Assessment of oil and gas

companies’ climate strategy

12 of the largest publicly listed integrated oil and gas companies in Europe and the United States, along with national oil and gas companies (NOC), accounted for a huge 28% of global production in 2023, 40% of near-term exploration and production expansion plans, and 18% of liquefaction terminal expansion plans.

These companies bear a major responsibility for the climate change that is already affecting entire economies and millions of people. Winding down their fossil fuel activities—including rapidly halting expansion strategies and gradually dismantling existing facilities—directly determines our ability to limit global warming to as close to 1.5°C as possible.

But is such a transformation possible, or is it just an illusion, given that most have recently backtracked on their climate commitments, announcing an increase in hydrocarbon production by 2030 and a decline in their investments in renewables?

To enable financial actors to adapt their financing, investment, and engagement strategies, Reclaim Finance has analyzed their orientations in detail. Several key indicators have been selected to assess the credibility of their climate action. All aim to answer three questions:

- What are the company’s investment choices?

- What are its production and greenhouse gas emission targets?

- To what extent is the company really diversifying?

Read about the main conclusions of our analysis and download a detailed briefing specific to each of the 12 oil and gas companies below. For your convenience, a glossary is available here.

methodology

Given the importance of cutting greenhouse gas emissions within the current decade, our analysis focuses on corporate targets for 2030.

The International Energy Agency’s (IEA) Net Zero Emissions by 2050 Scenario (NZE), which is based on a 1.5°C trajectory, was chosen as the main reference scenario. This scenario models:

- A drop in oil and gas production of 21% and 13% respectively by 2030, compared with 2023 levels.

- A halt to the development of new oil and gas fields and liquefied natural gas (LNG) terminals.

- A 3-fold increase in installed renewables capacity by 2030, which requires doubling current investment levels in renewable power, grids and battery storage to USD $2.5 trillion by 2030.

- A 75% reduction in investment in fossil fuel production between 2023 and 2035, as well as a 2.5-fold increase in “clean energy” investment over the same period to maintain reliable energy supplies.

Our analysis puts the 12 oil and gas companies’ projections into perspective against the NZE.

key findings

None of the climate strategies are aligned with a 1.5°C scenario.

Analysis of the climate strategies of these 12 oil and gas companies in relation to the NZE scenario shows that their investments, production plans and diversification strategies do not enable them to follow a 1.5°C trajectory.

Priority to shareholders and fossil fuels, particularly gas

Continued expansion of oil and gas

An energy mix in 2030 based on fossil fuels

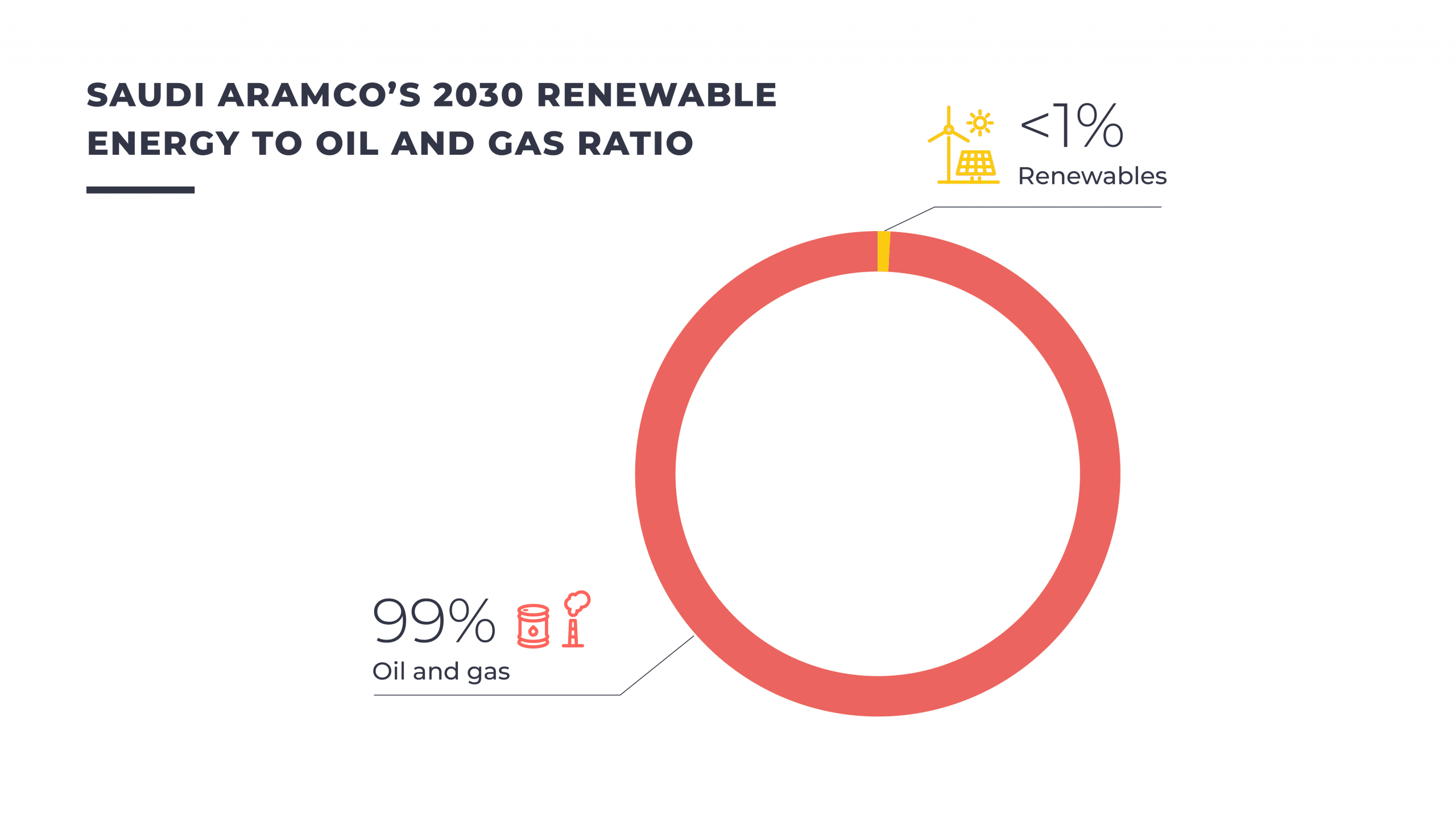

All of them forecast an energy mix in 2030 that would still include between 78% and more than 99% fossil fuels.

Exceeding the 1.5°C carbon budget in 2030

All of them will emit more greenhouse gases in 2030 than allowed in a 1.5°C scenario.

Misleading diversification

Climate backtracking

Climate strategies analysis

BP’s investment strategy

The British company reset its strategy in 2025, announcing a new investment plan that heavily relies on upstream oil and gas.

- Over the past 3 years, more than US$1.1 billion was invested annually in oil and gas exploration.

- In 2024, US$9.8 billion was invested in oil and gas upstream and integrated gas, and US$12.5 billion was distributed to shareholders, compared with just US$1.6 billion invested in its “low carbon energy” business – that includes renewable energies as well as biofuels, hydrogen and carbon capture and storage.

- From 2025 to 2027, BP plans to invest US$10.5 billion per year in oil and gas, and US$0.8 billion in “low carbon energy”. This is a significant rollback from earlier capital expenditure plan, which projected investing US$4 billion per year to 2030 in its “low carbon energy” business.

BP’s fossil fuel production plan

BP has not made any commitment to stop developing new oil and gas projects. The company is the 15th largest upstream developer worldwide.

In 2023, BP came back on its 2030 oil and gas production reduction target. In its new strategy, the company intensified its climate backtrack, planning to slightly increase its oil and gas production by 2030 to 2.3 to 2.5 million barrels of oil equivalent per day. If it meets this target, the company’s production will be 57% above the level required by the NZE.

BP’s oil and gas extraction in 2030 will represent 1.6% of the global hydrocarbon production projected in the NZE.

LNG is part of BP’s fossil expansion strategy with new export and import terminals under construction. BP’s net liquefaction capacity will increase to 16 Mtpa by 2030 and will overshoot by 16.2% the level required by the NZE.

BP’s diversification strategy

The company’s business model will continue to be based on oil and gas extraction and LNG in the coming years. Diversification into other energies will continue to represent a minority share of BP’s future production and will sometimes involve activities that are harmful to the environment.

A central part of BP’s electricity generation expansion strategy relies on gas power. BP has 1.6 GW of net gas power capacity planned through four new gas plant units – one of them being in Europe.

BP does not communicate a target on its future renewable capacities beyond 2025 anymore. The development of renewable energy has significantly dropped in the new strategy with a focus on capital light partnerships rather than organic development of new renewable infrastructures.

Eni’s investment strategy

The Italian company’s investment strategy heavily relies on hydrocarbons, in particular on upstream and midstream gas.

- From 2022 to 2024, Eni invested US$1.3 billion per year in oil and gas exploration.

