As Legal & General’s AGM opens tomorrow and with COP26 in Glasgow only six months away, it’s time to take a closer look at L&G’s climate plans, or lack thereof. L&G is the top UK coal investor and is not heeding calls to stop investing in new oil, coal and gas production. Current efforts to engage with high-emitting companies and loud commitments will not be enough. L&G needs to adopt strong exclusion policies in order to meet its net zero commitment by 2050.

L&G is not the climate hero it would like to be

Legal and General Group is a heavyweight in the City of London and among the biggest European asset managers (£1.3 tln of assets under management). The group is quite vocal on climate topics and has committed to achieving net zero carbon emissions by 2050 (1). It regularly and proudly puts forward its voting record to prove its leadership on climate issues. Unfortunately, a positive voting track record will not be enough to phase out fossil fuels from its portfolio (2).

Yesterday, the International Energy Agency issued its strongest warning yet on the need to phase out fossil fuels; achieving net zero by 2050 means keeping oil, gas and coal in the ground from 2021 onwards. Yet the L&G Group still hasn’t adopted global restrictions on fossil fuel developers and is propping up the fossil fuel industry with continuous investments in coal, oil and gas expansion.

Still heavily addicted to coal

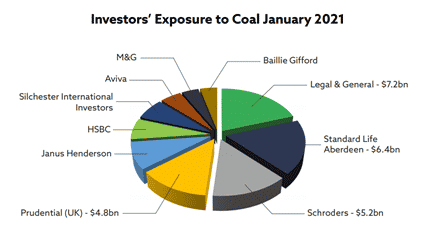

According to our recent Reclaim Finance & Urgewald report, Legal & General still holds $7.2 billion in the coal industry, which is more than 20% of all UK investments in the sector as of January 2021.

L&G’s current global coal exclusion policy is too weak to change that:

- Legal and General as an asset owner excludes coal companies with a 20% revenue threshold for mining and a 30% revenue or power generation threshold for power generation.

- Legal and General Investment Management uses a 30% revenue threshold, applied only to mining companies and to its active portfolio. The exclusion also applies to the ‘Future World’ funds. Overall, less than 35% of its assets are covered.

The exclusion thresholds are too high to divest from diversified coal mining companies and utilities, even if they are coal giants. The policy also makes room for new coal, given that it does not exclude coal developers. This means L&G can sustain investments in a diversified group like BHP Group, one of the top 100 greenhouse gas emitting companies of all time, producing 27 millions tons of coal a year, and with coal expansion plans.

Worst of all, the coal exclusion policy does not apply to the $1 trillion that is managed ‘passively’ and can still happily be invested in any coal company, no matter how much they fuel climate change. Legal and General will need to tackle its ‘passive’ problem if it truly wants to “accelerate the sustainability revolution”.

The UK has been loudly advocating for a coal phase out, yet is home to one of the biggest climate offenders in the EU. Legal and General needs to strengthen its coal policy and commit to immediately stop supporting oil & gas expansion, in time for COP26 in Glasgow.