Generali Insurance Asset Management (GIAM) finally adopted a first policy on coal and tar sands in April 2022. GIAM is the largest subsidiary of Generali Investments, the asset management branch of Generali Group: GIAM represents about 80% of Generali Investments’ €580 billion of assets under management.

The adoption of a Paris-aligned coal phase-out commitment for investment activities worldwide, including in Eastern Europe, must be praised. The policy adopts strict exclusion commitments on coal companies, based on their coal relative and absolute exposures as well as their coal power expansion plans. However, it could be further improved to fully align with climate science if the exclusion of coal developers also expanded to companies developing new coal mines and coal infrastructures and if exemptions were to be removed. But it is on oil and gas that everything remains to be done for GIAM to align with the imperative, drawn from the latest International Energy Agency (IEA) and Intergovernmental Panel on Climate Change (IPCC) reports (see below), to stop opening new fossil fuel projects.

This policy is almost similar to the one adopted last year by Generali Group for its investment activities. It proves that asset managers can align with their parent companies when the latter adopt robust fossil fuels exclusion policy – in this case, on coal. It could inspire other asset managers such as Allianz Global Investors or PIMCO to align themselves with the policy taken at group level.

Key points in the policy

Here are the commitments from GIAM’s policy (1):

On coal

GIAM commits to reducing to zero the exposure to coal of all business lines by 2030 in European and Organisation for Economic Co-operation and Development (OECD) countries, and by 2040 in the rest of the world.

GIAM will exclude the following companies from its portfolio:

- Companies actively involved in coal expansion, building new coal capacity of more than 0.3 GW (effective from the end of Q4 2022);

- Companies with more than 20% of their revenues/power generation deriving from coal or with an installed coal power capacity of more than 5 GW or with more than 10 million tons of coal production per year (this latest criterion being effective from the end of Q4 2022).

GIAM commits to strengthening the exclusion criteria and thresholds regularly to end all support to companies active in the coal sector by the above-mentioned dates.

On tar sands

GIAM will not make new investments:

- In companies with more than 5% of revenues derived from tar sands extraction;

- In companies operating controversial pipelines dedicated to the transport of tar sands.

Our analysis: a welcome policy, but still a long way to go

On coal: a strict, but not a best-in-class, policy

THE POSITIVES

- GIAM finally adopts a first fossil fuel policy aligned with Generali Group’s 2021 policy on investments, and even goes further on coal phase-out by including all European countries, without geographic exemptions, to its 2030 phase-out target (see the exemptions of Generali Group in our 2021 policy analysis).

- This is an impactful policy that bans 226 out of 309 coal plant developers indicated in the Global Coal Exit List (GCEL). GIAM applies strict relative and absolute coal exclusion criteria and commits to lower them to a full exit from the sector on a timeline aligned with climate science. If correctly implemented, this policy should lead GIAM to exclude major coal companies such as Enel, RWE or Fortum (still in GIAM’s portfolio as of November 2021): the asset manager sends a clear signal about its ambition to leave coal for good.

- On coal developers, the policy could be more restrictive by also excluding companies developing new coal mines and infrastructures. By not covering all developers, this policy could leave up to 215 companies developing coal mines and infrastructures out of the scope (out of over 500 coal developers listed in the GCEL). As a result, GIAM fails to reach a developers’ exclusion policy as thorough as that of AXA IM, which excludes companies developing coal mines and infrastructures, as well as coal power developers.

- In addition, the exemption for coal companies with credible energy-mix transition plans away from coal seriously questions the implementation of this coal policy. GIAM maintains the right to retain in its portfolio issuers that exceed the maximum thresholds indicated in its policy, in the event of credible science-based targets on the part of these issuers. GIAM does not share the criteria that should be included for science-based targets to be deemed credible. For more transparency, GIAM should make public the number of companies (and what share of assets they account for) that will effectively benefit from this exemption.