- In 2024, €6.8 billion were invested in oil and gas – primarily upstream – and €4.5 billion were distributed to shareholders, compared with just €0.9 billion invested in its “Plenitude” business – that includes renewable energy and other so-called “low carbon” energies.

- Up to 2028, Eni plans to allocate approximately 76% of its investments to oil and gas. Only 17% is earmarked for renewables activities.

- This is a significant rollback from Eni’s previous 2024-2027 investment plan, as Eni is now targeting 22% less investment in renewable power than before.

Eni’s fossil fuel production plan

Eni has made no commitment to stop developing new oil and gas projects. The company is the 16th largest upstream developer worldwide and the 28thth largest LNG export terminal developer.

In 2025, Eni increased its reported oil and gas production target. The company plans to increase its oil and gas production by 2-3% per year by 2030 instead of 2% per year previously targeted. With the company’s current expansion strategy, its 2030 fossil fuels production will be 78% above the NZE.

LNG is core to Eni’s gas-oriented expansion strategy with new export terminals planned. Eni net liquefaction capacity will increase to 15 Mtpa by 2030 and will overshoot by 96% the level required by the NZE.

Eni’s diversification strategy

The company’s business model will continue to be based on oil and gas extraction and LNG in the coming years. Diversification in other energies will keep representing a minority share of its future production and will sometimes involve activities that are harmful to the environment.

A central part of Eni’s power strategy relies on gas power, with 81% of its electricity being fossil-based as of 2024. Eni is planning six new gas power units, that will represent a 12% increase of its gross gas power capacity.

The Italian major slightly reduced its installed renewable capacity target by 2030, to 15 GW. Renewable power will then represent 6% of Eni’s production mix.

With its current strategy, Eni will remain one of the key oil and gas players. Indeed, in 2030, Eni’s oil and gas extraction will represent 1.5% of the global hydrocarbon production projected in the NZE, whereas the company will only represent 0.1% of the worldwide renewable power production.

Equinor’s investment strategy

The Norwegian company’s investment strategy increasingly prioritizes the oil and gas sector and redistribution to shareholders.

- Over the past 3 years, US$1.2 billion were invested annually in oil and gas exploration.

- In 2024, US$13.3 billion were invested in oil and gas exploration and production, and US$14.6 billion were distributed to shareholders, compared with just US$2.2 billion invested in its renewables.

- Up to 2027, Equinor plans to allocate approximately 38% of its investments to renewables and ”low carbon” activities. This is a significant rollback from its previous plan, which targeted to allocate 50% of its gross investments in “low carbon” activities by 2030.

Equinor’s fossil fuel production plan

Equinor has made no commitment to stop developing new oil and gas projects. The company is the 17th largest upstream developer worldwide and the 44thth largest LNG export terminal developer.

Equinor went back on its commitment to reduce its oil and gas production to 2 million barrels of oil equivalent per day by 2030, and now plans 2.2 million per day in 2030, 10% higher than previously targeted. With the company’s current expansion strategy, its 2030 fossil fuels production will be 80% above the NZE.

LNG is one component of Equinor’s gas-oriented fossil expansion strategy. While Equinor does not own any export terminal yet, the company plans to develop one new export terminal by 2030. Equinor’s net liquefaction capacity will then increase to 5.2 Mtpa by 2030, that will overshoot the NZE.

Equinor’s diversification strategy

The company’s business model will be based on oil and gas extraction and LNG in the coming years. Diversification in other energies will keep representing a minority share of its future production and will sometimes involve activities that are harmful to the environment.

A central part of Equinor’s power strategy relies on gas power. Equinor is planning a new gas power unit, that will represent more than 50% increase in Equinor’s gross gas power capacity.

Equinor came back on its commitment to reach 12 to 16 GW of installed capacity by 2030 and abandoned its 2030 net renewable generation target. Now, Equinor is only targeting 10 to 12 GW of installed or under development net capacity and has not set any updated renewable production target. Assuming Equinor will meet its targets, its energy production from renewables will be 20.9 times lower than its energy production from oil and gas in 2030.

With its current strategy, Equinor will remain one of the key oil and gas players. Indeed, in 2030, Equinor’s oil and gas extraction will represent 1.6% of the global hydrocarbon production projected in the NZE, whereas the company will only represent 0.1% of the worldwide renewable power production.

Repsol’s investment strategy

The Spanish company’s investment strategy heavily continues to rely heavily on oil and gas:

- Over the past 3 years, US$251 million were invested annually in oil and gas exploration.

- In 2024, €2.6 billion were invested in upstream and €2.3 billion were distributed to shareholders, compared with just €2.5 billion invested in its renewable branch.

- From 2024 to 2027, Repsol plans to allocate a third of its investments to upstream oil and gas, while less than 20% of its future capital expenditure will be allocated in renewable energy.

Repsol’s fossil fuel production plan

Repsol has made no commitment to stop developing new oil and gas projects. The company is the 40th largest upstream developer worldwide.

Repsol targets a production range of 550,000 – 600,000 barrels of oil equivalent per day until 2030, which is stable compared to its current production. If it meets this target, the company’s production will be 38% above the level required by the IEA’s NZE.

Repsol’s diversification strategy

The company’s business model will continue to be based on oil and gas extraction in the coming years. Diversification in other energies will keep representing a minority share of its future production and will sometimes involve activities that are harmful to the environment.

Repsol’s diversification strategy relies on gas power, that represents 26% of Repsol’s 2024 power production, as well as on hydrogen and bioenergy.

Repsol aims to develop its renewable energy sources, with a capacity increase from 3.7 GW today to 15-20 GW by 2030. If Repsol meets its targets, renewable energy will represent 19% of the company’s energy production mix, while oil and gas will represent 71% of its energy production mix.

With its current strategy, Repsol will remain one of the key oil and gas players. Indeed, in 2030, Repsol’s oil and gas extraction will represent 0.5% of the global hydrocarbon production projected in the NZE, whereas the company will only represent 0.2% of the worldwide renewable power production.

Shell’s investment strategy

The British – Dutch company’s investment strategy heavily relies on hydrocarbons, in particular on upstream and integrated gas

- Over the past 3 years, US$2.4 billion were invested annually in oil and gas exploration.

- In 2024, US$12.7 billion were invested in upstream and integrated gas – that primarily includes LNG activities – and US$22.9 billion were distributed to shareholders, compared with just US$2.5 billion invested in its “Renewables and Energy Solutions” business – that includes renewable energy and other so-called “low carbon” energies.

- Up to 2030, Shell plans to allocate approximately 60% of its investments to its “upstream and integrated gas” segment. Only 9% is earmarked for its “Renewables and energy solutions” business.

- This is a significant rollback from Shell’s previous capital expenditure plan, which targeted 19% of its 2025 investments in “Renewables and energy solutions” activities.

Shell’s fossil fuel production plan

Shell has made no commitment to stop developing new oil and gas projects. The company is the 10th largest upstream developer worldwide and the 9thth largest LNG export terminal developer.

In 2023, Shell already came back on its 2030 target to reduce oil production. In 2025, the company committed to increase its oil and gas production by 1% per year by 2030, driven by gas. With the company’s current expansion strategy, its 2030 fossil fuels production will be 23% above the NZE.

LNG is core to Shell’s fossil expansion strategy with new export and import terminals planned. Shell’s net liquefaction capacity will increase to 58 Mtpa by 2030 and will overshoot by 39% the level required by the NZE.

Shell’s diversification strategy

The company’s business model will continue to be based on oil and gas extraction and LNG in the coming years. Diversification in other energies will keep representing a minority share of its future production and will sometimes involve activities that are harmful to the environment.

A central part of Shell’s power strategy relies on gas power. Shell is planning 3 new gas power units, that will represent a 12% increase of Shell’s gross gas power capacity.

Shell does not communicate a target on its future renewable capacities. Its current installed and under development renewable portfolio capacity reaches 7.4 GW. Assuming these projects will be carried out by 2030, without any other portfolio change, Shell will still be producing 47 times more energy with its oil and gas extraction than with its renewable capacities in 2030.

With its current strategy, Shell will remain one of the key oil and gas players. Indeed, in 2030, Shell’s oil and gas extraction will represent 2.5% of the global hydrocarbon production projected in the NZE, whereas the company will only represent 0.1% of the worldwide renewable power production.

TotalEnergies’ investment strategy

The French company’s investment strategy heavily relies on hydrocarbons, in particular on upstream and LNG.

- From 2022 to 2024, TotalEnergies invested US$1.0 billion per year in oil and gas exploration.

- In 2024, US$13.9 billion were invested oil and gas – primarily upstream and LNG – and US$15.5 billion were distributed to shareholders, compared with just US$3.9 billion invested in its “Integrated power” business – that includes renewable power and gas power.

- Up to 2030, TotalEnergies plans to allocate approximately 74% of its investments to its oil and gas segments. Only 24% is earmarked for its “Integrated power” business, and 2.5% for its “low carbon molecules” business.

