Following President Xi’s announcement at the United Nations General Assembly that China “will not build new coal-fired power projects abroad” on September 21st, the Bank of China published a statement on its website three days later announcing that “starting in the fourth quarter of 2021, the Bank of China will no longer finance new coal mining and new coal-fired power projects abroad, except for contracted projects”.

- This represents the first public coal policy of a Chinese commercial bank active in this field ever, sending an important signal to the coal industry globally from one of the financiers of last resort of such projects .

- It remains, though, unclear if this new exclusion covers the ‘ongoing’ deals where the bank is involved but which have not yet completed their financing, of which there are at least seven.

-

One thing is clear: the Bank of China still has a long way to align its coal policy with the climate imperative to exit coal by 2040 globally. It should immediately and completely stop the direct financing of coal projects inside and outside China and the general financing of coal developers globally.

Our analysis: an important step but still a long way to go

The Positives:

- This public statement is the first of its kind coming from a Chinese bank active in this field at a sector level. Up to now, the only public statement coming from Chinese banks on coal referred to a specific project: like several of its peers, Bank of China ruled out the direct financing of the Adani Carmichael coal mine in Australia in December 2017.

- This announcement follows the launch of the first public campaign targeting the bank as “The Bank of Coal”, which was launched just a few days before, earlier this month.

- 44 international banks have now ended the direct financing of new coal mines and plants globally, and Chinese banks have in essence become the financiers of last resort for such projects, so this is an important and powerful signal being sent to the coal industry worldwide.

The Negatives:

- The statement is unfortunately not clear regarding the fate of “ongoing” deals: coal projects in which a bank is involved, where discussions with the company building the project started and where the financing is in the process of being raised, but which have not yet reached ‘financial close’, when the final contracts are being officially signed once the financing has been fully arranged. The wording “contracted” in the statement tends to indicate that such deals should be excluded by the bank, since these deals have precisely not been “contracted” yet. But it is also very similar to the usual policy loophole that has plagued many coal policies in the past. Such a loophole would be even more dangerous this time, since the Bank of China is not involved in just one or two ‘last’ coal projects, but at least seven of them, totaling approximately 10GW of new coal power capacity planned in Bangladesh, Zimbabwe, Botswana, Turkey and Vietnam. Almost all the banks involved in such ‘ongoing’ deals ended up withdrawing from such deals at a later stage.

- Another big loophole in the statement is the fact that new coal projects in China are not covered, while they represent by far the biggest global threat in terms of new coal. A recent report by Global Energy Monitor indicates that 163 GW, more than half of the remaining coal power pipeline globally, is still planned in China.

If Bank of China wants to fully put an end to the financing of the expansion of the coal industry, the end of direct financing is only a first step since the vast majority of the financing goes through the indirect general financing of coal developers, those companies still planning new coal globally. The latest financial figures published last February indicate that between October 2018 and October 2020, Bank of China financed over 100 of the companies in the Global Coal Exit List to the tune of 33 billion USD, making it the fifth largest coal banker worldwide.

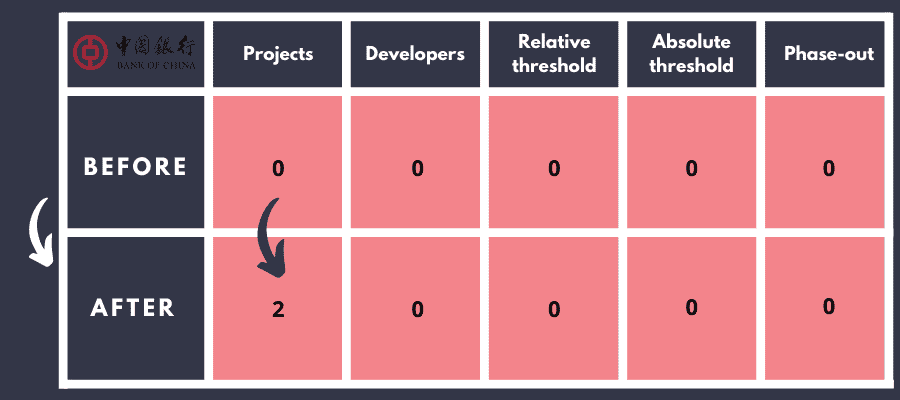

Bank of China scores in the Coal Policy Tool

This table presents the coal scores of Bank of China based on five criteria of the Coal Policy Tool

Our conclusion

Bank of China must clarify its public statement and withdraw from the seven ongoing deals it is involved in. Yet, this won’t be enough for Bank of China to really help China meet its target of reaching peak carbon emissions by 2030 and achieving carbon neutrality by 2060, even less if the bank intends to align with the climate objectives of the Paris Agreement. To do so, an immediate next step for Bank of China is to end the direct financing of new coal projects in China as well as the indirect financing of coal developers globally, and join the eight international banks which have already done so like Credit Agricole or BNP Paribas.