On oil and gas: a timid policy where almost everything remains to be done

THE POSITIVES

- GIAM also makes a first small step on tar sands excluding companies with more than 5% of revenues derived from tar sands extraction – accounting for more than 88% of the world’s tar sands production and for over 98% of the tar sands resources under development or field evaluation, according to the 2021 Global Oil and Gas Exit List (GOGEL) (2) – and those operating controversial pipelines from its new investments. Extracting tar sands emits on average three times more CO2 than other types of oils according to Rystad Energy (in French). This commitment should not make us forget that tar sands accounted for less than 2% of the global hydrocarbons production, and less than 1,5% of the global resources under development or field evaluation, according to the 2021 GOGEL.

- On oil and gas, GIAM should now commit to stop supporting oil & gas companies planning to expand, in both conventional and unconventional sectors (notably, shale oil and gas, Arctic oil and gas, ultra deep-water). This would put GIAM in line with IEA’s Net Zero by 2050 pathway, in which both new oil and new gas fields should not be approved after 2021. GIAM should also commit to an ambitious oil & gas phase-out date, that should include the whole oil and gas value chains. Generali Insurance has committed to cease insuring oil and gas upstream activities, with a detailed mention of the shale oil and gas and Arctic region (3) sectors: if climate-related risks are identified at the insurer’s level, there is no reason they should not be taken into consideration for investments activities as well.

For the next steps, Generali Investments – GIAM’s parent company – needs to improve the scope of this policy by extending it to all of its subsidiaries, since GIAM only represents 80% of Generali Investments’ total assets. GIAM should also make its divestment policy systematic (4).

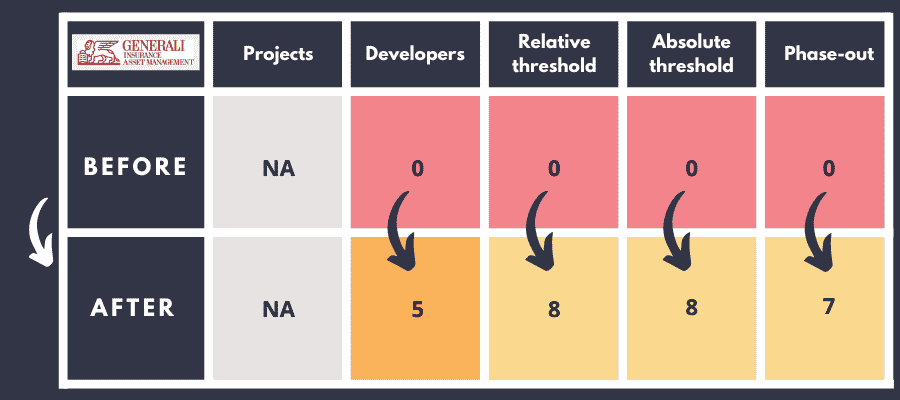

Generali Insurance Asset Management scores in the Coal Policy Tool

This table presents the coal scores of Generali Insurance Asset Management based on five criteria of the Coal Policy Tool.

Reclaim Finance welcomes these long overdue commitments from GIAM. On coal, the new exclusions adopted by GIAM mark a stark improvement regarding the logic of its long-term strategy to reach zero coal exposure in its investment activities. However, by not applying a strict exclusion of coal developers, GIAM fails to integrate the group of asset managers excluding companies opening both new coal plants and new coal mines or infrastructures, such as AXA IM or Ostrum (Natixis IM). Moreover, its failure to adopt any strong criteria against oil and gas expansion, including in the most impactful sectors of unconventional oil and gas, means that GIAM will keep contributing to the development of projects that have no room in the remaining 1.5°C carbon budget. GIAM exposes itself to important financial risks. In its Sixth Assessment Report, in the Mitigation of climate change part, the IPCC not only confirms what the IEA already said about the imperative to tend to no expansion, but also makes it clear that “limiting warming to 2°C or 1.5°C will strand fossil-related assets, including fossil infrastructure and unburned fossil fuel resources”. GIAM must get back to work.

Here is below the updated scoring grid of our Coal Policy Tool regarding GIAM and other main asset managers.