- This is a significant rollback from TotalEnergies’ previous investment target of 33% for its “integrated power” and “low carbon molecules” businesses, prioritizing fossil fuels-based growth.

TotalEnergies’ fossil fuel production plan

TotalEnergies has made no commitment to stop developing new oil and gas projects. The company is the 6th largest upstream developer worldwide and the 10thth largest LNG export terminal developer.

TotalEnergies came back on its oil and gas production target. While it was formerly forecasting 2-3% annual oil and gas production growth to 2028, the company now plans to increase its oil and gas production by 3% per year by 2030. With the company’s current expansion strategy, its 2030 fossil fuels production will be at least 61% above the NZE.

LNG is core to TotalEnergies’ fossil expansion strategy with new export and import terminals planned. The major’s net liquefaction capacity will increase to 33 Mtpa by 2030 and will overshoot by 95% the level required by the NZE.

TotalEnergies’ diversification strategy

The company’s business model will continue to be based on oil and gas extraction and LNG in the coming years. Diversification in other energies will keep representing a minority share of its future production and will sometimes involve activities that are harmful to the environment.

A central part of TotalEnergies’ power strategy relies on gas power. TotalEnergies is planning six new gas power units and plans to double its gas power production by 2030. Gas power will then represent 30% of the company’s electricity production.

TotalEnergies plans to develop its renewable energy activities, with a capacity increase from 15 GW today to around 58 GW by 2030. Renewable power will then represent 8% of TotalEnergies’ production mix.

With its current strategy, TotalEnergies will remain one of the key oil and gas players. Indeed, in 2030, TotalEnergies’ oil and gas extraction will represent 2.3% of the global hydrocarbon production projected in the NZE, whereas the company will only represent 0.3% of the worldwide renewable power production.

Chevron’s investment strategy

The US company’s investment strategy heavily relies on hydrocarbons, in particular on upstream.

- From 2022 to 2024, Chevron invested US$1.0 billion per year in oil and gas exploration.

- In 2024, US$16.0 billion were invested oil and gas – primarily in upstream – and US$27.0 billion were distributed to shareholders. Chevron does not report any investment in renewable power in 2024.

- To 2027, Chevron plans to invest US$15 billion per year but does not report any investment planned in renewable power.

Chevron’s fossil fuel production plan

Chevron has made no commitment to stop developing new oil and gas projects. The company is the 9th largest upstream developer worldwide.

Chevron aims to increase its oil and gas production by 6% per year by 2026. By maintaining that growth rate during the decade, Chevron’s 2030 oil and gas production would be 66% above the NZE.

LNG is part of Chevron’s fossil expansion strategy with one new export terminal planned. The major’s net liquefaction capacity will increase to 20 Mtpa by 2030 and will overshoot by 12% the level required by the NZE.

Chevron’s diversification strategy

The company’s business model will continue to be based on oil and gas extraction and LNG in the coming years. Reported diversification in renewable power is non-existent.

Diversification in other energies will keep representing a minority share of its future production and will sometimes involve activities that are harmful to the environment.

A central part of Chevron’s power strategy relies on gas power. Chevron is planning 12 new gas power units, that will represent a 76% increase of its gross gas power capacity.

With its current strategy, Chevron will remain one of the key oil and gas players. Indeed, in 2030, with a 6% annual oil and gas production growth rate, Chevron’s oil and gas extraction will represent 3.8% of the global hydrocarbon production projected in the NZE.

ExxonMobil’s investment strategy

The US company’s investment strategy heavily relies on hydrocarbons, in particular on upstream and LNG.

- From 2022 to 2024, ExxonMobil invested US$1.0 billion per year in oil and gas exploration.

- In 2024, US$26.7 billion were invested oil and gas – primarily in upstream – and US$37.0 billion were distributed to shareholders. ExxonMobil does not report any investment in renewable power in 2024.

- To 2030, ExxonMobil plans to invest US$30 billion per year but does not report any investment planned in renewable power.

ExxonMobil’s fossil fuel production plan

ExxonMobil has made no commitment to stop developing new oil and gas projects. The company is the 4th largest upstream developer worldwide and the 17thth largest LNG export terminal developer.

In 2025, ExxonMobil set a new oil and gas production target: while the US company previously planned to increase its oil and gas production to 4.2 million barrels of oil equivalent per day by 2027, the company is now aiming at 5.4 million per day by 2030. With the company’s current expansion strategy, its 2030 fossil fuels production will be 53% above the NZE.

LNG is core to ExxonMobil’s fossil expansion strategy with new export and import terminals planned. The major’s net liquefaction capacity will increase to 36 Mtpa by 2030 and will overshoot by 65% the level required by the NZE.

ExxonMobil’s diversification strategy

The company’s business model will continue to be based on oil and gas extraction and LNG in the coming years. Reported diversification in renewable power is non-existent.

Diversification in other energies will keep representing a minority share of its future production and will sometimes involve activities that are harmful to the environment.

A central part of ExxonMobil’s power strategy relies on gas power. ExxonMobil is planning six new gas power units, that will represent a 68% increase of its gross gas power capacity.

With its current strategy, ExxonMobil will remain one of the key oil and gas players. Indeed, in 2030, ExxonMobil’s oil and gas extraction will represent 4.4% of the global hydrocarbon production projected in the NZE.

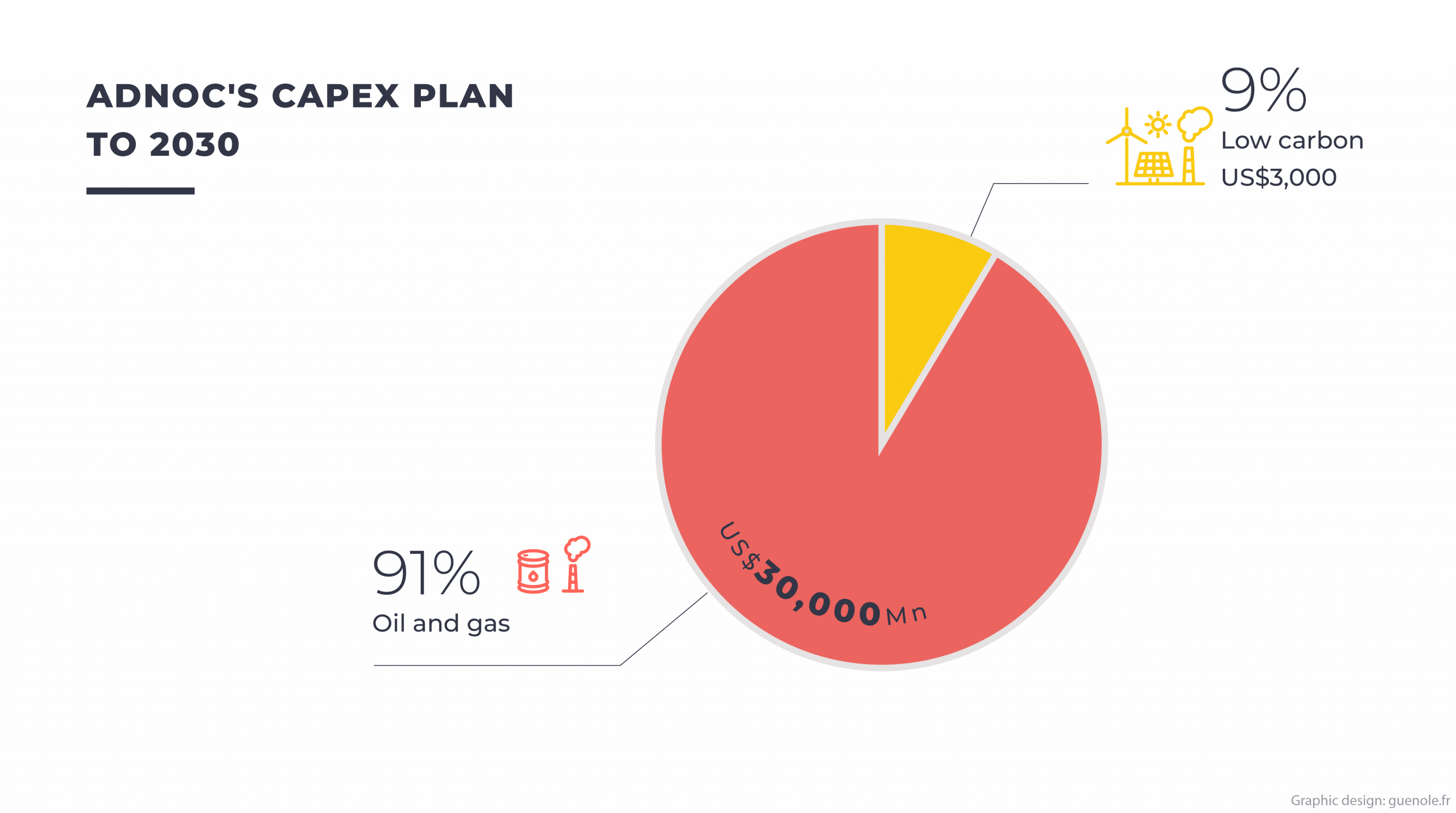

ADNOC’s investment strategy

The state-owned Emirati national oil company continues to rely heavily on oil and gas:

- Over the past 3 years, US$20 million were invested in oil and gas exploration.

