Following an eight-year people-powered #DivestNY campaign, the New York State Common Retirement Fund (NYSCRF), valued at an estimated $226 billion, announced on December 9 new climate commitments and details regarding its approach to fossil fuels. The concrete impact of this approach in terms of divestment will depend a lot on the minimal standards that the fund will set regarding oil and gas in the coming years, but the fact that coal utilities are not covered in this divestment approach is a significant loophole, despite the divestment of 22 coal mining companies.

1. What is new?

In a press release on its website, the NYSCRF published the new elements of its climate strategy:

-

The adoption of a goal to transition its portfolio to net zero greenhouse gas emissions by 2040;

-

The divestment of 22 coal mining companies among the 27 ones that the fund selected and engaged with earlier this year;

-

The completion within four years, by 2025, of a review of investments in energy sector companies, using minimum standards to assess transition readiness and climate-related investment risk, with, where consistent with fiduciary duty, divestment of companies that fail to meet minimum standards in the following sectors:

- Oil sands;

- Shale oil and gas;

- Integrated oil and gas;

- Other oil and gas exploration and production;

- Oil and gas equipment and services;

- and oil and gas storage and transportation.

2. Our analysis on coal: just a start

The NYSCRF has adopted a specific approach regarding coal mining companies. It selected 27 companies in the fund that were deriving more than 10% of their revenues from thermal coal mining, and it analyzed them based on minimum standards it set earlier this year, including companies’ efforts to align their business model with the Paris Agreement’s goals by:

- reducing capital expenditures on coal;

- setting long-term targets to reduce greenhouse gas emission;

- improving climate reporting;

- and increasing revenue from low-carbon or green technologies.

The fund then engaged with these companies and decided to divest from 22 of them last summer.

We welcome the engagement approach based on some public demands. However, the content of NYSCRF’s approach remains insufficient for several reasons:

- Only coal mining companies are covered and the NYSCRF misses covering the other companies active along the coal value chain, starting with coal power companies. The Global Coal Exit List (GCEL), the global coal companies list of reference, covers 463 mining companies against 547 power companies.

- It is unclear if the NYSCRF engages with all investee mining companies >10% or only with the 27 companies >10%, and in that case under what criteria these specific 27 companies have been selected.

- The NYSCRF fails to disclose the precise targets to be met for each of the four minimal standards highlighted above and what are the other standards. It remains unclear how companies will successfully pass the engagement process or will be divested in case of failure.

- While the NYSCRF did not publicly disclose the names of the coal mining companies that were not divested, it provided this information to Reclaim Finance. It said to not have divested Anglo American because the mining company fell below the 10% threshold, and to not have divested South 32, Banpu, CIMIC and Exxaro Resources because they met the minimum standards. We could comment on each of them but appear to be the most problematic are the decisions taken for Exxaro Resources and Banpu. Both are classified as companies with coal expansion plans, Exxaro Resources for planning to develop new coal mines in South Africa, and Banpu, for planning some coal power development in China, , according to the GCEL.

The NYSCRF mentions in its press release that it will “continue to increase its engagement efforts with companies across industries to encourage them to reach net zero carbon emissions more quickly, and will continue to vote against board directors at portfolio companies that fail to take steps to mitigate climate risks”, including with coal power companies. But no detail is provided on any potential minimum standards for this sector that could potentially lead to divestment from some companies.

If this approach puts the NYSCRF at the forefront of US pension funds in terms of coal divestment, compared to for instance CalPERS or CalSTRS which use a 50% revenues exclusion threshold, the fund lags behind some other international peers. The Norwegian pension fund KLP for instance uses a blanket 5% revenues exclusion threshold for both coal mining and coal power companies, and it also excludes companies above 20 Mt of annual coal production or 10 GW of coal power capacity. Nest, a pension fund in the UK, requires companies in its portfolio to adopt a coal exit plan at the latest by 2030.

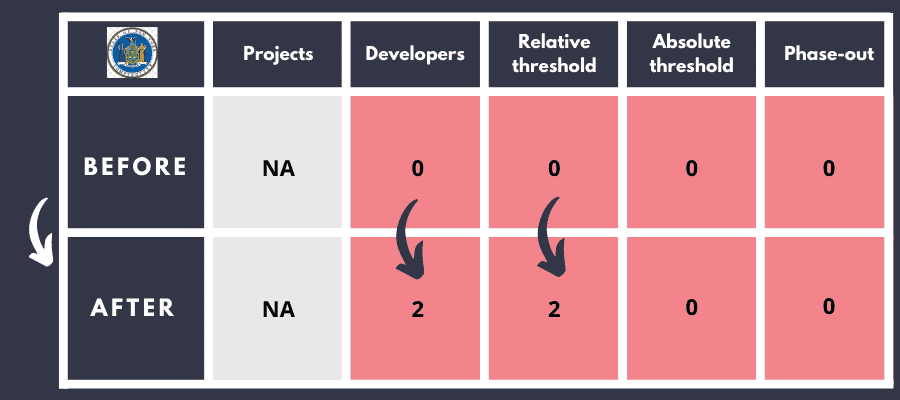

NYSCRF’s scores in the Coal Policy Tool

This table shows the scores of NYSCRF’s coal policy on four criteria of the Coal Policy Tool.

3. Our analysis on oil and gas: a long process with uncertain results

The NYSCRF announced that it will follow the same approach with oil and gas subsectors as it did with the coal mining sector, starting with oil sands, but this will take time: four years, by 2025. This is a very long period of time given the climate emergency we face, and everything remains to be seen in terms of the concrete outcomes of this process.

The impact of this approach will depend on the minimal standards that the fund will set for each of the different oil and gas subsectors it has identified. If these minimum standards are very stringent, they could lead to a long list of companies being divested if these companies do not act according to the fund’s objectives. But the failure to adopt such high standards would lead to the opposite result, with a weak pressure on fossil companies without any concrete divestment at the end of the process.

The litmus test to assess the credibility of these minimum standards will be to know if they cover the exclusion of any new fossil fuel project development in their analysis, given that such projects are incompatible with the 1.5°C climate target.

The approach taken by the NYSCRF lags behind the blanket divestment approach adopted recently by the financial arm of the French State, the Caisse des Dépôts et Consignations (CDC), with a 10% threshold for the combined revenues from tar sands, shale oil and gas and the Arctic.

4. Our conclusion

The NYSCRF made the headlines with its new announcements last week, but a lot remains to be seen in terms of concrete action regarding divestment. The first coal mining companies divested provide a first example of what could happen with other oil and gas companies in the coming years, but this process is extremely long regarding the climate emergency which requires an annual 6% fossil fuel production reduction until 2030. This urgency explains why the first thing to do for the fund is to immediately divest from all coal developers and cover the coal power sector in its approach. It should also commit to fully phase out coal by 2030 in Europe/OECD countries and by 2040 worldwide. Finally, it should speed up its process to be able to put pressure on oil and gas companies more quickly, with concrete divestment in the short term for all companies still planning new fossil projects.