Decoding the coming AGM ↓

On the 6th of May, investors will be called to vote upon Repsol’s “Report on the Company’s Energy Transition Strategy” (1). This report essentially builds on the group’s 2021-2025 Strategic Plan (2) and does not strengthen Repsol’s climate ambitions. Although the company sets decarbonization targets, they are far from sufficient to meet the level of reduction in absolute emissions needed to stay on a 1.5°C pathway: by 2050, the company will overshoot its carbon budget by 78.7%. (3) While the International Panel on Climate Change (IPCC) made clear in its latest report there are only three years left for GHG emissions to peak (4), Repsol’s short term energy sales will remain heavily focused on fossil fuels. As a consequence, the company is expected to use as much as 82% of its carbon budget by 2030. Ahead of Repsol’s AGM, shareholders who have pledged to align their portfolios with 1.5°C must vote against the company’s so-called climate plan and against the reappointment of the four Directors who share a direct responsibility in the company’s fossil expansion strategy.

Repsol’s latest climate targets are not up to the stake

In its report, Repsol states it set itself absolute emissions targets (5) across all scopes, including scope 3, the most material one for fossil fuel companies. However, investors should not be fooled: if Repsol aims to reduce emissions from scope 1, 2 and 3 by 30% by 2030 (against 2016 levels), this includes a 55% cut to its scope 1 and 2 emissions, with a much more moderate and unquantified decrease on scope 3. Moreover, less than half of Repsol’s scope 3 emissions are covered by this target, further reducing the ambition of such a measure (6). Should Repsol meet these targets, its overall reported emissions for 2030 would decrease by a mere 16% versus 2016 levels. This is equivalent to a 18.3% decrease versus 2019 levels, far beneath the 41% reduction prescribed by the International Energy Agency (IEA) in its Net Zero scenario (7).

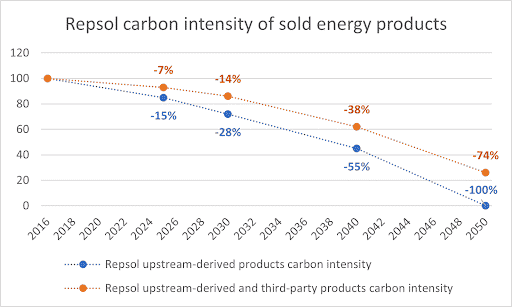

Repsol also announced carbon intensity targets. Apart from being a discutable metric (8), the targets put forward in its Energy Transition Strategy report carry the same issue as for its absolute targets and do not account for third-party products. As shown on the graph below, when factored in, the contribution of these products leads to a lesser reduction in the carbon intensity of Repsol’s sold energy products (9). To align the carbon intensity of all its sold energy products on what is required by our 1.5°C scenario by 2030 (10), the company would need to achieve a 47% cut in its carbon intensity, or almost a 7-fold increase of its current target.

Repsol does not plan to reduce its oil and gas production

Although the group identifies the ongoing use of oil and gas as a risk, and announces its intention to shift “toward less carbon-intensive energies which involves a reduction in the use of hydrocarbons”, Repsol does not commit to reducing its oil and gas production. Quite the opposite: from a 648 kboe/day production level in 2020, the company aims to stay around 650 kboe/day over the 2021-25 period (11), and appear to be willing to maintain these levels to 2030 (12). Such declarations are supported by Rystad Energy UCube data, showing the group could even increase its production by 2.6% by 2030 (against 2020 levels) if it decides to develop its discovered assets.

Over short-term, Repsol’s fossil fuel expansion is a done deal. The company aims to allocate more than 65% of its CAPEX to oil and gas activities (13), and is currently developing enough new projects to increase its total producing resources by 18% over the next few years (14). Among those new projects under development, more than half are happening in unconventional sectors (15), with higher environnemental risks: almost 30% comes from fracking, whose practice is likely linked to methane – a potent greenhouse gas – leakages far above the industry standards (16), while more than 35% takes place in the Arctic region, a particularly sensitive ecosystem and critical area for climate regulation (17).

While maintaining its oil and gas production, the company also invests in renewable power capacity. By 2030, it aims to have 20 GW operating (18), which would lead to renewable electricity accounting for, at most, 21% of its energy mix (19). While the renewable share is increasing, one should keep in mind this does not bring any climate benefit if absolute emissions do not decrease. A diversifying strategy is no transition strategy, and adding more energy production capacities, regardless of how clean they are, will not bring on the needed cut in emissions. Consequently, even though development of new and clean energy systems is key for the transition, this criteria must not be looked at in isolation to assess the credibility of a climate plan.

How to vote for the climate at Repsol’s AGM?

For the first time, Repsol will consult its shareholders on its climate strategy, through an advisory “Say on Climate” vote (item n°17 of the agenda). It is also worth noting that Repsol is one of the few European oil and gas majors that is not targeted by shareholder resolutions on climate this year.

As the analysis above clearly demonstrates, Repsol’s so-called climate strategy is very far from being aligned on a 1.5°C pathway. Results from the CA100+ “Net Zero Company Benchmark” confirm this finding (20): the Spanish company’s transition plan only complies with four out of the nine criteria assessed in the benchmark. What is more, Repsol fails on the most important criteria (short-, medium-, and long-term GHG reduction targets, CAPEX alignment, etc.). Even more concerning, Repsol has not yet complied with the very basic “Net zero ambition by 2050” criteria (contrary to 4 of its European peers). Faced with the risk of rubber-stamping an incomplete and unambitious climate plan, Repsol investors should vote against resolution N°17 and oppose Repsol’s fake “Say on Climate”.

However, voting against Repsol’s climate plan is not enough. Investors must also send a more direct message to the company regarding the urgency of stopping oil and gas expansion. This year, four of Repsol’s Directors seek to be reappointed by the AGM (items n°11 to n°14). As Directors, they share a direct responsibility in the company’s fossil expansion policy. Therefore, climate-conscious investors should vote against their reappointment, as an escalation strategy for their failure to make the company stop developing new 1.5°C-incompatible oil and gas projects.

The table below provides a summary of our voting recommendations.

| Resolution | Issue | Our recommendation | Vote results on May 6th |

|---|---|---|---|

| Item n°11 to n°14 – Re-appointment of Directors | Sanction the company’s oil & gas expansion strategy | Vote against | All Directors have been re-elected |

| Item n°17 – Advisory vote on the company’s climate strategy | Repsol’s climate plan is neither complete nor aligned on a 1.5°C pathway | Vote against | Approved by 83% of shareholders |