- It lacks transparency on its past and current investments in oil and gas.

on its past and current investments in oil and gas. - ADNOC continues to rely heavily on oil and gas with only 10% of its 2023-2027 overall CAPEX being devoted to low-carbon activities, that include renewable power.

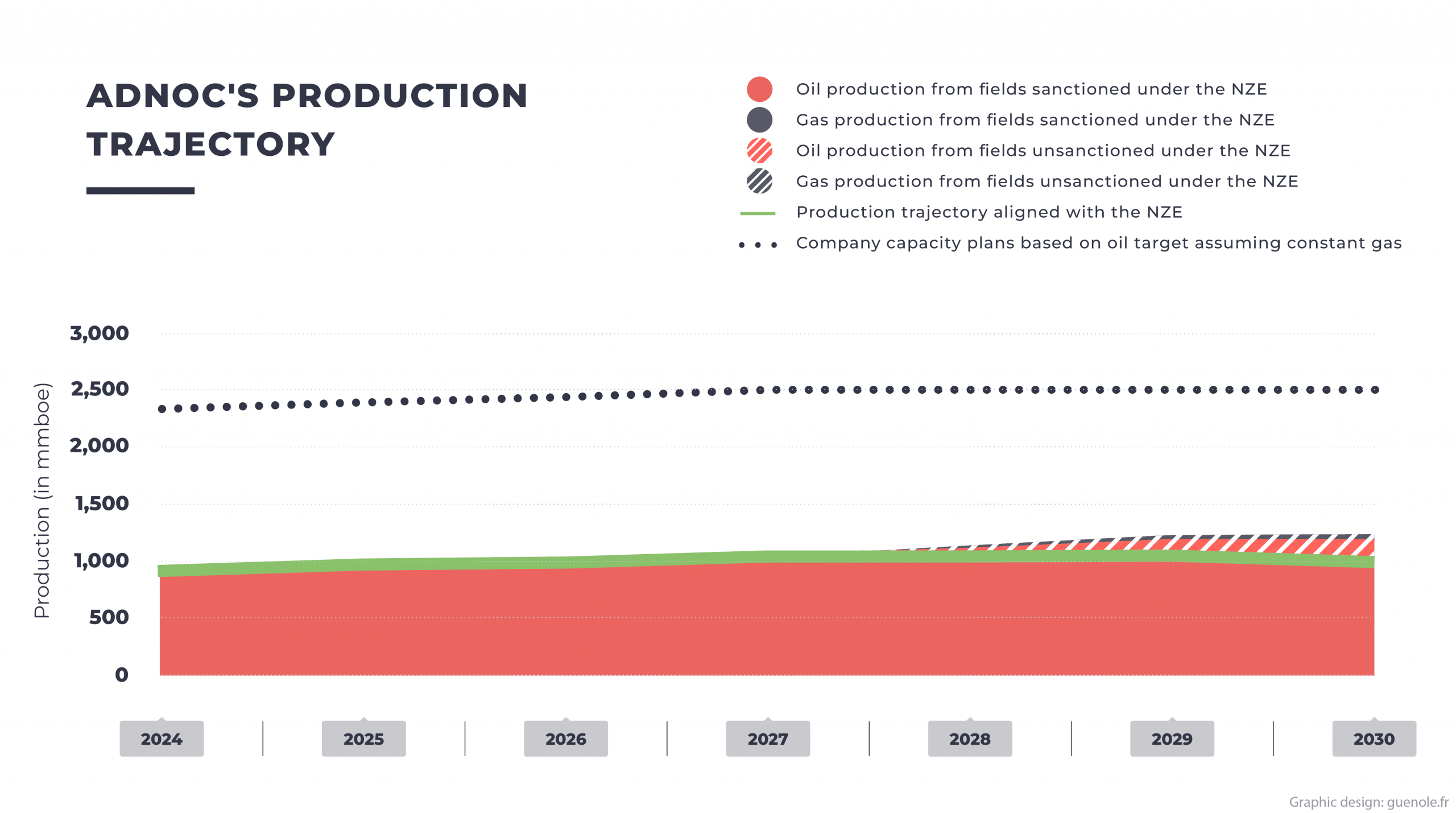

ADNOC’s fossil fuel production plan

ADNOC has made no commitment to stop developing new oil and gas projects. The company is the 5th biggest oil and gas upstream developer worldwide. ADNOC is the company that has the highest absolute short-term expansion overshooting the NZE.

With its current production and short-term expansion plans, ADNOC’s production in 2030 will be 20% higher than the NZE.

ADNOC is primarily an oil-focused company, oil representing 98% of its current fossil production. The NOC plans to increase its crude oil production capacity by 25% between 2020 and 2027. At full capacity, 2030 production for oil and gas will be 168% above NZE alignment.

