine and coal infrastructure projects must stop too, as well as the underwriting of companies undertaking such projects. In a Japanese context, financial actors are overwhelmingly ranking among climate laggards. This commitment, as tiny as it is, might nevertheless be the start of a step change on coal financing within MS&AD, in Japan and hopefully more broadly in East Asia: the financing of coal expansion must end immediately.

1. What’s new

MS&AD announced through a press release that its coal policy has been updated: from now on, “it will not provide insurance for, nor make investments in new coal-fired power plants.”

In September 2020, it had already committed to stop underwriting such projects, but it kept a large exception framework that is now removed.

2. Our analysis: MS&AD still far behind

MS&AD is a major contributor to coal financing: the first non-life insurance in the ASEAN region, and a major investor in coal: US$ 233 million invested in 12 coal companies listed in the Global Coal Exit List, as of January 2021. These companies operate coal plants with a combined capacity of 17 GW (and plan 2.3 GW additional ones) and extract annually 37.8 million tons of coal.

Its decision to stop the underwriting of all new coal plants is a step in the right direction. MS&AD is the first Japanese insurer to take such decision, before SOMPO and Tokio Marine, its two main national competitors, which still have such exceptions in place. However, the fact that this policy does not fully cover coal expansion, as Allianz, and AXA already do, is extremely disappointing. Stopping insuring new coal plant projects is one thing, but MS&AD must also stop insuring companies developing such projects. Committing to end the underwriting of coal mine and coal infrastructure projects and ending all financial support towards coal developers should be the bare minimum for any serious commitment on coal. It’s worth repeating that any new coal project is inconsistent with a 1.5°C trajectory, as demonstrated by the latest IPCC and IEA reports.

Moreover, MS&AD’s policy falls even shorter of what climate science requires for the coal sector to align with a 1.5°C trajectory. Research from Climate Analytics demonstrated that coal power must be fully phased-out by 2030 in all European & OECD countries, and by 2040 worldwide, and the IEA’s recent net zero scenario shows the need to quickly reduce coal production and consumption. Yet, MS&AD fails to commit to fully exit the coal sector or to set a Paris-aligned trajectory and plan to progressively end all underwriting and financing for coal by these deadlines. In this, MS&AD should follow AXA and Allianz, which both committed to end coal underwriting by 2030 In Europe and OECD countries, and by 2040 worldwide.

Clearly, MS&AD lags behind its peers internationally: AXA already adopted a robust coal policies planning both an immediate end to any supports towards coal expansion and to exclude companies highly dependent on coal.

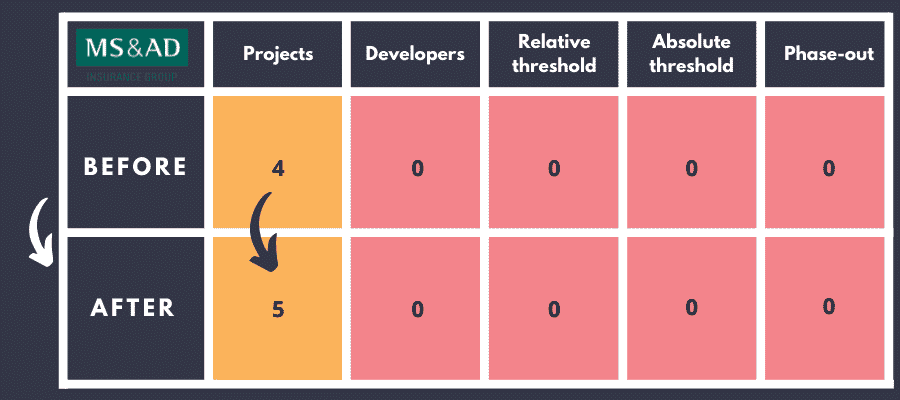

MS&AD’s scores in the Coal Policy Tool

Conclusion: No time to waste, the planet cannot wait

This new policy by MS&AD is utterly insufficient to align with the climate objectives of the Paris Agreement. There remains a mountain to climb, starting with an end to all support for coal expansion. All financial support towards new coal mines and coal infrastructure projects must stop, as must the financing and underwriting of all companies developing such projects.

Even if SOMPO and Tokio Marine are now behind, MS&AD cannot rest on its laurels: it must rapidly catch up with the international best practices in the sector set by AXA and Allianz.