Despite an improved framing, the climate scenarios published by the Network For Greening the Financial System (NGFS) in June 2021 fail to provide realistic and low risk 1.5°C pathways. The NGFS’ 1.5°C scenarios rely on assumptions that would put us at risk of significant global warming overshoot, above all through the promotion of unsustainable energy usage and investment in harmful activities. The NGFS notably fails to acknowledge the need for a sharp reduction of fossil fuel production, with an immediate end to investment in fossil fuel projects. Reclaim Finance has analyzed the work of the NGFS and offers some key recommendations to the network and its members.

A deeply flawed initial set of scenarios

In February 2021, Oil Change International and Reclaim Finance published an analysis of the first set of NGFS scenarios released in June 2020. This analysis identified major flaws, that could delay climate action and increase the associated financial risks. The scheduled review of NGFS scenarios was an opportunity to remedy these flaws, notably by adopting a precautionary approach to carbon dioxide removal (CDR) and framing the scenarios to center those that entail immediate climate action.

Such improvements are crucial for guiding the financial system toward a more sustainable path. Indeed, NGFS scenarios are already being used by French, British and European regulators to conduct risk analysis. They are strongly supported by the UK COP26 financial framework and the renewed EU sustainable finance strategy. Furthermore, the second set of NGFS scenarios came out in July 2021, in a context of multiplying climate commitments from financial institutions and just after the first “Net-Zero” scenario from the International Energy Agency. This new scenario stressed the need to stop investment in fossil fuel reserves and drastically reduce production.

A more ambitious framing.. hiding very problematic assumptions

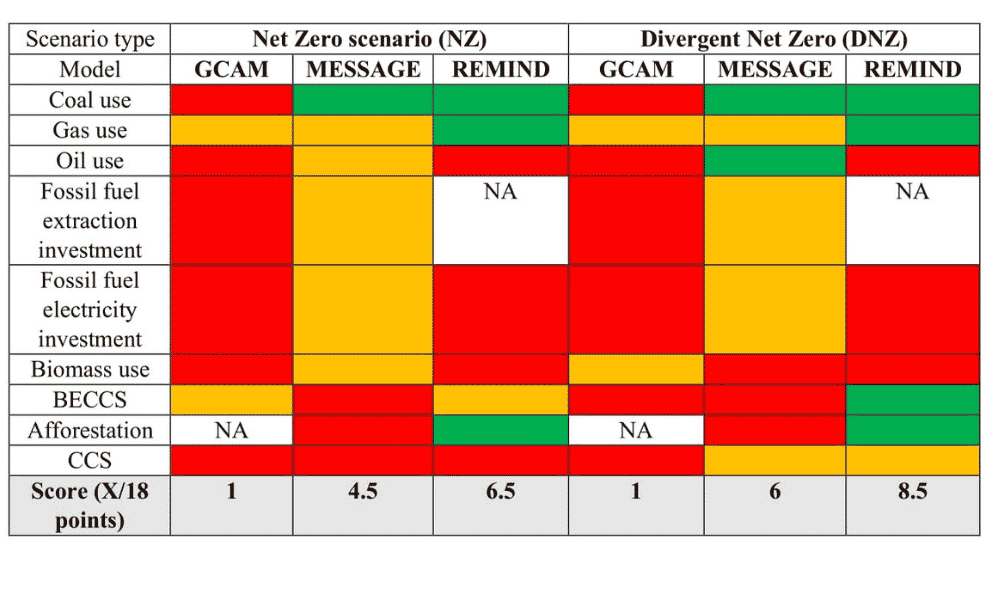

For its second set of scenarios, the NGFS improved its framing to center scenarios that limit global warming to 1.5°C. The NGFS promotes two sets of scenarios, the “net-zero 2050” (NZ) and “divergent net-zero” (DNZ) scenarios – for a total of six scenarios originating from three different models – that reach this objective.

However, while the new framing chosen by the NGFS acknowledges the need for radical climate action, the underlying assumptions taken in its 1.5°C scenarios could lead to financial institutions doing exactly the opposite:

- NGFS scenarios rely excessively on carbon capture and storage (CCS), thus allowing a slower reduction of fossil fuel use. In this regard the distinction made by the NGFS between allegedly “medium” and “low” CDR scenarios is largely misleading. Furthermore, the NGFS encourages reliance on CCS and other negative emission technologies (NETs) by branding NZ scenarios – with higher fossil fuel use and CDR – as “orderly” and considering “medium” CDR availability less risky than “low” availability.

- Fossil fuel investment levels in NGFS scenarios are especially concerning. The NGFS failed to acknowledge the need to end investments in new fossil fuels and to reach a carbon neutral power system well before 2050.

- NGFS scenarios imply a significant use of biomass. They largely disregard the potential for sustainable biomass generation. Furthermore, they are still betting on significant levels of biomass energy with carbon capture and storage (BECCS) in the long term.

These flaws could severely derail climate change mitigation efforts, pushing us past a 1.5°C global warming. They also push financial institutions to take additional risks by financing more fossil fuels – including new projects that risk becoming stranded – potentially unsustainable biomass development and very uncertain carbon capture programs.

Toward credible and low risk NGFS scenarios

To provide a credible and low risk pathway forward, the NGFS must urgently:

- Acknowledge the need to end investment in new fossil fuels and reflect this in the fossil fuel investment forecast of its 1.5°C scenarios.

- Base its 1.5°C scenarios on very low CDR levels or no CDR – notably for CCS – and stop branding higher CDR scenarios as less risky or “orderly”.

- Reflect the need to immediately and significantly reduce fossil fuel use and production to limit global warming to 1.5°C.

- Adopt a precautionary approach to biomass use, by avoiding additional land use for bioenergy production and by taking the sustainable range of biomass production defined by the Energy Transition Commission into account.

Furthermore, as Oil Change International and Reclaim Finance stressed in their previous report, scenario analysis is intrinsically limited and should be supplemented with concrete measures to mitigate climate change and its related risks. The NGFS should put forward concrete recommendations for immediate action, notably to cut support to companies developing new fossil fuel projects or significantly involved in coal or unconventional oil and gas.

Paul Schreiber, Campaigner at Reclaim Finance, said:

“Unfortunately, the NGFS has missed yet another opportunity to set the correct pace for climate action in the financial sector. While the network finally centers 1.5°C scenarios, its assumptions could push us far beyond this critical threshold. Put simply, these scenarios rely too heavily on carbon capture and storage and permit ongoing investments in fossil fuels, a recipe for climate chaos and stranded assets. The NGFS needs to get with the times, listen to climate science and the International Energy Agency and endorse an end to new fossil fuel projects and investments.”