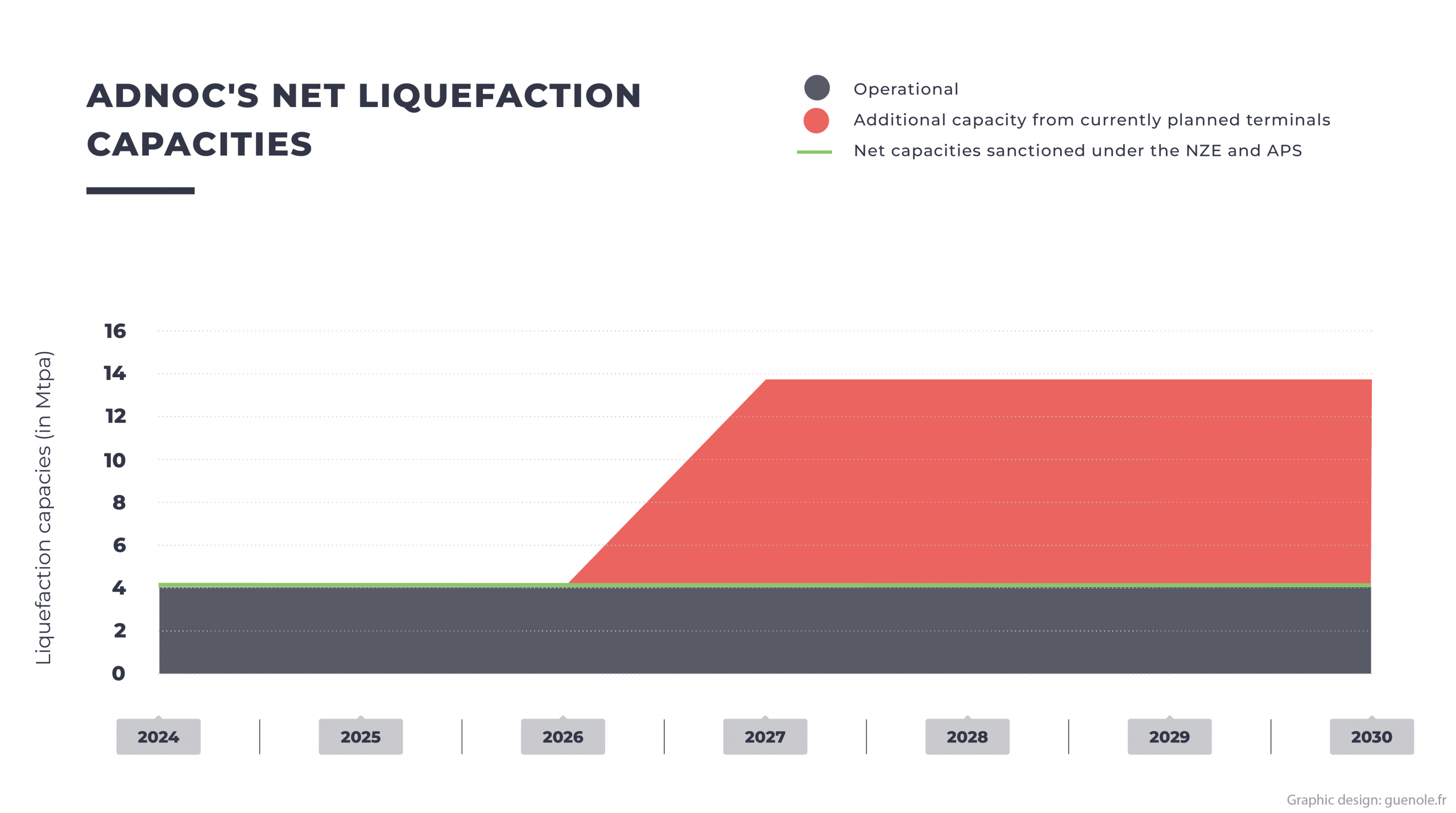

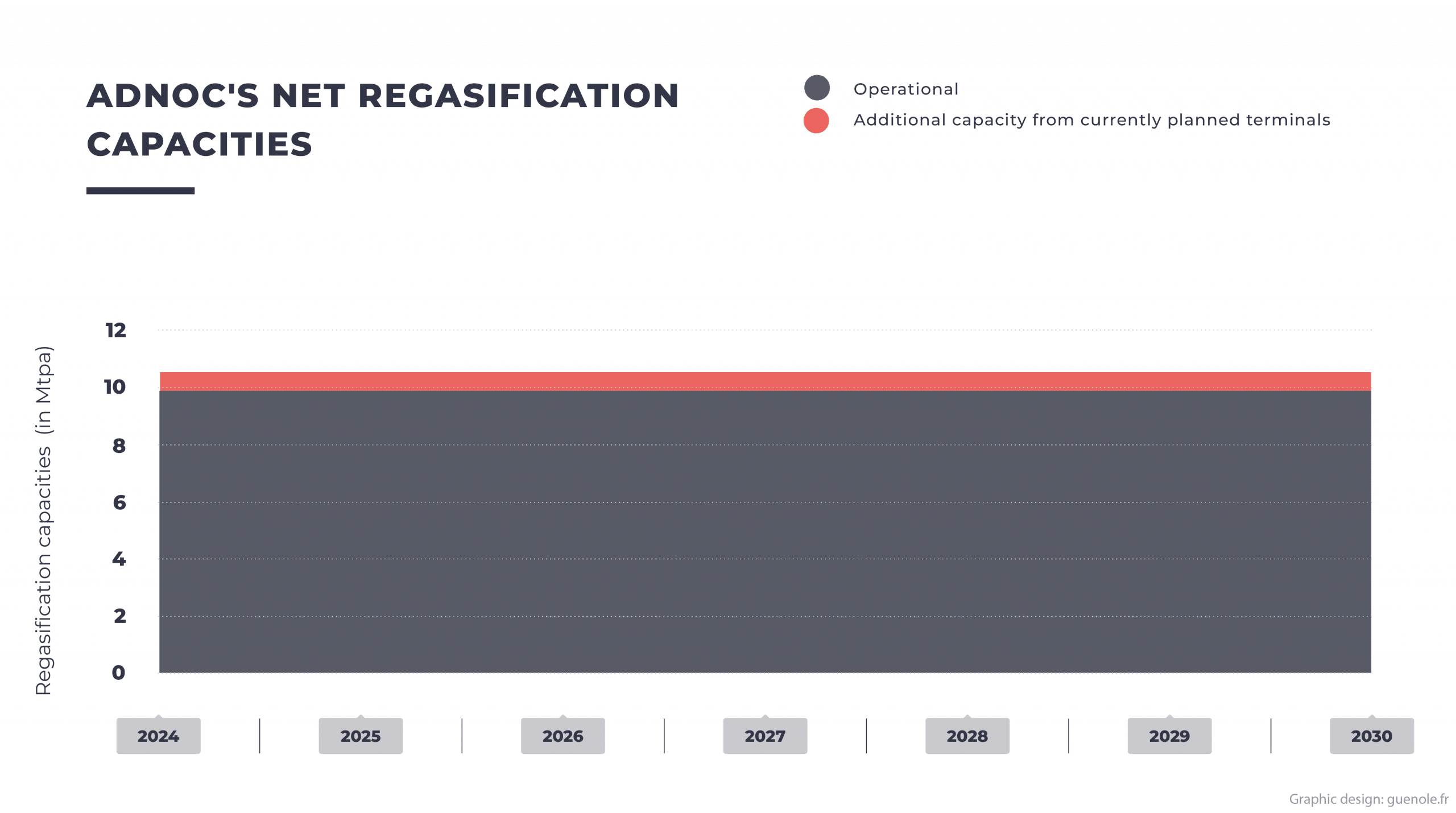

ADNOC gas strategy relies on LNG with construction plans of new LNG export and import terminals. By 2030, ADNOC’s net liquefaction capacity will be multiplied by 3.3x to 14 Mtpa, overshooting the NZE.

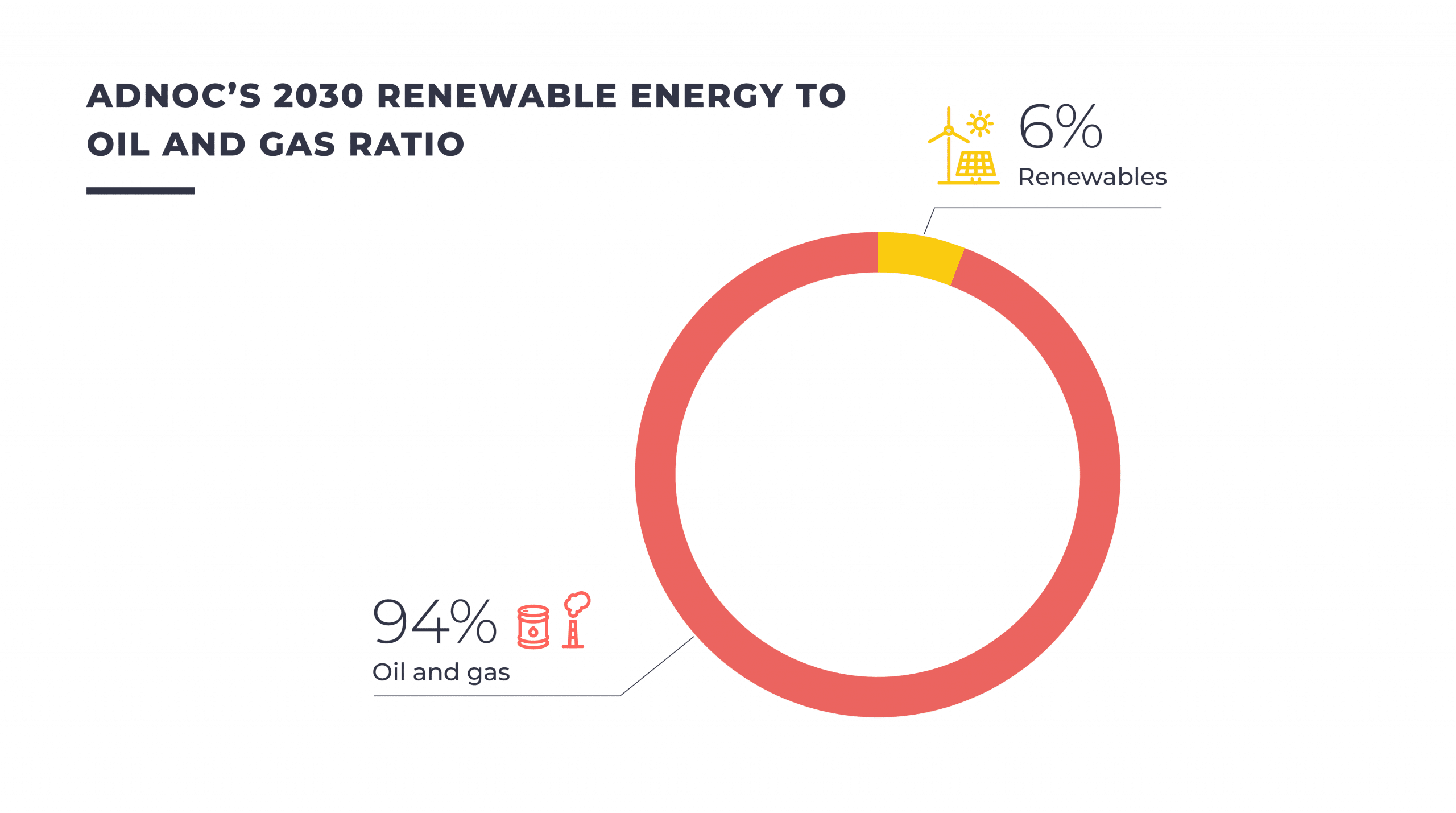

ADNOC’s diversification strategy

The company’s business model will continue to be based on oil extraction in the coming years. Diversification in other energies will keep representing a minority share of its future production and will sometimes involve activities that are harmful to the environment.

ADNOC detains 24% of Masdar, a renewable energy company, and does not communicate on other renewable capacity. Through Masdar, ADNOC’s renewable capacity could reach 24 GW by 2030. Therefore, renewable power will represent less than 7% of ADNOC’s 2030 energy production mix.

The company also intends to diversify into fossil-based activities, such as hydrogen and blue ammonia. The production process of blue ammonia uses gas with carbon capture and storage. ADNOC plans to produce directly 1 Mtpa of blue ammonia by 2025 and plans a net production of 240,000 tons of green hydrogen in 2030 through Masdar.

Petrobras’ investment strategy

The Brazilian company’s investment strategy continues to rely heavily on oil and gas:

- Over the past 3 years, US$0.7 billion were invested in oil and gas exploration.

- Petrobras does not report any past or future investment in renewable energy.

- 83% of its 2023-2027 investment plan is dedicated to upstream oil and gas.

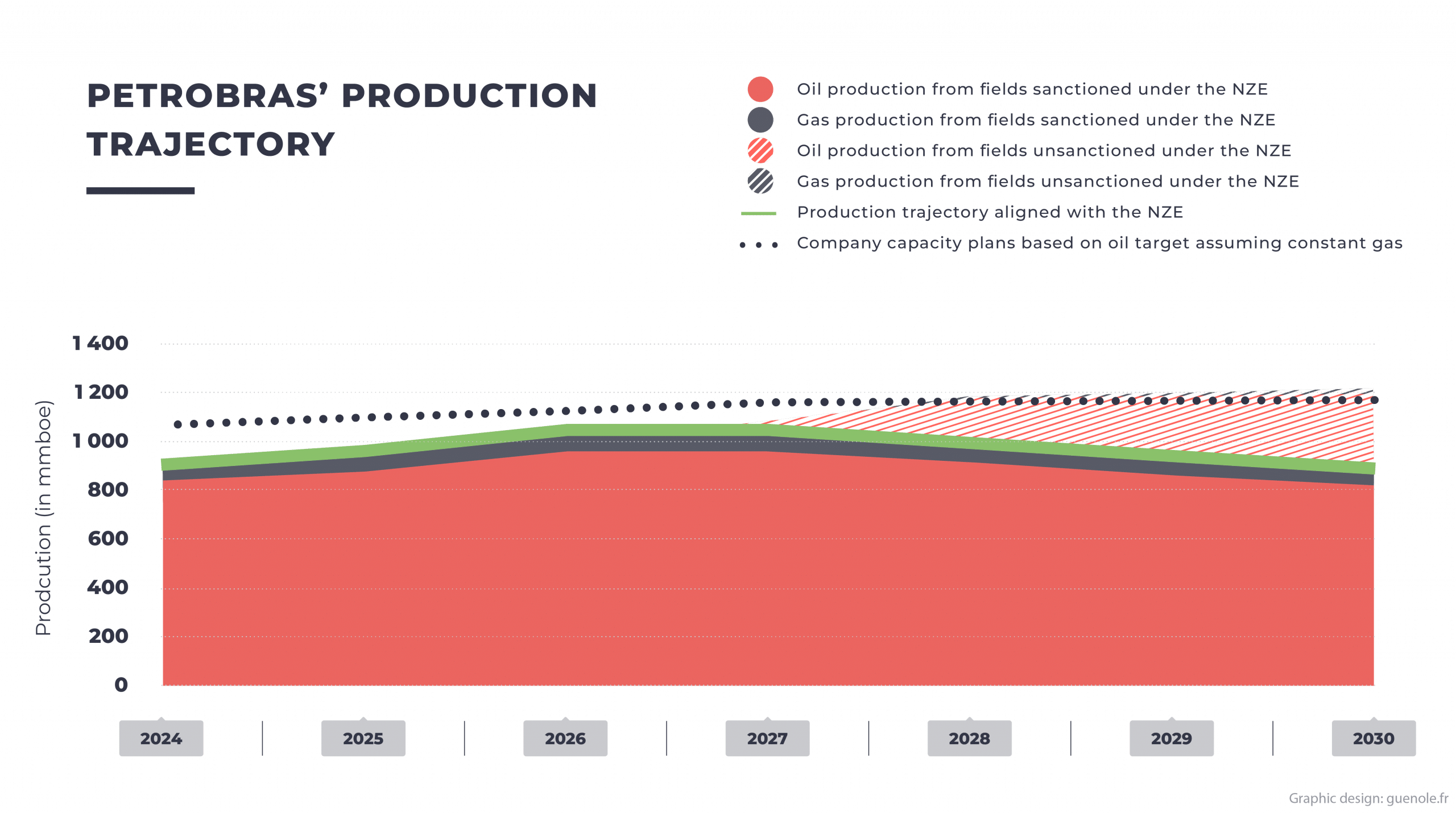

Petrobras’ fossil fuel production plan

Petrobras has made no commitment to stop developing new oil and gas projects. The company is the 4th largest upstream developer worldwide.

With its current production and short-term expansion plans, Petrobras’ production level will be 50% higher than the NZE.

The NOC plans to increase by 2027 its oil production by 19% to 2.5 million barrels of oil per day and its gas production by 50% to 0.3 million barrels oil equivalent. Due to large oil discoveries in the pre-salt basin, Petrobras’ production target is outdated and lower than production from already committed plans. Even with its current target, and if the company maintains its production at plateau beyond 2027, Petrobras’ production would still overshot the NZE by 26% in 2030.

Petrobras’ diversification strategy

The company’s business model will continue to be based on oil extraction in the coming years. Diversification in other energies will remain marginal.

Petrobras does not communicate on renewable energy and hydrogen future capacities. It only defines offshore wind and hydrogen as prospective business, without setting any target.

QatarEnergy’s investment strategy

The state-owned Qatari company’s investment strategy continues to rely heavily on oil and gas:

- Over the past 3 years, US$0.3 billion was invested in oil and gas exploration.

- QatarEnergy lacks transparency on its past and future investment strategy. In its US$82.5 billion 2021-2025 CAPEX plan, QatarEnergy does not report investments dedicated to renewable power generation.

QatarEnergy’s fossil fuel production plan

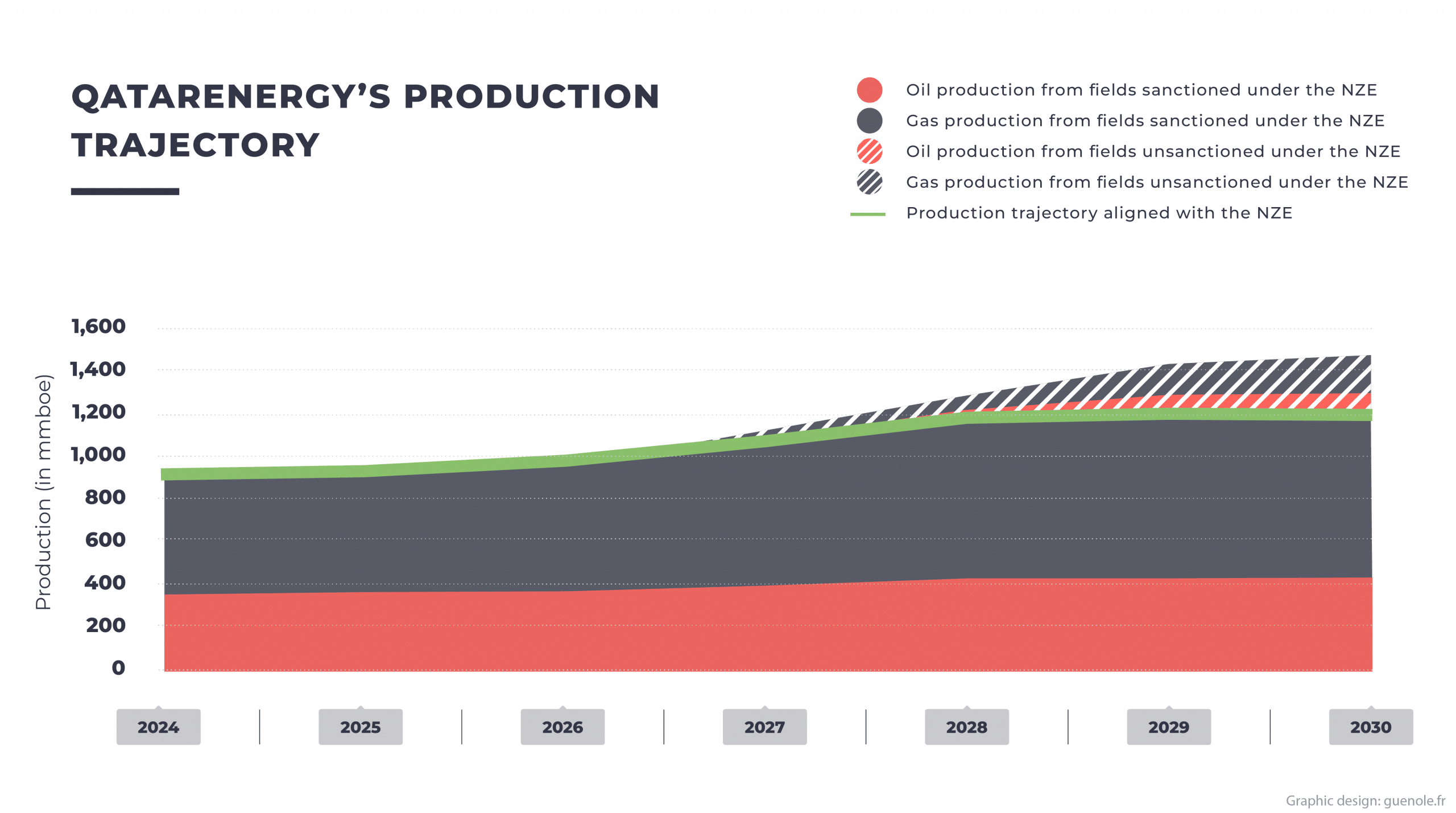

QatarEnergy has made no commitment to stop developing new oil and gas projects. The company is the 2nd largest upstream developer worldwide and the 3rd largest liquefaction terminal developer.

With its current production and short-term expansion plans, QatarEnergy’s production level will be 20% higher than the NZE.

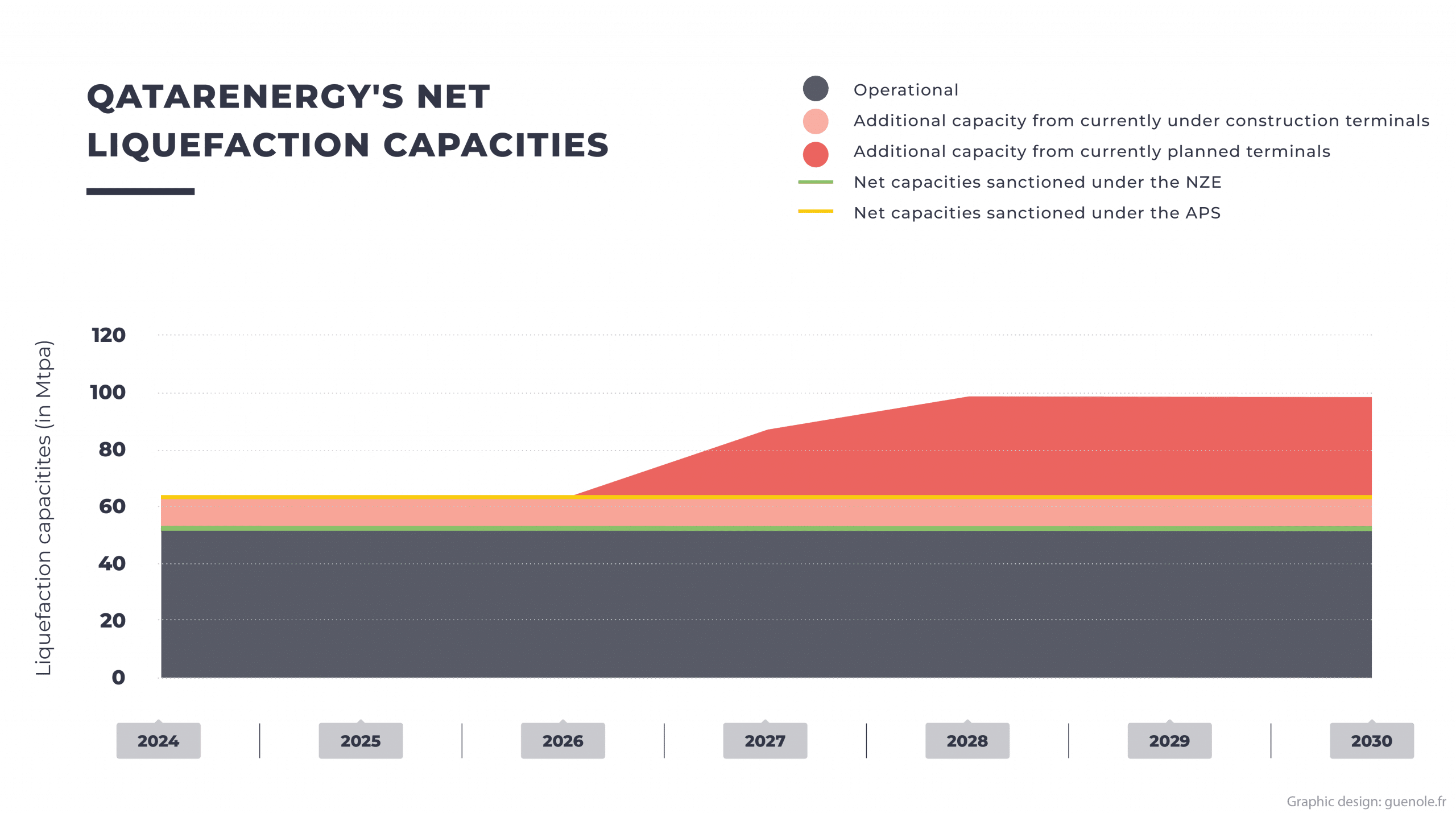

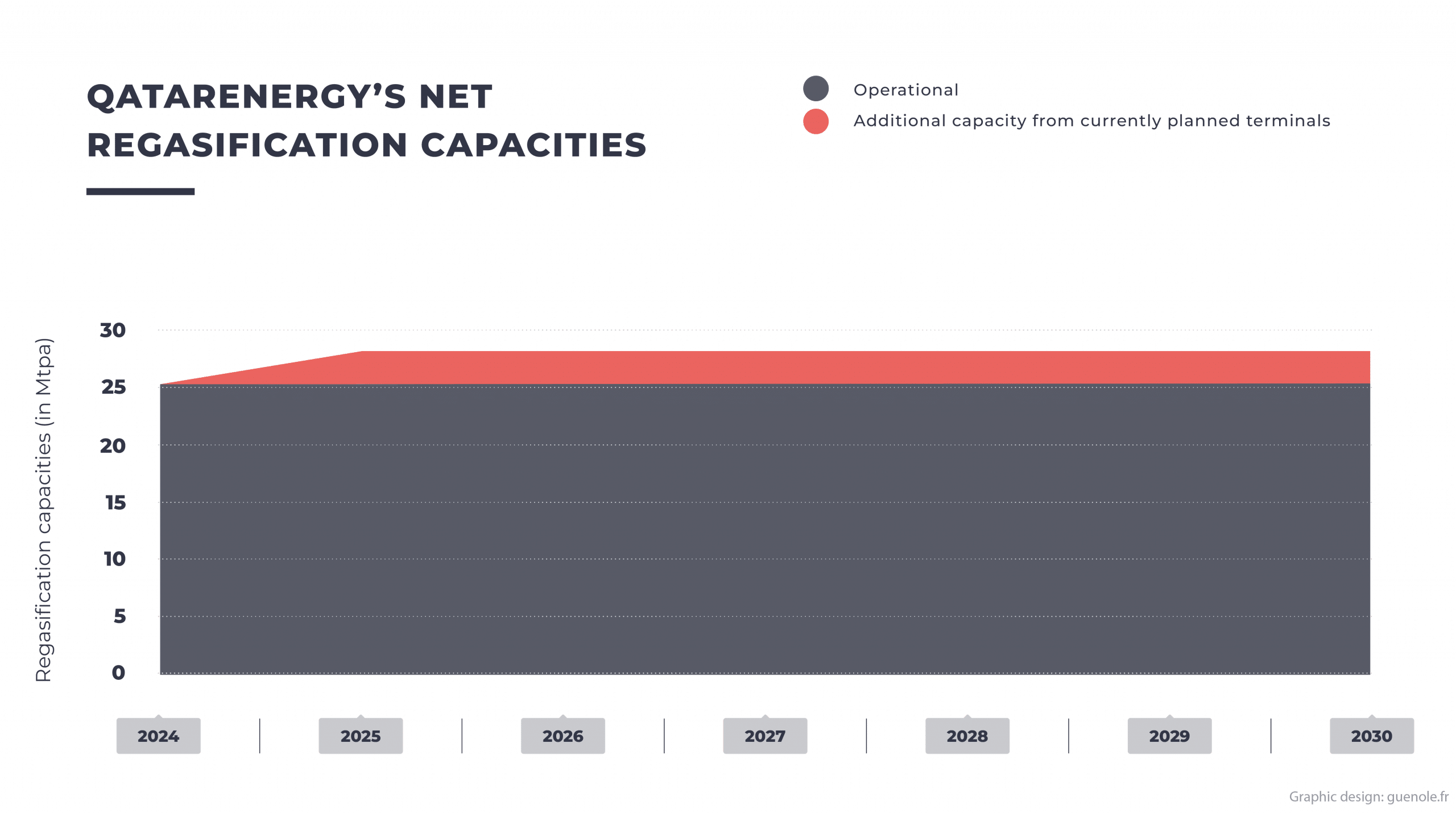

The NOC does not communicate on any oil and gas production target. LNG is core to QatarEnergy’s strategy with new export and import terminals planned. With its expansion strategy, QatarEnergy’s net liquefaction capacity will increase by 88% to 99 Mtpa by 2030, overshooting the level required by the NZE.

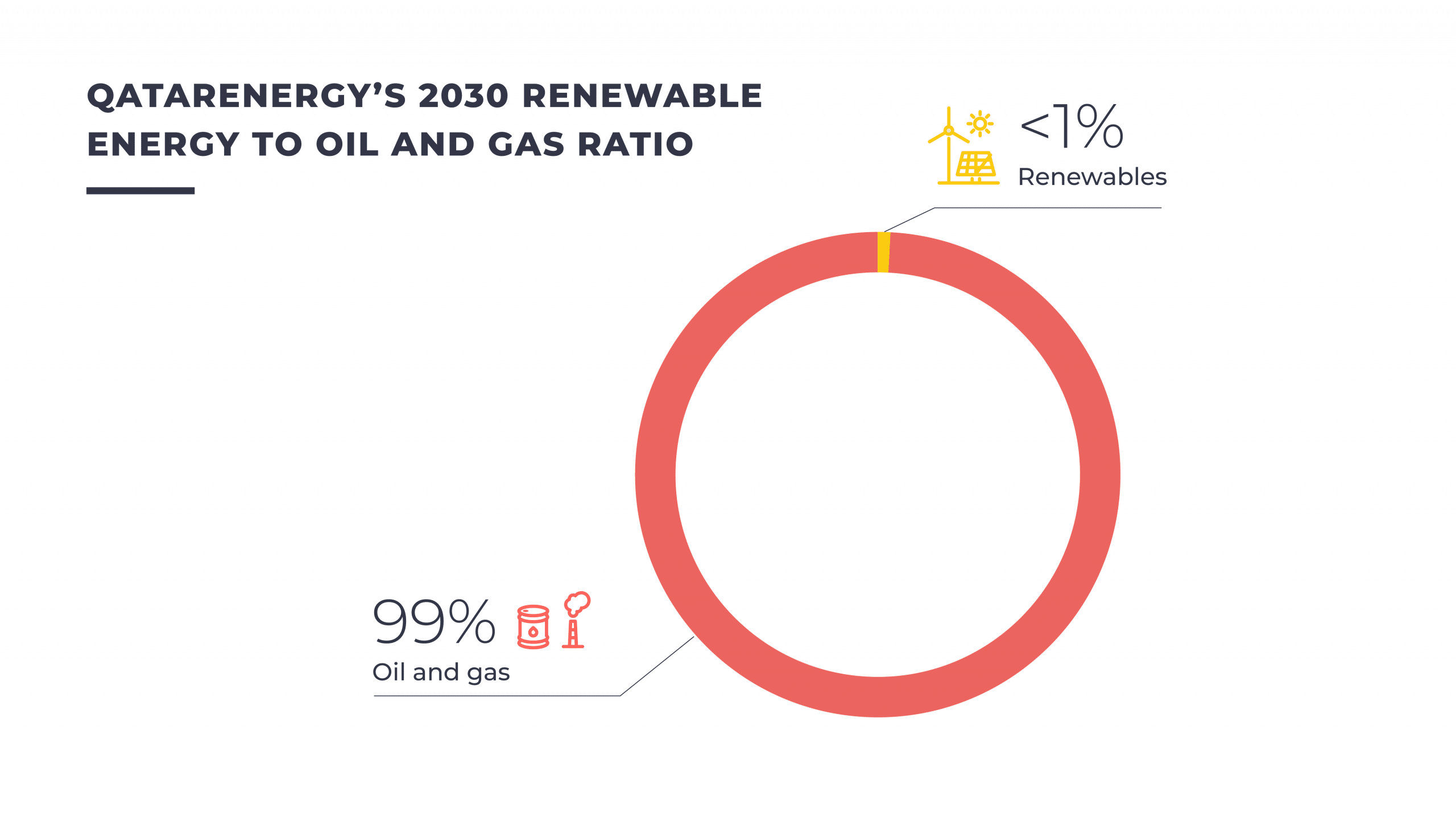

QatarEnergy’s diversification strategy

The company’s business model will continue to be based on oil and gas extraction in the coming years. Diversification in other energies will keep representing a minority share of its future production.

QatarEnergy plans a net renewable capacity of 2-4 GW by 2030. Renewable power will represent less than 1 % of QatarEnergy’s 2030 energy production mix.

Saudi Aramco’s investment strategy

The Saudi Arabian company’s investment strategy continues to rely heavily on oil and gas:

- Over the past 3 years, US$2.8 billion were invested in oil and gas exploration.

- In 2022, 78% of Saudi Aramco’s investments were made in oil and gas exploration and production. 22% were dedicated to its downstream business, which is primarily composed of refining and chemicals and contains renewable power.

- Saudi Aramco lacks transparency on its future investment strategy.

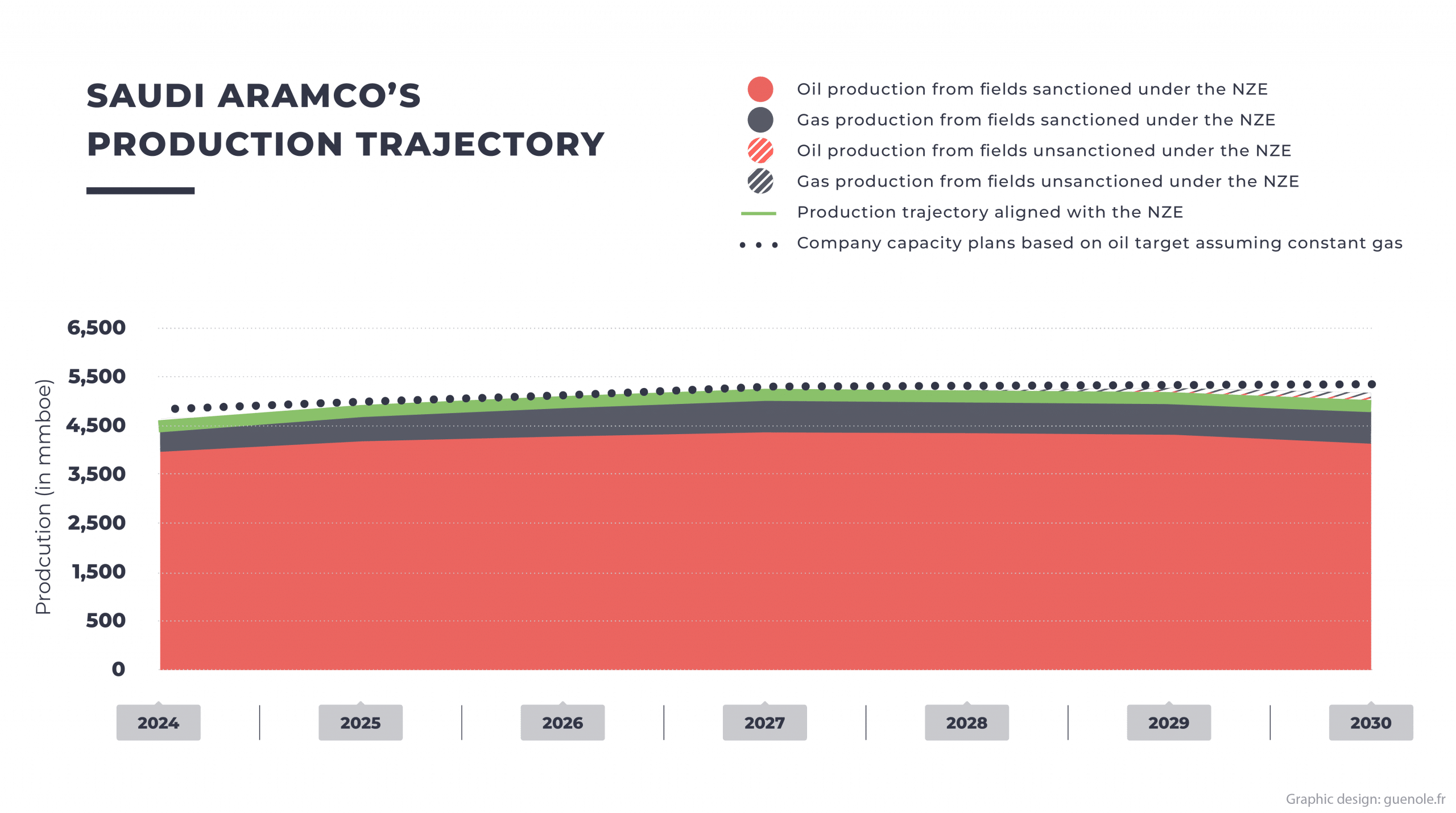

Saudi Aramco’s fossil fuel production plan

Saudi Aramco has made no commitment to stop developing new oil and gas projects. The company is the largest upstream developer worldwide.

With its current production and short-term expansion plans, Saudi Aramco’s production level will be 6% higher than the NZE.

In 2024, Saudi Aramco updated its oil production capacity increase target and is now aiming to maintain its oil production capacity at 12 million barrels of oil per day. The company plans to increase its gas production by 50% by 2030.

Saudi Aramco’s diversification strategy

The company’s business model will continue to be based on oil extraction in the coming years. Diversification in other energies will keep representing a minority share of its future production and will sometimes involve activities that are harmful to the environment.

Saudi Aramco plans a net renewable capacity of 12 GW by 2030. Renewable power will represent less than 1% of Saudi Aramco’s 2030 energy production mix.

The company also intends to diversify into fossil-based activities, such as blue hydrogen and blue ammonia. The production process uses gas with carbon capture and storage. The NOC intends to produce 11 Mtpa of ammonia in 2030.